Immix (IMMX) Up on Orphan Drug Tag for AL Amyloidosis Therapy

Shares of clinical-stage biopharmaceutical company Immix Biopharma, Inc. IMMX gained 15.4% on Sep 21 after the company announced that the FDA has granted Orphan Drug Designation (ODD) designation for lead candidate NXC-201 for treating a life-threatening blood disorder, AL Amyloidosis.

NXC-201, a next-generation CAR-T cell therapy, is being developed for relapsed/refractory AL Amyloidosis and relapsed/refractory multiple myeloma.

NXC-201 is currently being evaluated in a phase Ib/IIa clinical trial, NEXICART-1 (NCT04720313). The candidate is being developed by Immix’s subsidiary, Nexcella, Inc.

The ODD is generally granted to drugs and biologics that are intended for safe and effective treatment, diagnosis or prevention of rare diseases or conditions that affect fewer than 200,000 people in the United States. The designation encompasses certain benefits, like financial incentives, to support clinical development and the potential for up to 7 years of market exclusivity in the U.S. upon regulatory approval. It also includes a waiver of the prescription drug user fee (currently at almost $3 million for a new drug).

Per Grand View Research, the amyloidosis market, a life-threatening blood disorder, is expected to reach $6 billion in 2025.

Initial response rates of 92% and 100% have been observed from the NEXICART-1 study in patients with multiple myeloma and AL amyloidosis, respectively.

The successful development and commercialization of NXC-201 will be a significant boost for the company.

Last month, the FDA granted ODD for NXC-201 for treating multiple myeloma (blood cancer).

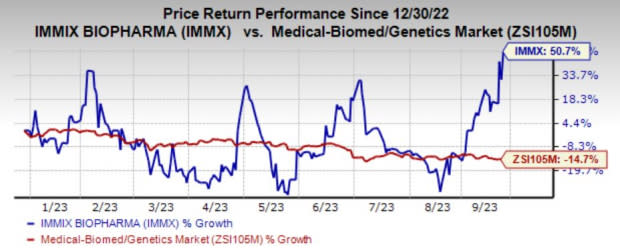

Shares of the company have surged 50.7% in the year so far against the industry’s decline of 14.7%.

Image Source: Zacks Investment Research

The company is also developing a novel class of Tissue Specific Therapeutics ("TSTx”) in oncology and immune-dysregulated diseases. Immix’s lead TSTx asset, IMX-110, is a TSTx with TME Normalization, a technology that Immix is developing initially for soft tissue sarcoma. In addition, Immix is developing IMX-111, a Tissue-Specific Biologic built on its TME Normalization Technology for the treatment of advanced colorectal cancer.

IMX-110 has also been granted Rare Pediatric Disease Designation by the FDA.

Zacks Rank and Stocks to Consider

Immix Biopharma currently carries a Zacks Rank #4 (Sell).

Some well-placed stocks in the industry are Eton Pharmaceuticals ETON and Dynavax Technologies DVAX. Eton currently carries a Zacks Rank #1 (Strong Buy) and Dynavax carries a Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Loss estimates for Eton for 2023 have narrowed to 10 cents from 31 cents in the past 60 days, while earnings estimates for 2024 are pegged at 26 cents per share.

Loss estimates for Dynavax for 2023 have narrowed to 23 cents from 56 cents in the past 90 days, while earnings estimates for 2024 are pegged at 3 cents per share.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Eton Pharmaceuticals, Inc. (ETON) : Free Stock Analysis Report

Immix Biopharma, Inc. (IMMX) : Free Stock Analysis Report