Increases to CEO Compensation Might Be Put On Hold For Now at Macquarie Telecom Group Limited (ASX:MAQ)

Despite strong share price growth of 131% for Macquarie Telecom Group Limited (ASX:MAQ) over the last few years, earnings growth has been disappointing, which suggests something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 21 November 2022. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

View our latest analysis for Macquarie Telecom Group

How Does Total Compensation For David Tudehope Compare With Other Companies In The Industry?

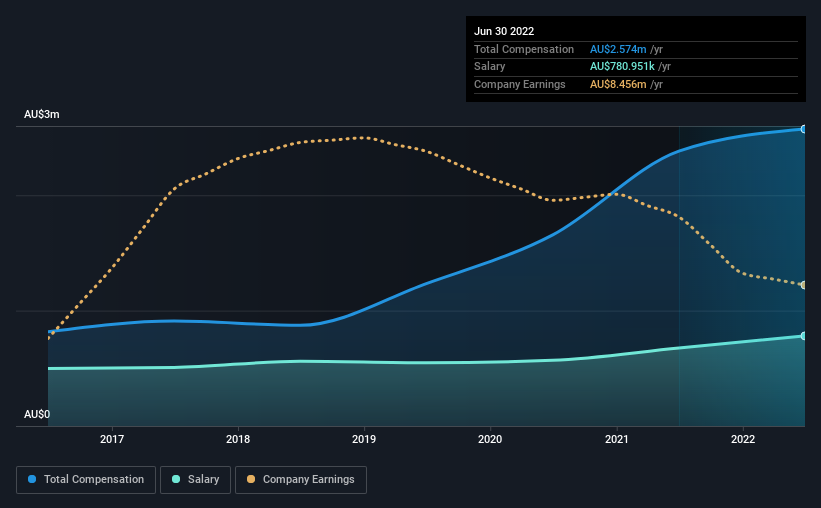

At the time of writing, our data shows that Macquarie Telecom Group Limited has a market capitalization of AU$1.2b, and reported total annual CEO compensation of AU$2.6m for the year to June 2022. We note that's an increase of 8.0% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at AU$781k.

On comparing similar companies from the same industry with market caps ranging from AU$590m to AU$2.4b, we found that the median CEO total compensation was AU$1.6m. This suggests that David Tudehope is paid more than the median for the industry. What's more, David Tudehope holds AU$605m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2022 | 2021 | Proportion (2022) |

Salary | AU$781k | AU$676k | 30% |

Other | AU$1.8m | AU$1.7m | 70% |

Total Compensation | AU$2.6m | AU$2.4m | 100% |

On an industry level, around 46% of total compensation represents salary and 54% is other remuneration. In Macquarie Telecom Group's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Macquarie Telecom Group Limited's Growth

Over the last three years, Macquarie Telecom Group Limited has shrunk its earnings per share by 20% per year. It achieved revenue growth of 8.5% over the last year.

Overall this is not a very positive result for shareholders. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Macquarie Telecom Group Limited Been A Good Investment?

Most shareholders would probably be pleased with Macquarie Telecom Group Limited for providing a total return of 131% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean returns may be hard to keep up. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 2 warning signs for Macquarie Telecom Group (of which 1 is potentially serious!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Macquarie Telecom Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here