Inari Medical Inc (NARI) Reports Growth Amidst Operating Losses in Q4 2023

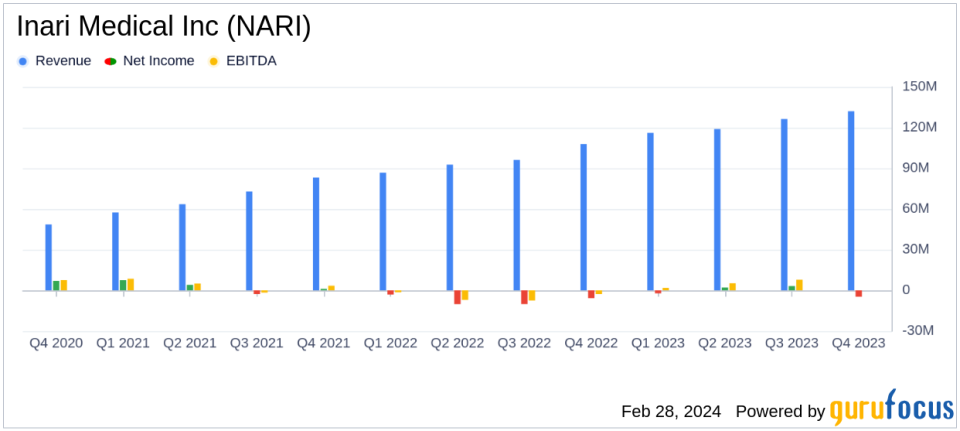

Revenue Growth: Inari Medical Inc (NASDAQ:NARI) reported a 22.6% increase in Q4 revenue year-over-year, reaching $132.1 million.

Operating Losses: GAAP operating loss widened to $9.3 million in Q4 2023 from $5.9 million in the same quarter last year.

Net Loss Improvement: Net loss improved slightly to $4.7 million in Q4 2023, down from $5.8 million in Q4 2022.

Full Year Performance: Full year 2023 revenue rose to $493.6 million, a 28.7% increase from the previous year.

2024 Revenue Guidance: Inari Medical projects 2024 revenue to be between $580 million and $595 million, indicating a growth of 17.5% to 20.5% over 2023.

Inari Medical Inc (NASDAQ:NARI), a medical device company dedicated to treating venous and other diseases, released its 8-K filing on February 28, 2024, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its ClotTriever and FlowTriever systems, saw a significant increase in revenue, driven by procedural growth and global commercial expansion. However, operating losses widened due to acquisition-related costs and increased operating expenses.

Financial Performance Overview

Inari Medical's revenue for the fourth quarter of 2023 was $132.1 million, marking a 22.6% increase over the $107.8 million reported in the same quarter of the previous year. This growth is attributed to the increased adoption of the company's procedures, new product introductions, and expansion in international markets. Despite the revenue growth, the company experienced a GAAP operating loss of $9.3 million, compared to a $5.9 million loss in Q4 of the previous year. The non-GAAP operating loss was significantly lower at $0.3 million, after adjusting for acquisition-related costs and amortization of acquired intangible assets.

For the full year of 2023, Inari Medical reported a revenue of $493.6 million, a 28.7% increase from the $383.5 million in the prior year. The gross margin remained robust at 88.0%, although slightly down from 88.4% in the previous year. The GAAP operating loss for the year was $14.0 million, an improvement from the $28.1 million loss in the prior year. The net loss for the full year was $1.6 million, or $0.03 per share, compared to a net loss of $29.3 million, or $0.55 per share, in the previous year.

Challenges and Outlook

While Inari Medical's revenue growth is a positive indicator of the company's market penetration and adoption of its medical devices, the widening operating losses highlight the challenges associated with scaling operations and integrating acquisitions such as LimFlow. CEO Drew Hykes emphasized the company's commitment to establishing its therapy as the standard of care for venous thromboembolism (VTE) and expressed confidence in achieving sustainable growth.

Looking ahead, Inari Medical anticipates revenue for the full year 2024 to be in the range of $580 million to $595 million, reflecting a growth of approximately 17.5% to 20.5% over 2023. The company also expects to reach sustained operating profitability in the first half of 2025.

Investor Considerations

Value investors may find Inari Medical's strong revenue growth and high gross margins appealing, indicating the company's ability to generate sales efficiently. However, the increased operating expenses and acquisition-related costs leading to operating losses may warrant a cautious approach. The company's forward-looking guidance suggests optimism for continued growth and a path to profitability, which could be a point of interest for potential investors.

For a more detailed analysis of Inari Medical Inc (NASDAQ:NARI)'s financial results, including income statements and balance sheets, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Inari Medical Inc for further details.

This article first appeared on GuruFocus.