Immersion Corp (IMMR) Reports Solid FY2023 Earnings with Increased Net Income

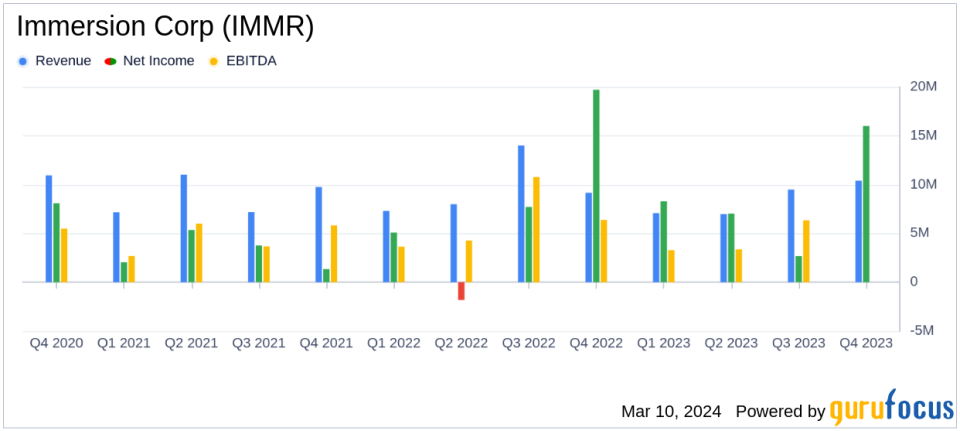

Revenue: FY2023 total revenues were $33.9 million, a decrease from $38.5 million in FY2022.

Net Income: GAAP net income for FY2023 was $34.0 million, or $1.04 per diluted share, up from $30.7 million in FY2022.

Non-GAAP Results: Non-GAAP net income for FY2023 stood at $38.5 million, or $1.18 per diluted share.

Share Repurchase: Immersion repurchased 1,217,774 shares in 2023, representing 3.9% of shares outstanding.

Liquidity: Cash, cash equivalents, and short-term investments totaled $160.4 million as of December 31, 2023.

Dividend: A quarterly dividend of $0.045 per share will be paid on April 19, 2024.

On March 7, 2024, Immersion Corp (NASDAQ:IMMR) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. Immersion Corp, a pioneer in haptic technology, reported a year of solid financial performance despite a slight decline in annual revenue. The company's focus on enforcing intellectual property rights and renewing license deals has been a key driver of its financial achievements.

Financial Performance and Strategic Execution

Immersion Corp's revenue for the fourth quarter of 2023 was $10.4 million, up from $9.2 million in the same quarter of the previous year. The company's GAAP net income for the quarter was $16.0 million, or $0.49 per diluted share, a decrease from $19.7 million in the fourth quarter of 2022. Non-GAAP net income for the quarter was slightly higher at $16.9 million, or $0.52 per diluted share. The company also repurchased 319,017 shares at an average price of $6.52 per share during the quarter.

For the full year, Immersion's revenues were $33.9 million, a decrease from $38.5 million in 2022. However, the company's net income for 2023 was $34.0 million, or $1.04 per diluted share, an increase from $30.7 million, or $0.92 per diluted share, for 2022. Non-GAAP net income for 2023 was $38.5 million, or $1.18 per diluted share, compared to non-GAAP net income for 2022 of $34.5 million, or $1.03 per diluted share.

Immersion's Chairman & CEO, Eric Singer, highlighted the company's steady execution and accomplishments throughout the year, emphasizing the strategic allocation of capital and the increase in stockholder's equity to $183.1 million. Singer expressed confidence in the company's strong balance sheet as it enters 2024.

"2023 was a year of steady execution and accomplishment for Immersion as we maintained our efforts to enforce our intellectual property, renew license deals, and thoughtfully allocate capital. We returned $15.7 million to shareholders via buybacks and dividends during the year while also increasing our stockholders equity to $183.1 million, or $5.81 per share, as of December 31, 2023. This is an increase of over $27.4 million from $157.7 million, or $4.89 per share, at the end of 2022."

Financial Statements Highlights

The balance sheet shows an increase in cash, cash equivalents, and short-term investments to $160.4 million as of December 31, 2023, from $149.7 million at the end of the previous year. The company's stockholders' equity also saw a significant increase, indicating a strong financial position.

Immersion's operating expenses for the year were $16.0 million, up from $14.0 million in 2022. The increase in operating expenses was also reflected in the non-GAAP operating expenses, which were $11.5 million in 2023, compared to $10.2 million in 2022.

The company's commitment to returning value to shareholders is evident in the repurchase of 1,217,774 shares in 2023 and the announcement of a quarterly dividend of $0.045 per share, payable on April 19, 2024.

Looking Ahead

Immersion Corp's performance in 2023 demonstrates its ability to navigate the complexities of the haptic technology market and maintain profitability. The company's strategic focus on intellectual property enforcement and license agreement renewals, combined with prudent capital allocation, positions it well for the future. As Immersion continues to innovate and expand its haptic technology solutions, investors and stakeholders can anticipate the company's sustained commitment to enhancing shareholder value.

For a detailed understanding of Immersion Corp's financials and strategic direction, readers are encouraged to review the full 8-K filing.

Investor Contact: J. Michael Dodson, Immersion Corporation, mdodson@immersion.com

Explore the complete 8-K earnings release (here) from Immersion Corp for further details.

This article first appeared on GuruFocus.