Indivior PLC (INDV)'s True Worth: A Complete Analysis of Its Market Value

Indivior PLC (NASDAQ:INDV) has recently seen a daily gain of 1.76% and a 3-month gain of 7.9%. With an Earnings Per Share (EPS) of 0.64, the question arises: Is the stock modestly undervalued? In this article, we aim to explore this question and provide a comprehensive valuation analysis of Indivior PLC. So, let's dive in.

Company Introduction

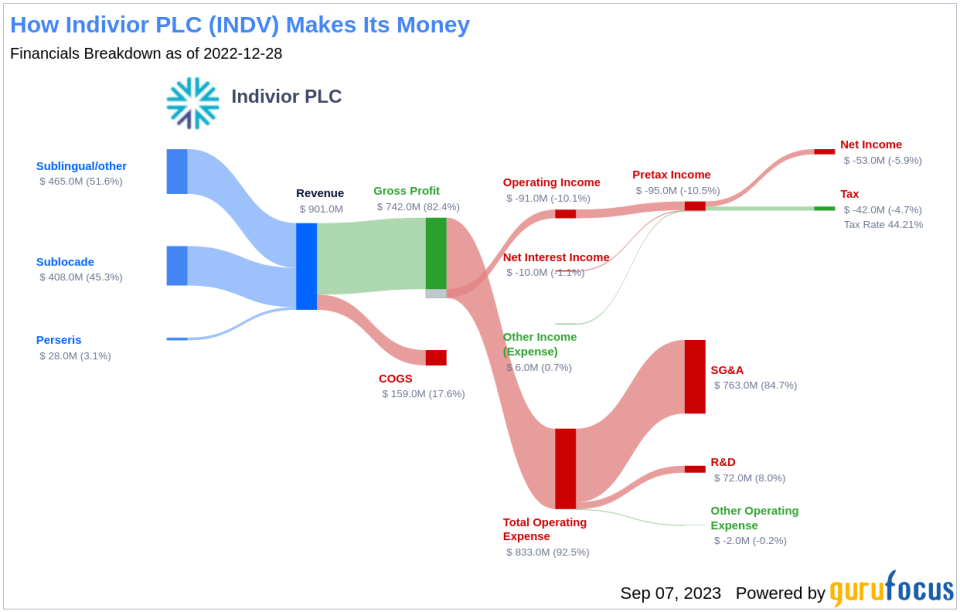

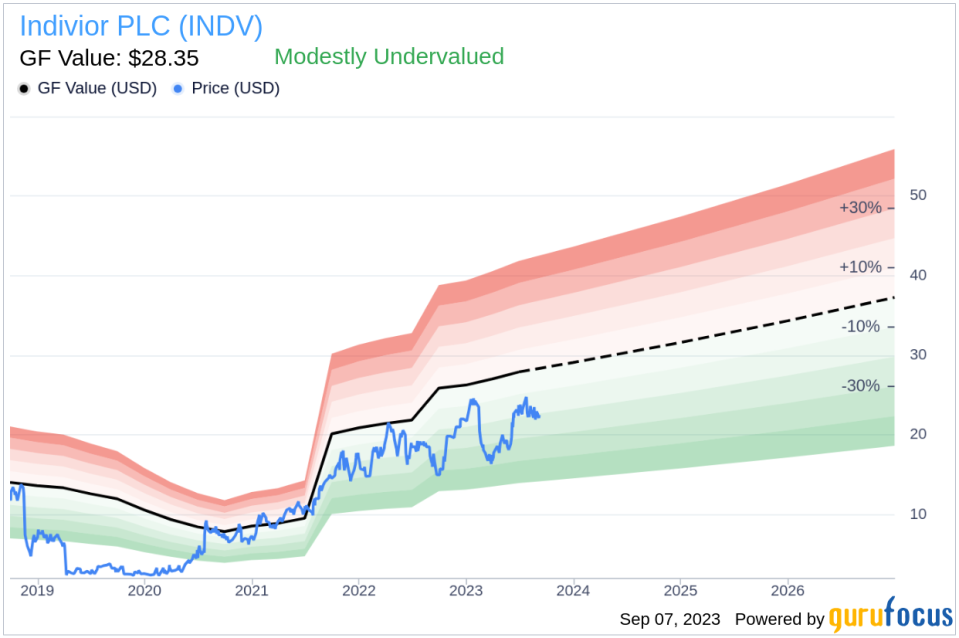

Indivior PLC is a specialty and generic drug manufacturing company, primarily focused on the development, manufacture, and sale of prescription drugs based on buprenorphine for the treatment of opioid dependence. The company generates the majority of its revenue in the United States, followed by the rest of the world. With a current stock price of $22.51 and a market cap of $3.20 billion, the company's GF Value, an estimation of fair value, stands at $28.35. This comparison between the stock price and the GF Value paves the way for a deeper exploration of the company's value.

