Imax (IMAX)'s True Worth: A Complete Analysis of Its Market Value

Imax Corp (NYSE:IMAX) experienced a daily loss of -1.13%, with a 16.38% gain over the last three months. The company's Earnings Per Share (EPS) stands at 0.08. But is the stock modestly undervalued? This article aims to answer this question by providing an in-depth valuation analysis of Imax. Join us as we explore the intrinsic value of this stock.

Company Introduction

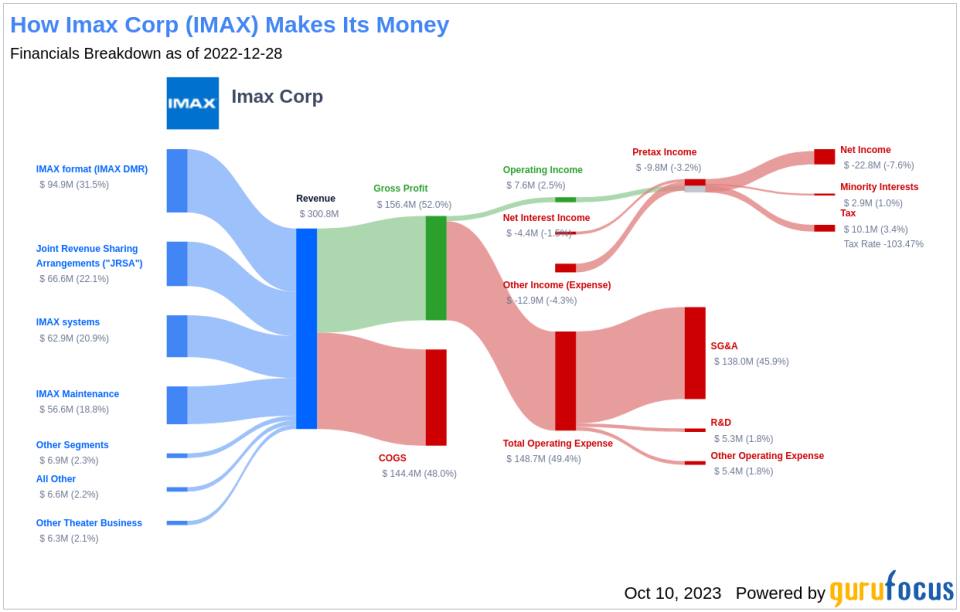

Imax Corp (NYSE:IMAX) is a technology hardware and brand-licensing company that has seen significant growth over the years. It does not operate the majority of Imax theaters but generates revenue through selling and leasing proprietary equipment and fees for digitally remastering standard films into the Imax format. From 210 commercial theaters in 2008 to over 1,630 today, Imax has scaled its operations significantly. The company has also increased its annual Imax releases from 13 in 2007 to 68 in 2028. With roughly 70% of the firm's screens in China (48%) and the U.S. (22%), Imax has a global presence in 87 countries.

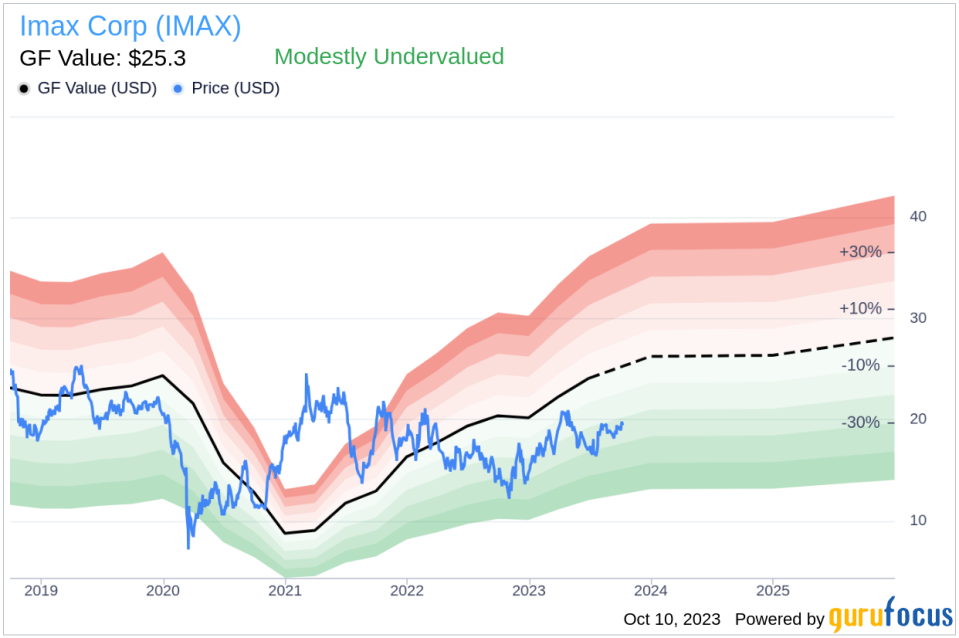

Currently, Imax (NYSE:IMAX) trades at $19.23 per share with a market cap of $1.10 billion. Comparing this with the GF Value of $25.3, it appears that the stock might be modestly undervalued. Let's delve deeper into the company's value with a closer look at the GF Value and other financial metrics.

