Incyte's Bullish Outlook: A Surprising Strength You Shouldn't Overlook

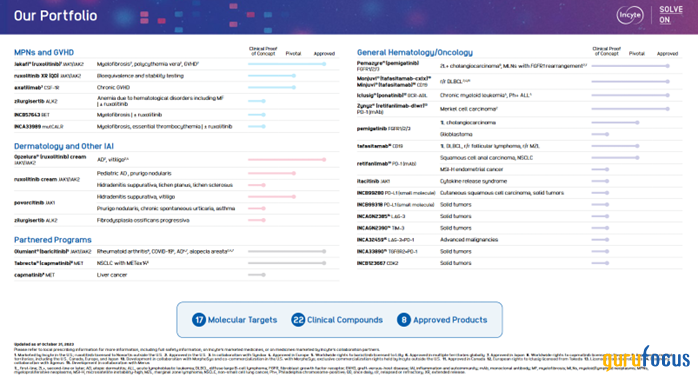

Incyte Corp. (NASDAQ:INCY) is a pharmaceutical company specializing in developing and commercializing medicines to treat patients with myeloproliferative neoplasms, graft-versus-host disease, solid tumors and various autoimmune diseases.

Investment thesis

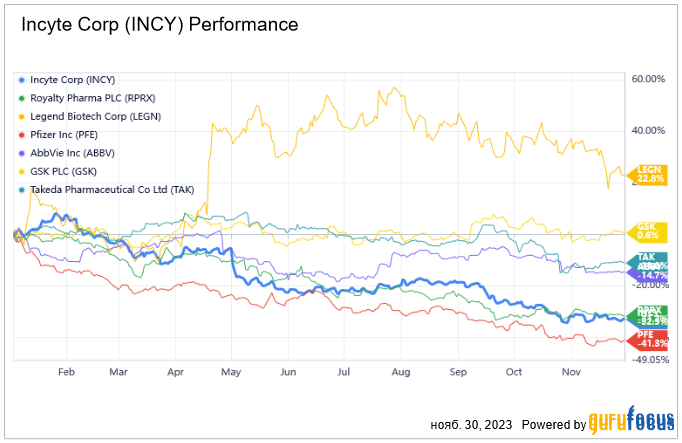

In recent months, Incyte's share price has been in a downward trend due to several factors. The first is growing concerns among financial market participants that the launch of new JAK inhibitors approved by regulators for the treatment of myelofibrosis could potentially slow the growth rate of Jakafi (ruxolitinib), which is Incyte's blockbuster and whose exclusivity ends in 2028. The second factor is the negative impact of President Biden's Inflation Reduction Act on the health care sector, including the fact the federal government received the power to negotiate prices for the most expensive medicines covered under Medicare.

However, we believe Wall Street grossly overestimates the impact of the above risks on Incyte's financial position.

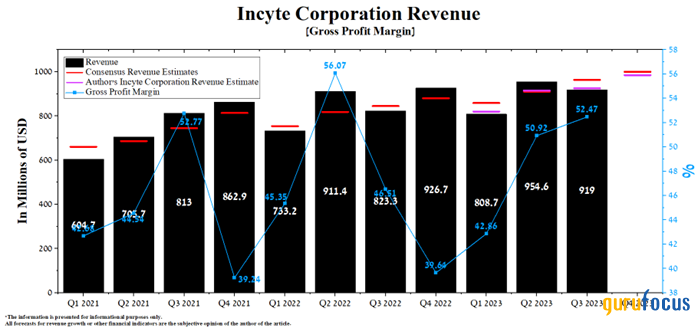

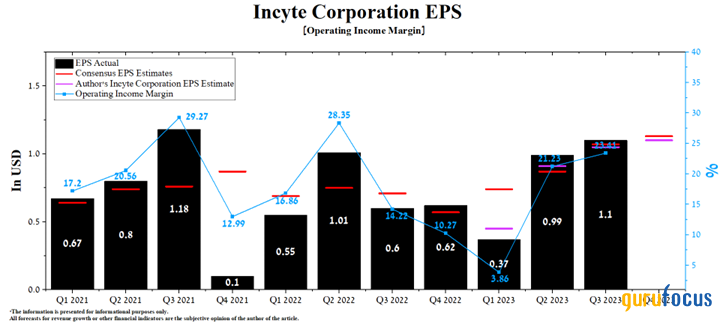

On Oct. 31, Incyte released financial results for the third quarter of 2023, which were generally better than our expectations. The company's revenue amounted to $919 million, an increase of 11.6% compared to the third quarter of 2022. On the other hand, non-GAAP earnings of $1.08 per share were 3 cents above analysts' consensus estimates.

Moreover, the demand for many of Incyte's innovative medicines, such as Jakafi, Opzelura, Minjuvi and Olumiant, continues to grow year over year due to their competitive advantages and the company's effective marketing strategies.

