India's Consumer Durable Finance Market Anticipated to Surge with a 21.85% CAGR Through 2029

Indian Consumer Durable Finance Market

Dublin, March 28, 2024 (GLOBE NEWSWIRE) -- The "India Consumer Durable Finance Market, By Region, By Competition Forecast & Opportunities, 2019-2029" report has been added to ResearchAndMarkets.com's offering.

Robust Growth in India's Consumer Durable Finance Sector

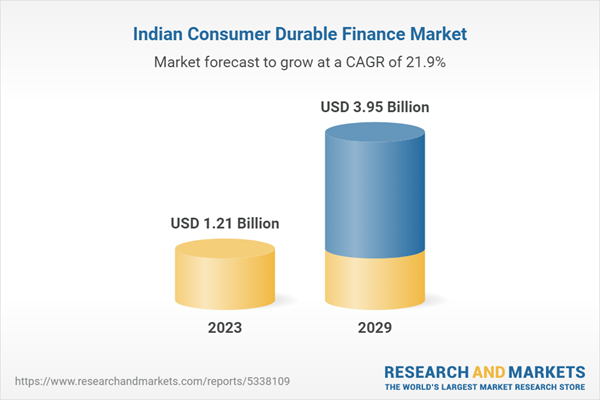

The consumer durable finance market in India has witnessed a sizable growth, accelerating from USD 1.21 billion in 2023 to a forecasted value of USD 3.95 billion by the end of 2029. This growth trajectory represents an impressive CAGR of 21.85%. In the light of increasing consumer aspirations, growing purchasing power, and the rising penetration of digital finance solutions, the market continues to demonstrate strong growth potential.

Key Drivers of the Market

Foremost among the factors propelling the market forward are the rising consumer aspirations and enhanced purchasing power, especially among India's burgeoning middle-class demographic. Urbanization, income growth, and rapidly evolving lifestyles also play critical roles in shaping consumer behavior and fueling the demand for high-quality electrical and electronic consumer goods.

Parallelly, the expansion of e-commerce and the widespread establishment of retail chain stores across the nation have made consumer durables more accessible while promoting a culture of competitive financing options and tailored loan products, greatly benefiting consumers.

Digital Transformation Catalyzing Market Dynamics

A significant contributor to the market's growth is the ongoing digital transformation that streamlines the loan application process, integrates e-commerce financing, and enables data-driven credit scoring. This integration has made consumer durable finance more accessible and attractive to the nation's digitally savvy populace.

Challenges & Regulatory Environment

While the market outlook is optimistic, challenges still exist, particularly in relation to economic volatility and affordability. Factors such as income disparities, economic uncertainty, and credit risks continue to affect the market's dynamics. Moreover, regulatory changes and the need to ensure strict adherence to compliance demand operational resilience from market participants.

Retail and E-commerce Sectors: A Competitive Landscape

The Indian market has seen a significant amount of competition arise from both traditional financial institutions and fintech companies. As these entities vie for market share, adapting to technological advancements remains a necessity for delivering the speed and convenience that customers now expect from digital loan services.

Outlook and Market Development

The sector is ripe for innovation as the demand for premium and smart consumer durables soars. Lenders are tailoring their offerings to match consumer demands and technological capabilities, extending loan tenures, and crafting product-specific financial solutions. Additionally, strategic partnerships between financial institutions and retail enterprises have paved the way for mutually beneficial collaborations, extending the market's reach across different regions of the country.

Segmental and Regional Market Insights

Smartphones continue to reign as a principal segment, encapsulating a significant share of the market. In the urbanized and affluent South region of India – comprising thriving economies such as Tamil Nadu and Karnataka – there is a pronounced demand for consumer durables and associated finance options, underpinning the region's importance in the marketplace.

Conclusion

The Indian Consumer Durable Finance Market is set for an upward trajectory, buoyed by a combination of economic development, consumer demand, and advancing technologies. As the market presents ample opportunities, it remains an attractive arena for investment and growth within the financial sector.

Key Attributes

Report Attribute | Details |

No. of Pages | 90 |

Forecast Period | 2023 - 2029 |

Estimated Market Value (USD) in 2023 | $1.21 Billion |

Forecasted Market Value (USD) by 2029 | $3.95 Billion |

Compound Annual Growth Rate | 21.8% |

Regions Covered | India |

A selection of companies mentioned in this report includes, but is not limited to:

Bajaj Capital Limited

Birla Global Finance Limited

Housing Development Finance Corporation

ICICI Group

LIC Finance Limited

L & T Finance Limited

Mahindra & Mahindra Financial Services Limited

Muthoot Finance Ltd

Cholamandalam

Tata Capital Financial Services Ltd

For more information about this report visit https://www.researchandmarkets.com/r/d6ywey

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900