Immunome (IMNM) Surges on Merger Agreement With Morphimmune

Immunome IMNM announced its definitive merger agreement with Morphimmune, a private biotechnology company focused on developing innovative solutions for challenging cancers. Shares of Immunome were up almost 30% on Jun 29, following the news.

The all-stock transaction has been approved by both the companies’ boards of directors. The newly combined entity will operate under the name Immunome, retaining its ticker symbol.

Under the terms of the agreement, IMNM will acquire Morphimmune through a reverse subsidiary merger.

The companies have successfully raised $125 million through an oversubscribed private placement investment. This funding round saw significant participation from leading institutional investors, showcasing strong confidence in the potential of the merged company.

The merger and private placement are expected to be completed by the end of the fourth quarter of 2023. This strategic move aims to pool their expertise, technologies and pipelines to accelerate the development of novel therapies in the fight against cancer.

Shares of Immunome have rallied 248.4% year to date against the industry’s 9.8% decline.

Image Source: Zacks Investment Research

Morphimmune’s shareholders will receive shares of Immunome, based on a fixed ratio. Following the merger’s completion and prior to the implementation of private investment, the current shareholders of Immunome will own about 55% of the new company, and those of Morphimmune will own around 45%.

The proceeds from the private placement will help in the development of Immunome's combined pipeline. Its research candidates include a novel anti-IL-38 monoclonal antibody, a folate receptor-targeted TLR7 agonist and a FAP-targeted radioligand.

The merged company aims to submit three investigational new drug (IND) applications within 18 months of the transaction's closure. Notably, the anti-IL-38 program is scheduled for an IND submission in the first quarter of 2024. The pre-clinical studies show that using antibodies to target IL-38 helps activate the body's tumor-fighting mechanisms.

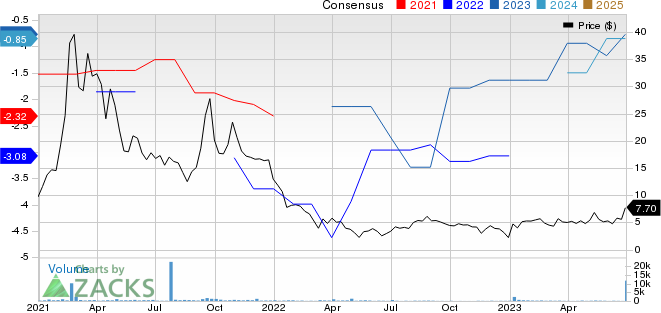

Immunome, Inc. Price and Consensus

Immunome, Inc. price-consensus-chart | Immunome, Inc. Quote

Zacks Rank & Stocks to Consider

Immunome currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the overall healthcare sector are Novartis NVS, Akero Therapeutics AKRO and Omega Therapeutics OMGA, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Novartis’ 2023 earnings has gone up from $6.56 per share to $6.74 in the past 90 days. Shares of Novartis have risen 9.5% year to date.

NVS’ earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 5.15%.

The consensus estimate for Akero Therapeutics has narrowed from a loss of $2.96 per share to a loss of $2.80 for 2023 in the past 90 days. Shares of Akero Therapeutics have nosedived 18.6% year to date.

AKRO’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 19.13%.

The consensus mark for Omega Therapeutics has narrowed from a loss of $2.49 per share to a loss of $2.05 for 2023 in the past 90 days. Shares of the company have rallied 3.5% year to date.

OMGA’s earnings beat estimates in two of the trailing four quarters, met the mark in one and missed in another, delivering an average surprise of 8.24%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Akero Therapeutics, Inc. (AKRO) : Free Stock Analysis Report

Immunome, Inc. (IMNM) : Free Stock Analysis Report

Omega Therapeutics, Inc. (OMGA) : Free Stock Analysis Report