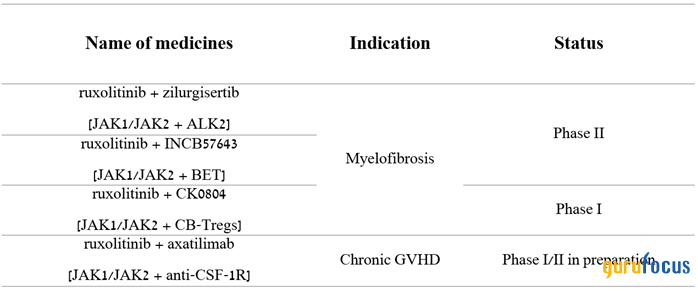

After receiving the CRL at the end of March 2023, the company continues to work on the resolution of Food and Drug Administration requirements to get approval for an extended-release version of Jakafi, and it is also developing combinations with other drugs to improve efficacy for treating myelofibrosis and chronic GVHD.

Author's elaboration, based on quarterly securities reports.

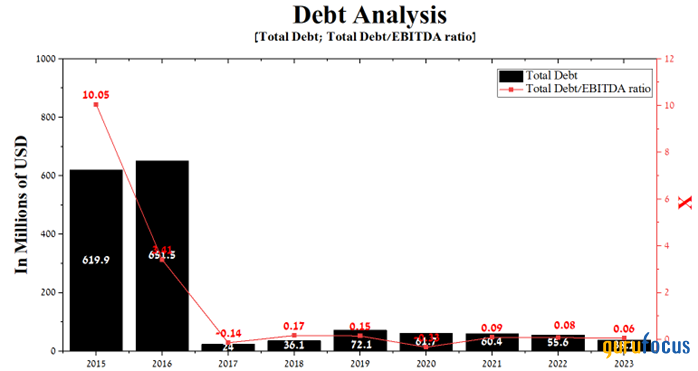

Further, Incyte has an extensive portfolio of experimental drugs, almost no debt and total cash and short-term investments that exceed $3.5 billion, representing 29.5% of its current market capitalization. As a result, the company has the financial capacity to begin pursuing a more aggressive merger and acquisition policy with the ultimate goal of diversifying its portfolio of product candidates and also increasing its revenue growth rate over the long term.

Author's elaboration, based on GuruFocus and Seeking Alpha data.

In addition to the factors discussed above, and with the company's operating income margin significantly improving in recent quarters, we believe Incyte's current stock valuation represents an attractive risk-reward profile for long-term investors.

The financial position of Incyte and its prospects

Incyte's revenue for the three months ended Sept. 30 was $919 million, missing our expectations by $6 million but up 11.6% year over year. Meanwhile, its forward price-sales ratio is 3.20, which is 11.02% below the sector average and 49.36% below the average over the past five years, indicating that Wall Street continues to remain conservative regarding the commercial prospects of the company's approved drugs and its product candidates.

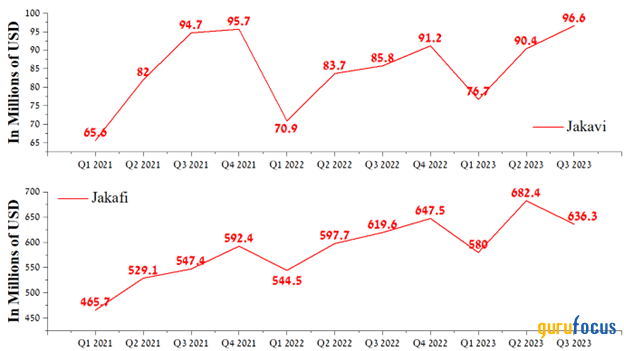

One of the crucial reasons for Incyte's year-over-year revenue growth is the increase in sales of its products that contain the active substance ruxolitinib. So Jakafi (ruxolitinib), an oral Janus kinase (JAK) inhibitor, approved by the FDA for the treatment of patients with myelofibrosis, polycythemia vera, chronic GVHD and steroid-refractory acute GVHD. Total sales of the company's blockbuster were $636.3 million in the third quarter, up 2.7% year over year, driven by higher prices and continued strong demand for it even as competition in the graft-versus-host disease treatment market intensifies.

However, ruxolitinib is commercialized outside the United States under the name Jakavi as a result of a partnership agreement with Novartis in 2009. Jakavi product royalty revenues were $96.6 million for the three months ended Sept. 30, an increase of 6.9% quarter over quarter thanks in part to its regulatory approval by the Japanese Ministry of Health, Labour and Welfare in September 2023 for the treatment of patients with GVHD.

Author's elaboration, based on quarterly securities reports.

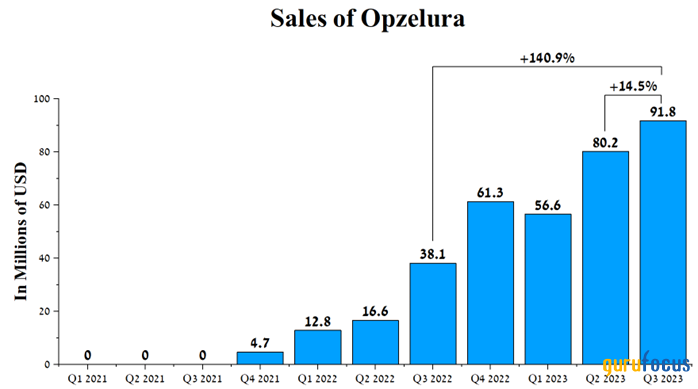

The second key contributor that plays a crucial role in improving Incyte's financial position is Opzelura (ruxolitinib), the mechanism of action of which is based on the inhibition of two enzymes, JAK1 and JAK2, which are involved in several key cytokine pathways.

