Imax (IMAX): A Hidden Gem in the Market? An In-Depth Analysis of Its Valuation

Imax Corp (NYSE:IMAX) reported a daily gain of 2.69%, and a three-month gain of 8.61%, with an Earnings Per Share (EPS) of 0.08. But is the media company's stock modestly undervalued? In this comprehensive analysis, we delve into the financials and intrinsic value of Imax Corp (NYSE:IMAX) to provide an answer. Keep reading to understand the company's valuation and potential for investment.

Introduction to Imax Corp (NYSE:IMAX)

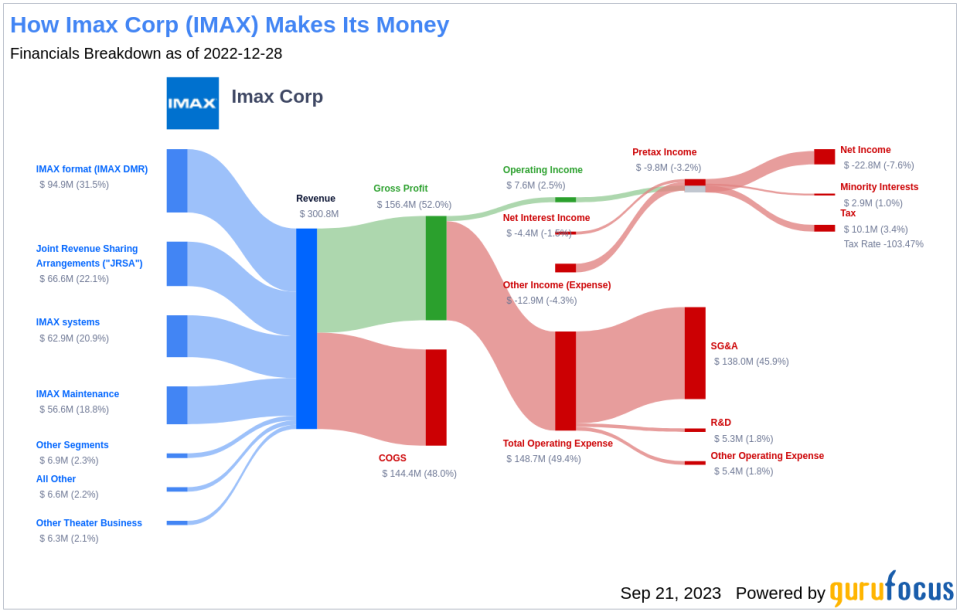

Imax Corp (NYSE:IMAX) is a leading technology hardware and brand-licensing company, primarily known for its proprietary equipment and digital remastering of standard films into the Imax format. From 210 commercial theaters in 2008 to over 1,630 today, Imax has significantly expanded its global presence. The company has released 68 Imax films in 2028, up from 13 in 2007. With around 70% of its screens in China (48%) and the U.S. (22%), Imax operates in 87 countries worldwide. The current stock price stands at $19.06, while the GF Value, an estimation of fair value, is $24.85.

Understanding the GF Value

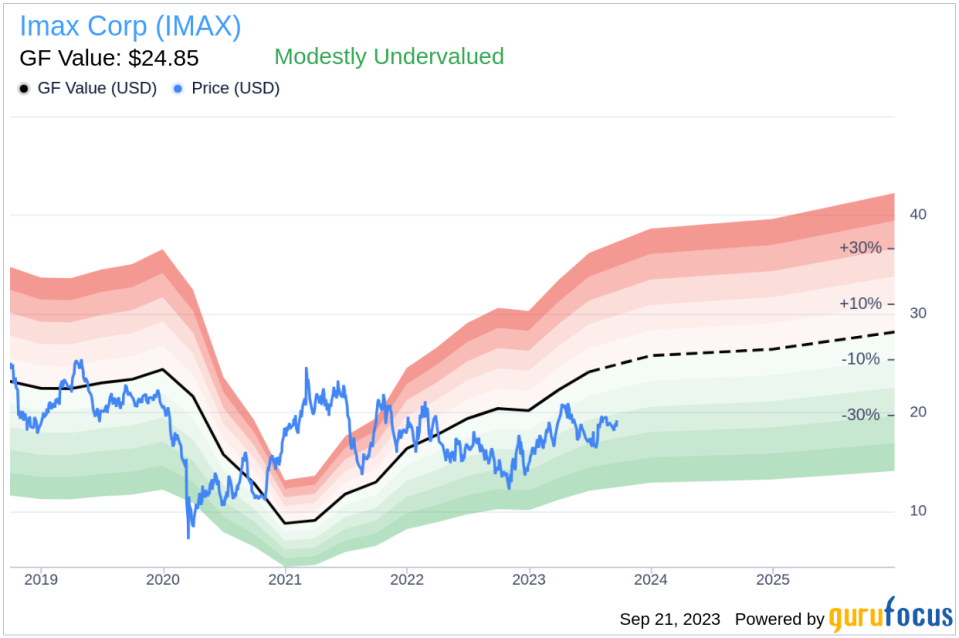

Our proprietary GF Value offers an estimate of the intrinsic value of a stock. It considers historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line represents the fair value at which the stock should ideally trade. If the stock price significantly exceeds the GF Value Line, the stock may be overvalued and likely to deliver poor future returns. Conversely, if the stock price is significantly below the GF Value Line, it may be undervalued and could offer higher future returns.