Understanding the GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line provides an overview of the fair value at which the stock should ideally trade.

Imax's GF Value suggests that the stock is modestly undervalued. This estimation is based on historical multiples, company's past business growth, and analyst estimates of future business performance. If the share price significantly exceeds the GF Value Line, the stock may be overvalued and future returns may be poor. Conversely, if the share price is significantly below the GF Value Line, the stock may be undervalued and future returns could be high.

At its current price of $19.23 per share, Imax's market cap stands at $1.10 billion, suggesting that the stock is modestly undervalued. Therefore, the long-term return of Imax's stock is likely to be higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

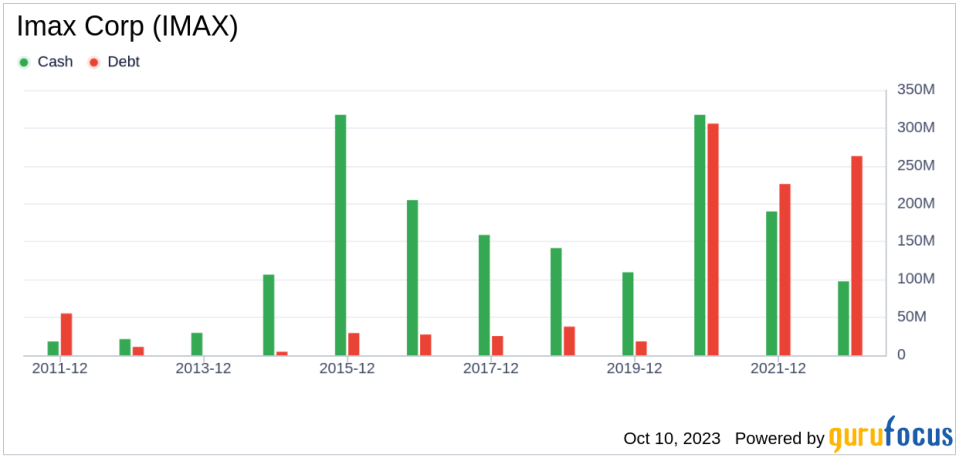

Companies with poor financial strength pose a high risk of permanent capital loss to investors. To avoid this, it's crucial to review a company's financial strength before deciding to purchase shares. Imax's cash-to-debt ratio of 0.37 ranks worse than 67.97% of 996 companies in the Media - Diversified industry. The overall financial strength of Imax is 5 out of 10, indicating that its financial strength is fair.

Profitability and Growth

Consistent profitability over the long term offers less risk for investors. Higher profit margins usually dictate a better investment compared to a company with lower profit margins. Imax has been profitable 7 over the past 10 years. Over the past twelve months, the company had a revenue of $351.70 million and Earnings Per Share (EPS) of $0.08. Its operating margin is 9.09%, which ranks better than 68.68% of 1025 companies in the Media - Diversified industry. Overall, the profitability of Imax is ranked 6 out of 10, indicating fair profitability.

Growth is a crucial factor in the valuation of a company. The 3-year average annual revenue growth rate of Imax is -6.2%, which ranks worse than 66.42% of 944 companies in the Media - Diversified industry. The 3-year average EBITDA growth rate is -26%, which ranks worse than 85.79% of 760 companies in the same industry.

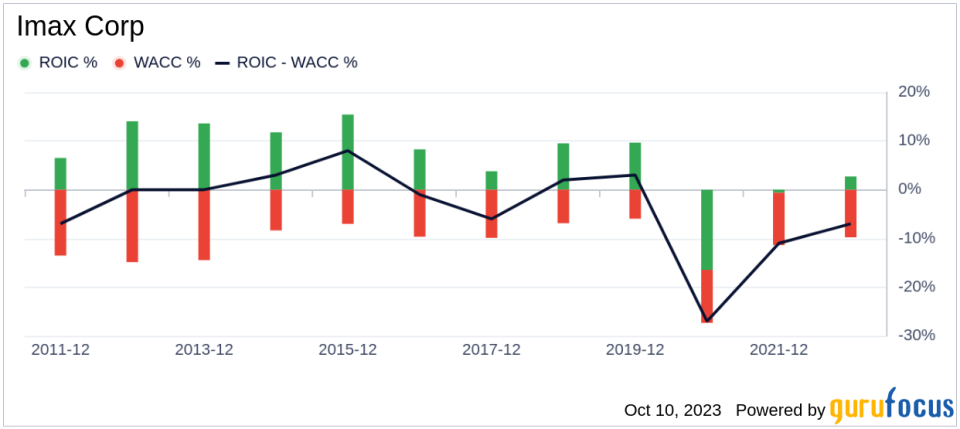

ROIC vs WACC

Another way to determine a company's profitability is to compare its return on invested capital (ROIC) with the weighted average cost of capital (WACC). The ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. The WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. When the ROIC is higher than the WACC, it implies the company is creating value for shareholders. For the past 12 months, Imax's ROIC is 2.58, and its cost of capital is 7.62.

Conclusion

In summary, the stock of Imax (NYSE:IMAX) appears to be modestly undervalued. The company's financial condition is fair, and its profitability is fair. Its growth ranks worse than 85.79% of 760 companies in the Media - Diversified industry. To learn more about Imax stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.