By meeting primary and secondary endpoints in a phase 3 clinical trial, the drug received its first FDA approval in September 2021 for treating patients with mild to moderate atopic dermatitis. According to Incyte, approximately 10 million adolescents and adults suffer from this inflammatory skin condition, which represents a large market for Opzelura.

Moreover, with Opzelura becoming the first FDA-approved drug to treat repigmentation in patients with vitiligo in 2022, its sales growth continues to exceed our expectations. So sales of Incyte's product amounted to $91.8 million in the third quarter, an increase of 140.9% compared to the previous year.

Author's elaboration, based on quarterly securities reports.

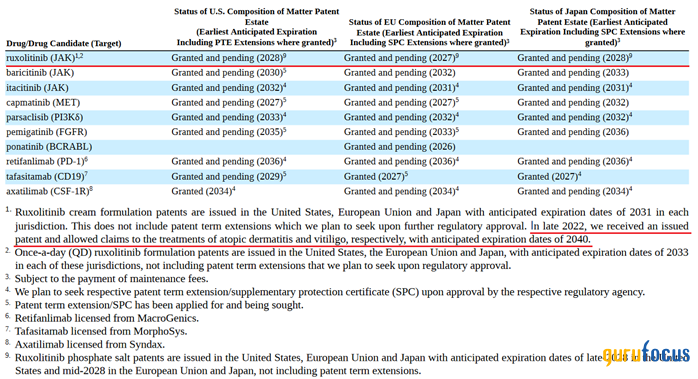

In addition, given the last patent on Opzelura for the treatment of atopic dermatitis and vitiligo expires in 2040, this reduces the financial risks associated with the launch of generic versions of Jakafi in 2028.

Author's elaboration, based on 10-K filing.

The American pharmaceutical company is expected to publish its report for the fourth quarter of 2023 on Feb.7, 2024. According to Seeking Alpha, Incyte's revenue for the quarter is expected to be in the range of $0.97 billion to $1.06 billion, up 3.8% from analysts' expectations for the previous quarter.

Author's elaboration, based on GuruFocus and Seeking Alpha data.

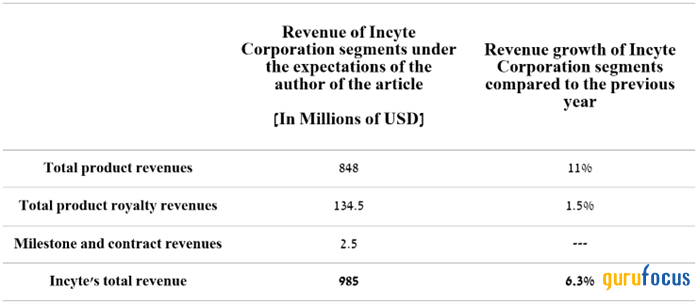

Meanwhile, according to our model, the company's total revenue will be below the median of this range and will reach $985 million. Incyte's quarterly and year-over-year revenue growth will be driven primarily by increased demand for Jakafi, Minjuvi, Opzelura and Olumiant.

Created by author

Based on the results of 2023, we expect the company's operating income margin to reach 17.5%. On the other hand, this financial metric will increase to 18.6% by 2024, mainly due to increased demand for the company's key medicines, lower costs of raw materials needed for their production and the expansion of its portfolio of product candidates.

Source: Incyte Corp.

According to Seeking Alpha, Incyte's fourth-quarter earnings per share is expected to be in the range of 83 cents to $1.34. At the same time, we expect its earnings to be in this range and reach $1.10, an increase of 77.4% compared to the previous year.

Author's elaboration, based on GuruFocus and Seeking Alpha data.

Besides, Incyte's trailing 12-month non-GAAP price-earnings ratio is 17.33, which is 1.12% lower than the sector average and 38.89% lower than the average over the past five years. Simultaneously, the forward non-GAAP price-earnings ratio is 14.97, which is one of the factors indicating Mr. Market's conservatism regarding the prospects of the leader in the global myelofibrosis treatment market.

Conclusion

Incyte is a pharmaceutical company specializing in developing and commercializing medicines to treat patients with myeloproliferative neoplasms, GVHD, solid tumors and various autoimmune diseases.

Due to the influence of the risks we highlighted at the beginning of the analysis and increased competition in the global diffuse large B-cell lymphoma therapeutics market, the price of Incyte shares has decreased by 32% since the beginning of 2023.

Author's elaboration, based on GuruFocus data.

On the other hand, the company's growing gross and operating income margins, extensive portfolio of experimental drugs, almost no debt, total cash and short-term investments that exceed $3.5 billion and increasing demand for its products that contain the active substance ruxolitinib are just some of the many key investment theses that make Incyte an attractive asset for long-term investors.

We initiate our coverage of Incyte with an "outperform" rating for the next 12 months.

This article first appeared on GuruFocus.