Immunome's (NASDAQ:IMNM) investors will be pleased with their favorable 45% return over the last year

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But if you pick the right individual stocks, you could make more than that. For example, the Immunome, Inc. (NASDAQ:IMNM) share price is up 45% in the last 1 year, clearly besting the market decline of around 1.0% (not including dividends). That's a solid performance by our standards! Immunome hasn't been listed for long, so it's still not clear if it is a long term winner.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for Immunome

With just US$2,364,000 worth of revenue in twelve months, we don't think the market considers Immunome to have proven its business plan. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, they may be hoping that Immunome comes up with a great new product, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt.

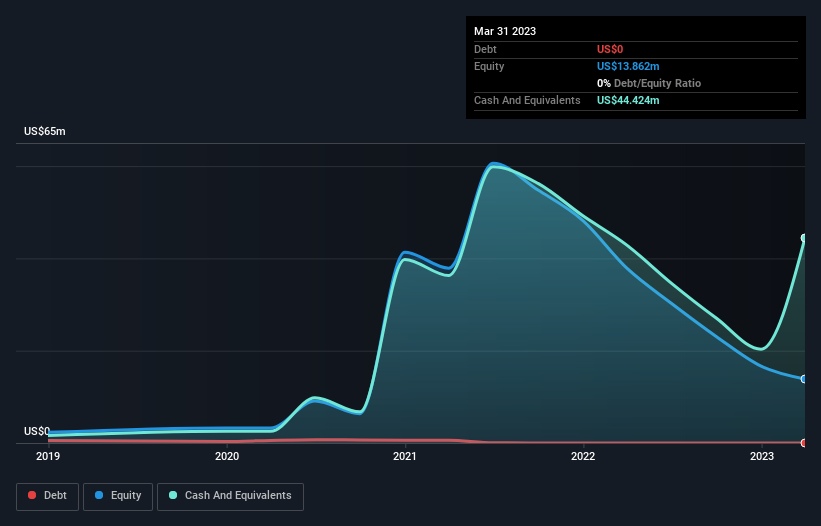

Immunome has plenty of cash in the bank, with cash in excess of all liabilities sitting at US$10m, when it last reported (March 2023). That allows management to focus on growing the business, and not worry too much about raising capital. And given that the share price has shot up 129% in the last year , it's fair to say investors are liking management's vision for the future. The image below shows how Immunome's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

Of course, the truth is that it is hard to value companies without much revenue or profit. However you can take a look at whether insiders have been buying up shares. If they are buying a significant amount of shares, that's certainly a good thing. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

Immunome boasts a total shareholder return of 45% for the last year. A substantial portion of that gain has come in the last three months, with the stock up 20% in that time. This suggests the company is continuing to win over new investors. It's always interesting to track share price performance over the longer term. But to understand Immunome better, we need to consider many other factors. To that end, you should learn about the 5 warning signs we've spotted with Immunome (including 1 which is a bit concerning) .

Of course Immunome may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here