Understanding GF Value

The GF Value represents the current intrinsic value of a stock derived from our proprietary method. It's based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line provides an overview of the fair value at which the stock should ideally be traded.

According to GuruFocus Value calculation, the stock of Indivior PLC appears to be modestly undervalued. This suggests that the long-term return of its stock is likely to be higher than its business growth.

Financial Strength

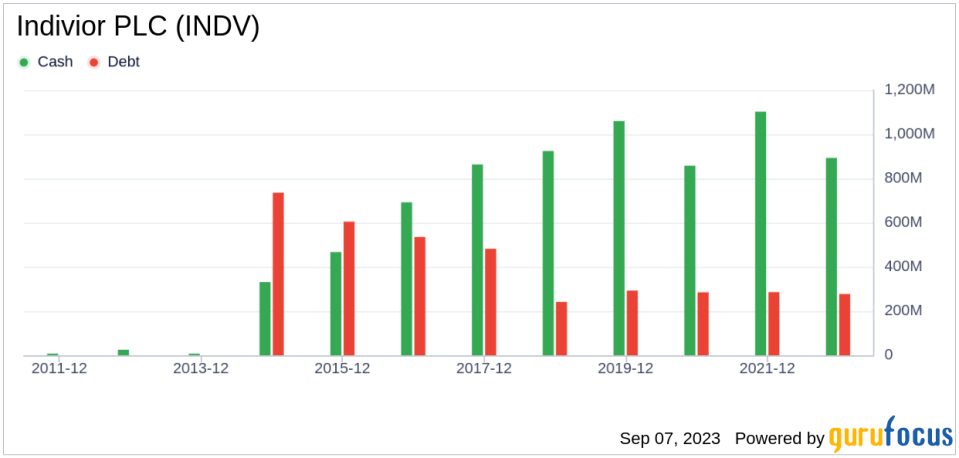

Assessing the financial strength of a company is crucial before investing in its stock. Indivior PLC has a cash-to-debt ratio of 2.45, which is better than 63.71% of 1050 companies in the Drug Manufacturers industry. The overall financial strength of Indivior PLC is rated 5 out of 10, indicating fair financial strength.

Profitability and Growth

A company's profitability and growth are significant factors in its valuation. Indivior PLC has been profitable 8 over the past 10 years. Over the past twelve months, the company had a revenue of $1 billion and Earnings Per Share (EPS) of $0.64. However, its operating margin of -6.22% ranks worse than 68.25% of 1033 companies in the Drug Manufacturers industry.

The 3-year average annual revenue growth rate of Indivior PLC is 8.6%, which ranks better than 58.66% of 912 companies in the Drug Manufacturers industry. However, the 3-year average EBITDA growth rate is 0%, which ranks worse than 0% of 881 companies in the Drug Manufacturers industry.

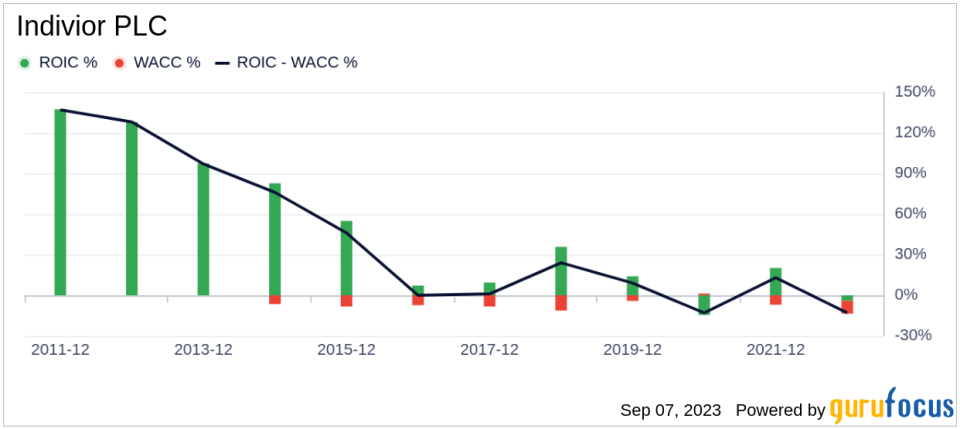

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) is another way to evaluate its profitability. During the past 12 months, Indivior PLC's ROIC is -3.39 while its WACC came in at 0.55.

Conclusion

In conclusion, the stock of Indivior PLC appears to be modestly undervalued. The company's financial condition and profitability are fair, although its growth ranks worse than 0% of 881 companies in the Drug Manufacturers industry. To learn more about Indivior PLC stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.