Is Incyte (INCY) Modestly Undervalued? A Deep Dive into its GF Value

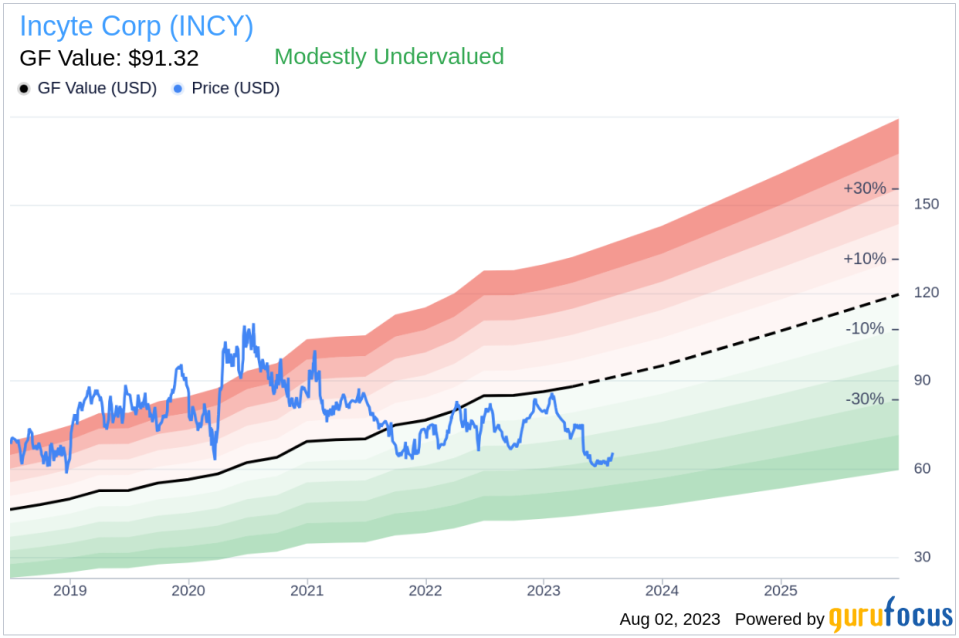

On August 2, 2023, Incyte Corp (NASDAQ:INCY) closed at a price of $65.68, marking a daily gain of 3.12%. With an Earnings Per Share (EPS) of 1.45, the question arises: Is the stock modestly undervalued? This article aims to unravel the answer through an in-depth analysis of Incyte's valuation. Let's delve into the details.

Company Overview

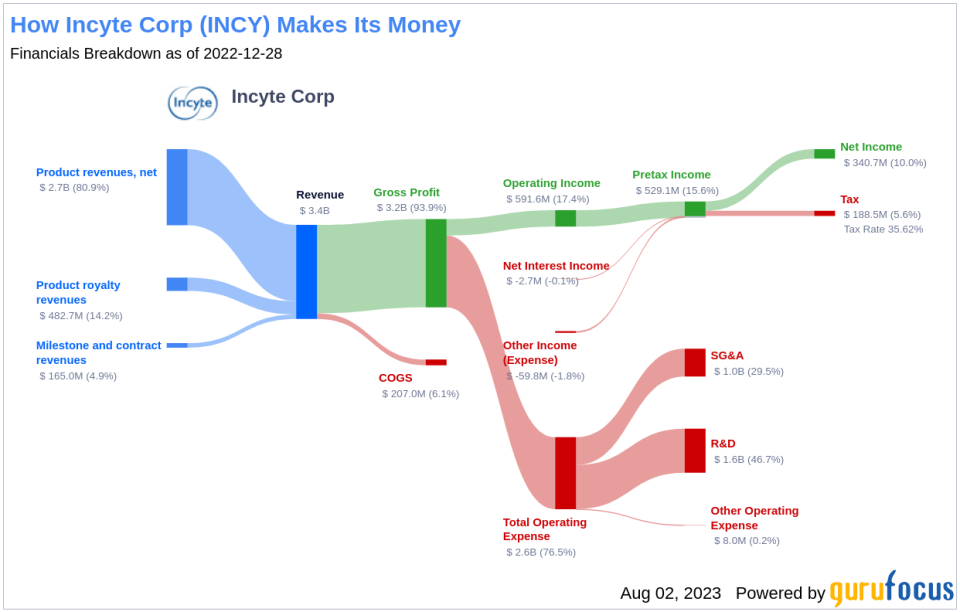

Incyte Corp (NASDAQ:INCY), a biopharmaceutical company, focuses on the discovery and development of small-molecule drugs. Its leading drug, Jakafi, treats two types of rare blood cancer and graft versus host disease. Incyte's portfolio also includes rheumatoid arthritis treatment Olumiant, oncology drugs Iclusig, Pemazyre, Tabrecta, and Monjuvi, and dermatology product Opzelura. The company's market cap stands at $14.7 billion with sales reaching $3.5 billion.

