Imperial (IMO) Q4 Earnings Coming Up: Here's What to Expect

Imperial Oil Limited IMO is set to release fourth-quarter results on Feb 2. The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of $1.54 per share on revenues of $12.3 billion.

Let’s delve into the factors that might have influenced the integrated energy company’s performance in the December quarter. But it’s worth taking a look at IMO’s previous-quarter performance first.

Highlights of Q3 Earnings & Surprise History

In the last reported quarter, the Calgary, Canada-based petroleum operator beat the consensus mark largely due to higher contributions from the company's upstream segment. Imperial Oil had reported adjusted earnings per share of $2.06, ahead of the Zacks Consensus Estimate of $1.81. However, revenues of $10.4 billion underperformed the consensus mark by 22.6% on lower liquids realizations.

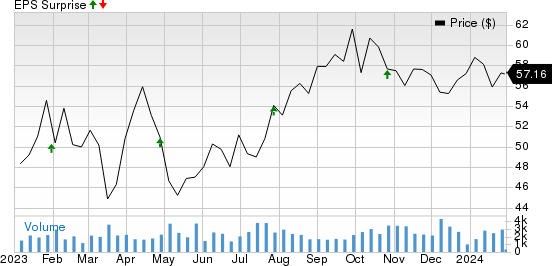

IMO beat the Zacks Consensus Estimate for earnings in each of the last four quarters, resulting in an earnings surprise of 9.4%, on average. This is depicted in the graph below:

Imperial Oil Limited Price and EPS Surprise

Imperial Oil Limited price-eps-surprise | Imperial Oil Limited Quote

Trend in Estimate Revision

The Zacks Consensus Estimate for the fourth-quarter bottom line has remained unchanged in the past seven days. The estimated figure indicates a 27% deterioration year over year. The Zacks Consensus Estimate for revenues, meanwhile, suggests a 15.6% increase from the year-ago period.

Factors to Consider

Imperial is expected to have benefited from higher hydrocarbon realizations during the quarter. Our expectation for the company’s fourth-quarter bitumen price is pegged at C$75.61 a barrel, up 26.3% from the year-ago quarter’s level of C$59.85. Further, our model predicts IMO to receive an average realized price of C$119.15 per barrel of synthetic oil compared with the year-ago quarter’s C$115.22. For conventional crude oil, our estimate is pegged at C$77.28 per barrel, while a year ago, the company got C$67.91. This price boost is likely to have buoyed the fourth-quarter revenues and cash flows of Imperial Oil.

Moreover, the increase in Imperial Oil’s upstream output might have buoyed its to-be-reported bottom line. Our estimate for net production volume is pegged at 404,000 barrels of oil equivalent per day, indicating a rise from 378,000 reported in the year-ago quarter.

On a somewhat bearish note, our expectation for IMO’s total cost of goods sold in the October-December quarter suggests a 25.3% surge to C$15.3 billion. The upward cost could be primarily attributed to inflationary pressures.

IMO is also expected to have suffered due to a slightly weaker macro environment in its downstream (or refining) unit. Our model predicts that the segment is likely to have earned a net income of C$516.6 million compared with C$1.2 billion reported in the year-ago quarter.

What Does Our Model Say?

The proven Zacks model does not conclusively show that Imperial Oil is likely to beat estimates in the fourth quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, for this company is -0.33%.

Zacks Rank: IMO, currently, carries a Zacks Rank #3.

Stocks to Consider

While an earnings beat looks uncertain for Imperial Oil, here are some firms from the energy space that you may want to consider on the basis of our model:

USA Compression Partners, LP USAC has an Earnings ESP of +4.35% and a Zacks Rank #2. The firm is scheduled to release earnings on Feb 13.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The 2024 Zacks Consensus Estimate for USA Compression Partners indicates 100% year-over-year earnings per share growth. Valued at around $2.6 billion, USAC has gained 26% in a year.

ExxonMobil XOM has an Earnings ESP of +0.47% and a Zacks Rank #3. The firm is scheduled to release earnings on Feb 2.

ExxonMobil beat the Zacks Consensus Estimate for earnings in two of the last four quarters and missed in the other two. It has a trailing four-quarter earnings surprise of 0.6%, on average. Valued at around $408.2 billion, XOM has lost 11.1% in a year.

Plains All American Pipeline, L.P. PAA has an Earnings ESP of +6.12% and a Zacks Rank #3. The firm is scheduled to release earnings on Feb 9.

Plains All American Pipeline beat the Zacks Consensus Estimate for earnings in three of the last four quarters and missed in the other. It has a trailing four-quarter earnings surprise of 18.3%, on average. Valued at around $11.4 billion, PAA has gained 30% in a year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Plains All American Pipeline, L.P. (PAA) : Free Stock Analysis Report

Imperial Oil Limited (IMO) : Free Stock Analysis Report

USA Compression Partners, LP (USAC) : Free Stock Analysis Report