Immuneering (IMRX) Plummets 71% in One Week: Here's Why

Immuneering Corporation IMRX is a clinical-stage biotech company focused on developing universal-RAS/RAF medicines to treat cancer patients.

Devoid of marketed drugs in its portfolio, Immuneering is entirely dependent on its pipeline for growth. The company’s lead pipeline candidate is IMM-1-104, an investigational RAS medication, which is being evaluated in a phase I/IIa study in patients with advanced solid tumors harboring RAS mutations.

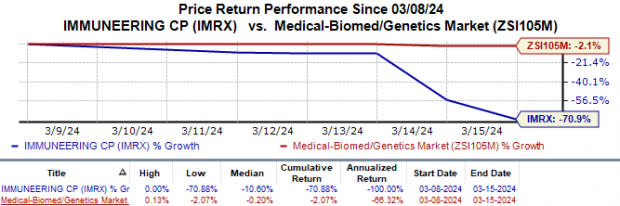

In the past week, Immuneering’s shares have plunged 70.9% compared with the industry’s 2.1% fall. This downside came after the company reported topline results from the phase I portion of the phase I/IIa study on IMM-1-104 last week.

Image Source: Zacks Investment Research

The endpoints of the phase I portion of the study were to assess the safety and tolerability of IMM-1-104, identify a candidate recommended Phase 2 dose (RP2D), and evaluate pharmacokinetics (PK). As of Feb 20 (cut-off date), management enrolled heavily-pretreated study participants who had a dozen different RAS mutations across eight different types of cancer.

As of the cut-off date, treatment with the drug was well-tolerated among study participants, with the occurrence of just one grade 3 event (non-serious rash). Results from the study demonstrated clear proof of concept, as treatment with IMM-1-104 showed promising signs of initial clinical activity through deep cyclic mechanisms. Based on this data, management decided to proceed with a 320mg dose of the drug as RP2D.

The above results failed to impress investors. Though the data does warrant clinical advancement of Immuneering’s lead drug, a lack of confirmed responses observed across different doses (including the RP2D) did not sit well with investors. With the study participant population being very diverse and low in number (n=41), it was difficult to point out the level of clinical activity in patients treated with the drug with clarity.

Due to the above factors, multiple Wall Street analysts downgraded the IMRX stock. Analysts at Jeffries downgraded the stock from ‘Buy’ to ‘Hold’ and also set the price target to $3 per share from the previously set target of $16.

Prior to the announcement of the above results, management started dosing patients in the phase IIa portion of the study. This portion will evaluate a 320mg dose of IMM-1-104 as monotherapy in pancreatic ductal adenocarcinoma (PDAC), non-small cell lung cancer (NSCLC) and melanoma, and as combination therapy in PDAC.

Initial data from the phase IIa portion is expected later this year. The results from this portion are expected to provide a clearer picture as management intends to enroll more study participants at a longer follow-up period.

Apart from IMM-1-104, management has also moved a second pipeline drug, IMM-6-415 to clinical development. Immuneering has started evaluating this drug in a phase I/IIa study in patients with advanced solid tumors harboring RAS or RAF mutations. The company is expected to dose the first patient in this study before this month’s end.

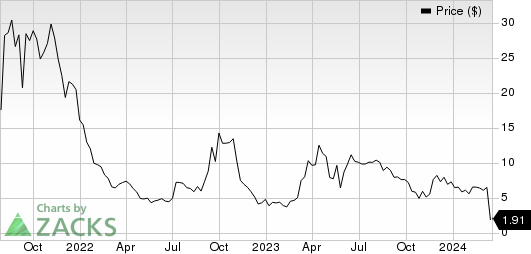

Immuneering Corporation Price

Immuneering Corporation price | Immuneering Corporation Quote

Zacks Rank & Key Picks

Immuneering currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include ADMA Biologics ADMA, ANI Pharmaceuticals ANIP and GSK plc GSK, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share (EPS) have risen from 22 cents to 30 cents. During the same period, EPS estimates for 2025 have improved from 32 cents to 50 cents. Year to date, shares of ADMA have risen 32.5%.

Earnings of ADMA Biologics beat estimates in three of the last four quarters while meeting the same on one occasion. ADMA delivered a four-quarter average earnings surprise of 85.00%.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 EPShave risen from $4.06 to $4.40. In the same period, EPS estimates for 2025 have improved from $4.80 to $5.01. Year to date, shares of ANIP have risen 19.7%.

Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters. ANI delivered a four-quarter average earnings surprise of 109.06%.

In the past 60 days, estimates for GSK’s 2024 EPS have risen from $3.87 to $4.03. During the same period, EPS estimates for 2025 have improved from $4.20 to $4.39. Year to date, shares of GSK have risen 13.8%.

GSK's earnings beat estimates in three of the trailing four quarters while missing the mark on one occasion. On average, GSK’s four-quarter earnings surprise was 7.59%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Immuneering Corporation (IMRX) : Free Stock Analysis Report