Understanding GF Value

The GF Value is a proprietary measure of a stock's intrinsic value, considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line denotes the stock's ideal fair trading value.

Incyte (NASDAQ:INCY) seems to be modestly undervalued according to the GF Value. At its current price of $65.68 per share, the stock's market cap is $14.7 billion, suggesting it is modestly undervalued. Because Incyte is relatively undervalued, the long-term return of its stock is likely to be higher than its business growth.

Financial Strength

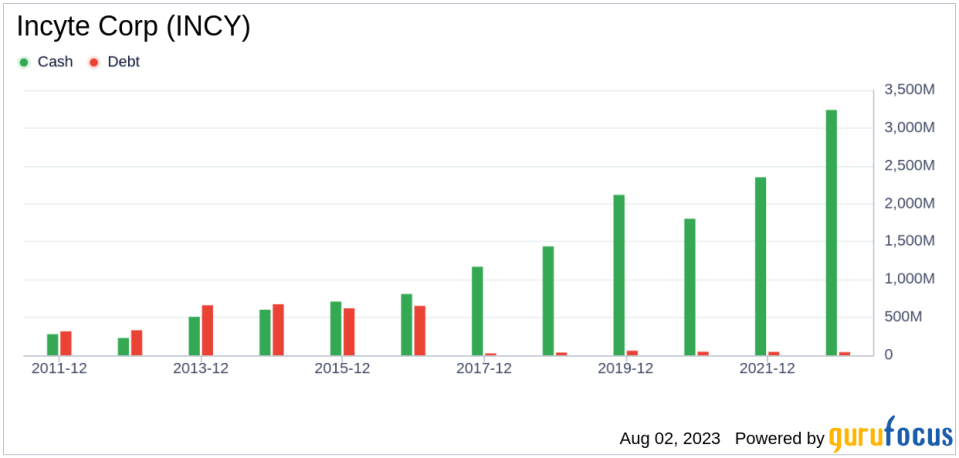

Assessing a company's financial strength is crucial before investing. Incyte has a cash-to-debt ratio of 77.36, ranking better than 75.11% of companies in the Biotechnology industry. Its overall financial strength is 10 out of 10, indicating strong financial health.

Profitability and Growth

Incyte's profitability and growth are essential factors to consider. The company has been profitable 6 over the past 10 years. Its operating margin is 14.4%, ranking better than 85.95% of companies in the Biotechnology industry. However, the 3-year average EBITDA growth rate is 2.4%, ranking lower than 53.71% of companies in the industry.

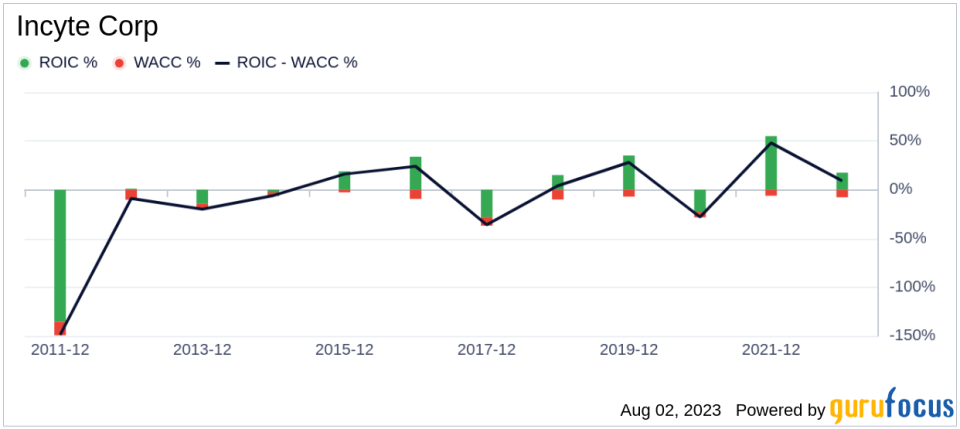

ROIC vs WACC

A comparison of Incyte's return on invested capital (ROIC) and its weighted average cost of capital (WACC) can provide insights into its profitability. Over the past 12 months, Incyte's ROIC stood at 14.74 while its WACC was at 7.08.

Conclusion

In conclusion, Incyte (NASDAQ:INCY) appears to be modestly undervalued. The company's strong financial condition and fair profitability make it an attractive investment. However, its growth ranks lower than 53.71% of companies in the Biotechnology industry. To learn more about Incyte stock, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.