Should Income Investors Look At National Bankshares, Inc. (NASDAQ:NKSH) Before Its Ex-Dividend?

National Bankshares, Inc. (NASDAQ:NKSH) stock is about to trade ex-dividend in 3 days time. You will need to purchase shares before the 22nd of November to receive the dividend, which will be paid on the 2nd of December.

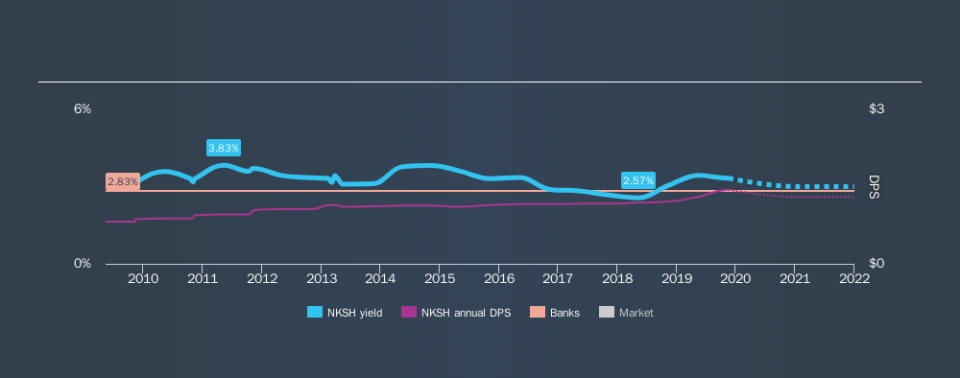

National Bankshares's upcoming dividend is US$0.72 a share, following on from the last 12 months, when the company distributed a total of US$1.44 per share to shareholders. Last year's total dividend payments show that National Bankshares has a trailing yield of 3.3% on the current share price of $43.28. If you buy this business for its dividend, you should have an idea of whether National Bankshares's dividend is reliable and sustainable. As a result, readers should always check whether National Bankshares has been able to grow its dividends, or if the dividend might be cut.

Check out our latest analysis for National Bankshares

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. National Bankshares paid out more than half (50%) of its earnings last year, which is a regular payout ratio for most companies.

Companies that pay out less in dividends than they earn in profits generally have more sustainable dividends. The lower the payout ratio, the more wiggle room the business has before it could be forced to cut the dividend.

Click here to see how much of its profit National Bankshares paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. That explains why we're not overly excited about National Bankshares's flat earnings over the past five years. Better than seeing them fall off a cliff, for sure, but the best dividend stocks grow their earnings meaningfully over the long run.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. National Bankshares has delivered an average of 5.8% per year annual increase in its dividend, based on the past ten years of dividend payments.

To Sum It Up

Has National Bankshares got what it takes to maintain its dividend payments? National Bankshares's earnings are effectively flat over recent years, even as the company pays out more than half of its earnings to shareholders as dividends. In sum this is a middling combination, and we find it hard to get excited about the company from a dividend perspective.

Keen to explore more data on National Bankshares's financial performance? Check out our visualisation of its historical revenue and earnings growth.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.