Infosys' (INFY) Finacle Partners With Guaranty Trust Bank

Infosys' INFY wholly-owned subsidiary, Finacle, has been chosen as the new digital transformation partner by Nigeria's Guaranty Trust Bank (“GTBank”). Notably, GTBank is set to initiate its multi-country digital transformation program using the Finacle Digital Banking Suite.

Finacle positions itself as the foremost provider of comprehensive digital banking solutions, catering to core banking, digital engagement, lending, payments, cash management and a wide array of other services. Additionally, it meets the artificial intelligence and blockchain needs of financial institutions.

GTBank, aiming to enhance its digitization and automation efforts while achieving cost-efficiency, chose Finacle due to its well-established track record in retail, wealth and corporate banking. The Finacle Digital Banking Suite will utilize Finacle's Cloud Native and API-Driven features, preparing GTBank for seamless integration with its ecosystem partners.

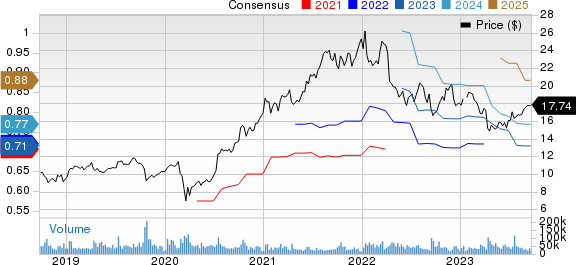

Infosys Limited Price and Consensus

Infosys Limited price-consensus-chart | Infosys Limited Quote

GTB Deal to Boost Infosys’ Financial Services Business

Shares of Infosys have declined 1.5% year to date against the Computer and Technology Sector’s rise of 34.7% in the same time frame.

This new partnership with GTBank has the potential to relieve the persistent weakness experienced by this Zacks Rank #4 (Sell) company, particularly within its banking and financial services clients, especially in areas like asset management, investment banking, mortgage, cards and payments.

In the last reported financial results for first-quarter fiscal 2024, Infosys noticed that financial institutions are delaying its decision-making processes amid the ongoing macroeconomic challenges. In the first quarter, revenues from the Financial Services segment fell 4.7% to $1.3 billion. The softness was particularly noticeable in Europe.

This new GTB deal, which has operations across multiple markets in Europe and Africa, can boost INFY’s Financial Services performance. Additionally, the large U.S. banking clients remained strong in the first quarter of 2024, offsetting some of Infosys' challenges.

INFY’s first-quarter revenues of 2024 grew 3.9% on a year-over-year basis to $4.62 billion. For fiscal 2024, the company expects revenues to grow between 1% and 3.5% year over year at cc. The Zacks Consensus Estimate is pegged at $18.63 billion, indicating 3.9% year-over-year growth.

Stocks to Consider

Some better-ranked stocks from the broader technology sector are Asure Software ASUR, NVIDIA NVDA and Dell DELL, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Asure Software’s third-quarter 2023 earnings has been revised northward by a penny to 6 cents per share in the past seven days. For 2023, earnings estimates have moved 2 cents upward to 54 cents per share in the past seven days.

Asure Software’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 676.4%. Shares of ASUR have lost 12.1% year to date.

The Zacks Consensus Estimate for NVIDIA's third-quarter fiscal 2024 earnings has been revised northward by $1 to $3.32 per share in the past 30 days. For fiscal 2024, earnings estimates have increased by $2.67 to $10.67 per share in the past 30 days.

NVIDIA’s earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters, while missing on one occasion, the average surprise being 9.8%. Shares of NVDA have surged 180.6% year to date.

The Zacks Consensus Estimate for Dell’s third-quarter 2023 earnings has been revised 8.08% upward to $1.47 per share in the past 30 days. For 2023, earnings estimates have moved 13.51% upward to $6.30 per share in the past 30 days.

Dell’s earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 39.52%. Shares of DELL have surged 70.1% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Noble Gas Inc. (INFY) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report