Independent Bank Corp (Ionia MI) Reports Modest Earnings Amid Economic Challenges

Net Interest Income: Increased by $0.7 million (1.7%) from Q3 2023.

Loan Growth: Net growth in loans of $49.4 million (5.2% annualized) since September 30, 2023.

Dividend: Paid a 23 cent per share dividend on common stock on November 13, 2023.

Net Income: Q4 net income of $13.7 million, down from $15.1 million in the same period last year.

Book Value: Increase in book value and tangible book value per share of $1.42 and $1.43 respectively.

Asset Quality: Strong asset quality metrics with a small release of loan loss reserves.

Share Repurchase: Authorized repurchase of up to 1,100,000 shares under the 2024 share repurchase plan.

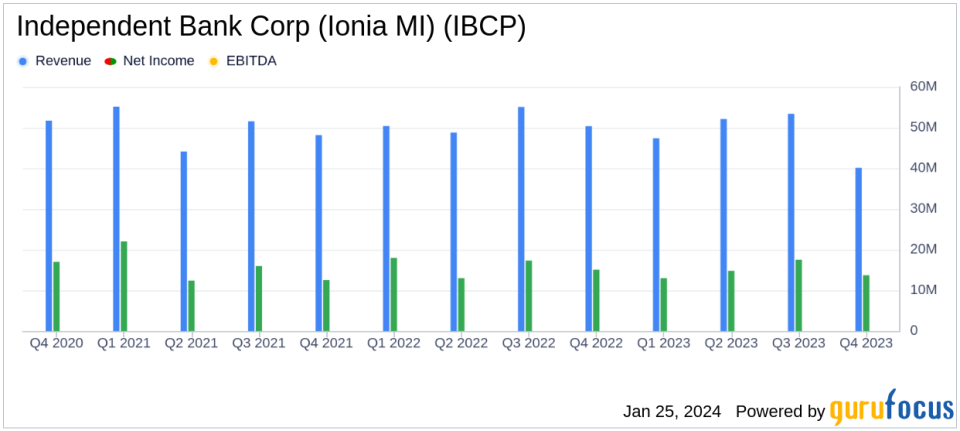

On January 25, 2024, Independent Bank Corp (Ionia MI) (NASDAQ:IBCP) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The bank, which offers a comprehensive range of banking services, including commercial lending and mortgage lending, reported a net income of $13.7 million, or $0.65 per diluted share, a decrease from the $15.1 million, or $0.71 per diluted share, reported in the prior-year period. Despite the challenges in the macroeconomic environment, the bank achieved a net growth in loans and an increase in net interest income.

Performance Overview

Independent Bank Corp (Ionia MI) (NASDAQ:IBCP) experienced a modest increase in net interest income over the third quarter of 2023, with a 1.7% rise amounting to $0.7 million. The bank's book value per share also increased by $1.42, alongside a tangible book value per share increase of $1.43. The company's loan portfolio saw a significant annualized growth of 5.2%, indicating a robust commercial lending activity. A dividend of 23 cents per share was paid out to shareholders, reflecting the bank's commitment to returning value.

However, the bank faced a decrease in net income compared to the same quarter in the previous year, primarily due to a change in the fair value of capitalized mortgage servicing rights, which had a $3.6 million negative impact. This non-cash adjustment, after tax, equated to $0.14 per diluted share. Adjusting for this, the bank's annualized return on assets would have been 1.26% for the fourth quarter of 2023, compared to 1.24% for the same period in 2022.

Financial Highlights and Challenges

The bank's net interest income for the fourth quarter stood at $40.1 million, a slight decrease from the year-ago period but an increase from the third quarter of 2023. The net interest margin, however, declined to 3.26% from 3.52% in the year-ago period. Non-interest income saw a decrease both for the quarter and the full year, primarily due to variances in mortgage banking revenues. Non-interest expenses remained relatively stable year-over-year.

Asset quality remained strong, with non-performing loans comprising only 0.14% of the total loan portfolio. The provision for credit losses was a credit of $0.6 million for the quarter, reflecting the bank's solid credit management practices.

Balance Sheet and Capital Strength

Independent Bank Corp (Ionia MI) (NASDAQ:IBCP) reported total assets of $5.26 billion, an increase from the previous year. Loan growth was robust, with loans, excluding those held for sale, reaching $3.79 billion. Deposits also grew significantly, totaling $4.62 billion. Shareholders' equity increased to $404.4 million, or 7.68% of total assets, up from the previous year's 6.95%.

The bank's regulatory capital ratios remained well above the "well capitalized" minimum, with a Tier 1 capital to average total assets ratio of 8.80%, and a total capital to risk-weighted assets ratio of 12.46%. Additionally, the bank's share repurchase plan demonstrates confidence in its financial position and commitment to shareholder value.

"Our fourth quarter performance capped off another remarkably strong year, with our organization performing exceptionally well despite continued challenges in the macroeconomic environment," said William B. Kessel, President and CEO of Independent Bank Corp (Ionia MI) (NASDAQ:IBCP).

Independent Bank Corp (Ionia MI) (NASDAQ:IBCP) remains committed to making strategic investments in talent and technology to drive customer growth, market share, and profitability. The bank's performance in the fourth quarter, despite economic headwinds, positions it well for continued success in 2024.

For a more detailed analysis and further information, investors and analysts are encouraged to review the full 8-K filing and attend the earnings conference call.

Explore the complete 8-K earnings release (here) from Independent Bank Corp (Ionia MI) for further details.

This article first appeared on GuruFocus.