Inari Medical's (NARI) PEERLESS II RCT to Boost Patient Outcome

Inari Medical, Inc. NARI recently announced the first patient enrollment in the PEERLESS II study. PEERLESS II, a prospective, global, multi-center randomized controlled trial (RCT), is expected to compare the outcomes of intermediate-risk acute pulmonary embolism (PE) patients treated with the FlowTriever System against those treated with traditional anticoagulation therapy alone.

Patient enrollment is a major stepping stone for Inari Medical’s PE and Venous Thromboembolism (VTE) treatment space globally.

Significance of the Study

The PEERLESS II study is running alongside the currently enrolling PEERLESS RCT, which is comparing FlowTriever to catheter-directed thrombolysis. Both trials aim to generate the high-quality clinical evidence needed to make advancements in the field and establish FlowTriever as the optimal therapy for intermediate-risk PE patients. The PEERLESS II study will include up to 1,200 randomized patients at up to 100 global centers.

Per an expert familiar with the PEERLESS II RCT, anticoagulation alone remains the standard of care despite advances in mechanical thrombectomy. However, this trial is expected to generate definitive evidence to influence PE treatment guidelines worldwide.

Per Inari Medical’s management, the company is actively enrolling for three RCTs — PEERLESS, PEERLESS II and DEFIANCE. This will likely demonstrate the company’s continued efforts to guideline-changing research aimed at improving patient outcomes.

Industry Prospects

Per a report by Data Bridge Market Research, the global PE market was estimated to be $1.65 billion in 2022 and is anticipated to reach $3.12 billion by 2030 at a CAGR of 8.3%. Factors like the rise in smoking addiction, the increase in prevalence of cancer and technological advancements are expected to drive the market.

Given the market potential, the positive study outcome is likely to provide a significant boost to Inari Medical’s business globally.

Recent Developments

This month, Inari Medical closed its acquisition of LimFlow S.A., a privately-held player in limb salvage for patients with chronic limb-threatening ischemia. NARI entered into a definitive agreement to acquire LimFlow earlier this month.

The same month, Inari Medical reported its third-quarter 2023 results, wherein it registered a robust uptick in its overall revenues. Per management, the quarterly performance was driven by strong underlying procedural growth and solid execution across all its growth drivers. Management also confirmed witnessing solid contributions from Inari Medical’s core VTE business, new product launches and international geographies.

Price Performance

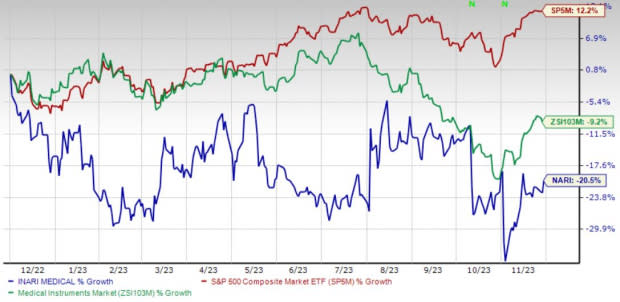

Shares of the company have lost 20.5% in the past year compared with the industry’s 9.2% decline. The S&P 500 has witnessed 12.2% growth in the said time frame.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Inari Medical carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Cardinal Health, Inc. CAH and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 18.3%. DVA’s earnings surpassed estimates in all the trailing four quarters, with an average surprise of 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 36% compared with the industry’s 1.1% rise in the past year.

Cardinal Health, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 15.2%. CAH’s earnings surpassed estimates in all the trailing four quarters, with an average of 15.7%.

Cardinal Health’s shares have gained 32.9% compared with the industry’s 7.3% rise in the past year.

Integer Holdings, flaunting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 11.9%.

Integer Holdings’ shares have rallied 17.8% against the industry’s 9.2% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Inari Medical, Inc. (NARI) : Free Stock Analysis Report