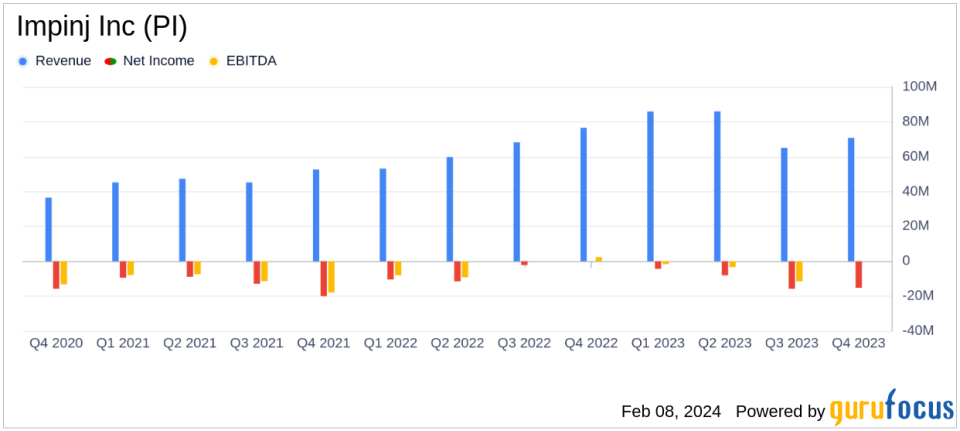

Impinj Inc (PI) Surpasses $300 Million Annual Revenue Milestone in 2023

Annual Revenue: Impinj Inc (NASDAQ:PI) reports a significant milestone with over $300 million in annual revenue for 2023.

GAAP and Non-GAAP Gross Margins: GAAP gross margin stood at 49.4%, with a higher non-GAAP gross margin of 51.9% for the full year.

Net Loss: The company experienced a GAAP net loss of $43.4 million, equating to a loss of $1.62 per diluted share.

Adjusted EBITDA and Non-GAAP Net Income: Positive adjusted EBITDA of $21.8 million and non-GAAP net income of $19.8 million, or $0.70 per diluted share, were reported.

Q4 Performance: Fourth quarter revenue was $70.7 million with a non-GAAP net income of $2.5 million, or $0.09 per diluted share.

Financial Outlook: For Q1 2024, revenue is projected to be between $72.0 to $75.0 million, with an adjusted EBITDA income of $3.0 to $4.5 million.

On February 8, 2024, Impinj Inc (NASDAQ:PI), a leader in RAIN RFID technology and a pioneer in the Internet of Things, announced its financial results for the fourth quarter and full year ended December 31, 2023. The company released its 8-K filing, revealing a year of solid growth with annual revenue exceeding the $300 million threshold for the first time, despite facing market headwinds.

Impinj operates a platform that enables wireless connectivity to everyday items, providing identity, location, and authenticity to business and consumer applications. Its products are used globally, with a significant portion of revenue derived from the Asia Pacific region.

Chris Diorio, Impinj co-founder and CEO, expressed confidence in the company's market position and the opportunities ahead, stating, "We delivered four quarters of positive adjusted EBITDA, successfully defended our intellectual property and introduced market-leading new products."

The company's financial achievements, including a non-GAAP gross margin of 51.9% for the full year, are particularly important in the hardware industry where margins can be indicative of operational efficiency and product value. The positive adjusted EBITDA and non-GAAP net income underscore the company's ability to manage its expenses and investments effectively, even as it navigates the challenges of a dynamic market.

Impinj's balance sheet shows a healthy cash and cash equivalents position of $94.8 million as of December 31, 2023, a significant increase from $19.6 million the previous year. This financial stability is crucial for sustaining operations and funding future growth initiatives.

Despite the GAAP net loss, the company's adjusted EBITDA and non-GAAP net income reflect a more nuanced picture of its financial health. These metrics are important as they exclude non-recurring expenses and non-cash charges, providing a clearer view of the company's operational performance.

Impinj's outlook for the first quarter of 2024 anticipates continued revenue growth, with projections of $72.0 to $75.0 million. The company also expects to maintain a positive adjusted EBITDA, further emphasizing its operational resilience.

Impinj's financial tables reveal key details:

"Revenue of $307.5 million for the full year 2023, with a GAAP gross margin of 49.4% and non-GAAP gross margin of 51.9%, demonstrates our ability to scale effectively while maintaining profitability," said Chris Diorio.

Impinj's performance in 2023, marked by revenue growth and positive adjusted EBITDA, positions the company well for the future. The company's strategic focus on innovation and market leadership in RAIN RFID technology continues to drive its financial success.

For more detailed information on Impinj's financial performance and future outlook, investors and interested parties are encouraged to join the conference call or access the webcast on the company's investor relations website.

Impinj's commitment to connecting billions of everyday items to the internet remains a cornerstone of its strategy, and the company's financial results reflect the ongoing demand for its platform and solutions in the expanding Internet of Things ecosystem.

For further inquiries, Impinj has provided contact information for both investor and media relations, ensuring open communication channels for stakeholders.

As Impinj continues to navigate the complexities of the global market, its financial results and forward-looking statements will be closely monitored by investors seeking to understand the company's trajectory and potential for long-term growth.

Explore the complete 8-K earnings release (here) from Impinj Inc for further details.

This article first appeared on GuruFocus.