For Imax (NYSE:IMAX), our valuation method suggests that the stock is modestly undervalued. Given its current price of $19.06 per share, there is potential for higher long-term returns compared to its business growth.

Link: Explore companies that may deliver higher future returns at reduced risk.

Financial Strength of Imax

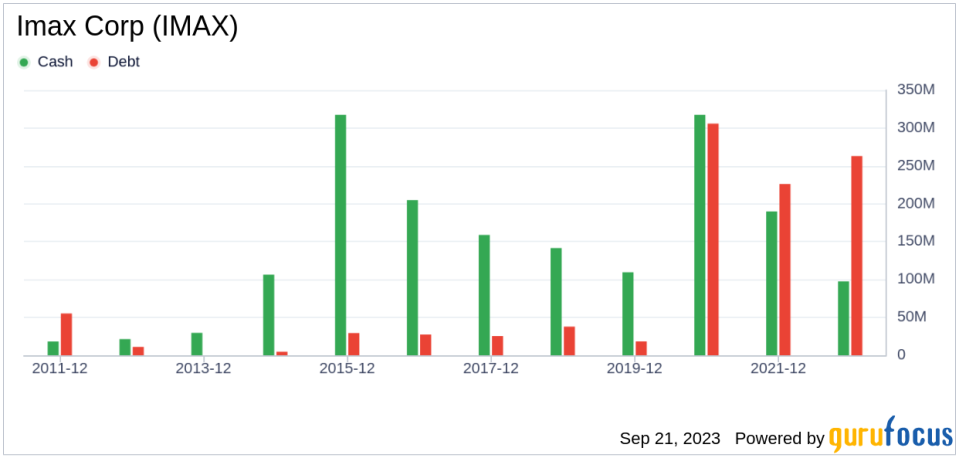

Investing in companies with poor financial strength can result in a higher risk of permanent capital loss. Therefore, it's crucial to assess a company's financial strength before investing. Imax's cash-to-debt ratio of 0.37 is lower than 68.23% of 1004 companies in the Media - Diversified industry. GuruFocus ranks Imax's overall financial strength at 5 out of 10, indicating fair financial strength.

Profitability and Growth

Investing in profitable companies typically carries less risk. Imax has been profitable for 7 out of the past 10 years, with revenues of $351.70 million and an Earnings Per Share (EPS) of $0.08 in the past 12 months. Its operating margin of 9.09% is better than 68.88% of 1038 companies in the Media - Diversified industry. GuruFocus ranks Imax's profitability as fair.

Company growth is a critical factor in valuation. Imax's 3-year average annual revenue growth rate is -6.2%, ranking lower than 66.07% of 955 companies in the Media - Diversified industry. The 3-year average EBITDA growth rate is -26%, ranking worse than 85.47% of 771 companies in the same industry.

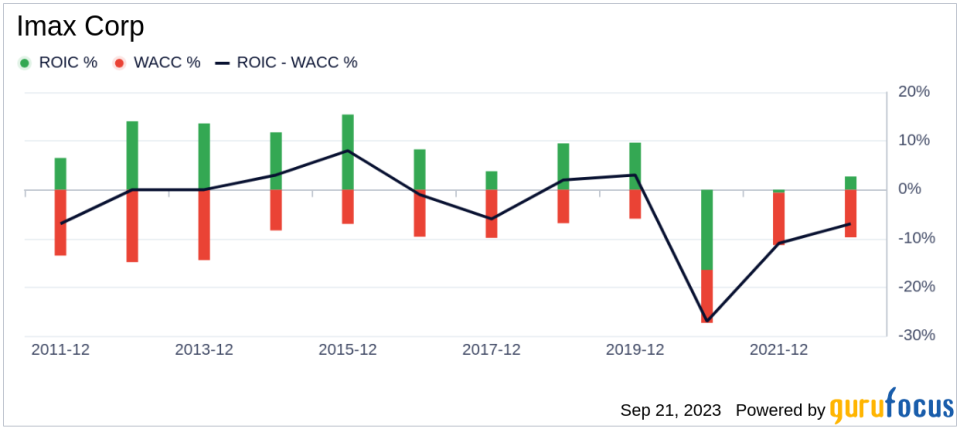

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) and the Weighted Average Cost of Capital (WACC) can provide insights into its profitability. Imax's ROIC for the past 12 months is 2.58, while its cost of capital is 7.59.

Conclusion

In summary, Imax (NYSE:IMAX) appears to be modestly undervalued. The company's financial condition and profitability are fair, but its growth ranks lower than 85.47% of 771 companies in the Media - Diversified industry. To learn more about Imax's financials, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.