Infosys (INFY) Launches Cloud Solution for Commercial Airlines

Infosys Limited INFY recently launched Infosys Cobalt Airline Cloud (“ICAC”), specifically designed for commercial airlines to help them accelerate their digital transformation journey. The company has leveraged its deep experience and expertise in the travel and hospitality sector to build ICAC, which it calls a first-of-its-kind industry cloud offering for commercial airline operators.

The ICAC platform offers solutions, APIs and re-usable business assets that can be used for transforming legacy workloads through disassembling and improving customer experiences by ensuring accuracy in baggage delivery.

The solution will improve operational efficiency by reducing Unit Load Device misplacement and losses to less than 2% from the current industry average of more than 5%. It will also help airlines optimize network and route planning. By leveraging AI for crowd control, theft and security, the ICAC platform will enhance passenger safety and ensure smooth operations while reducing the cost of manual airport operations.

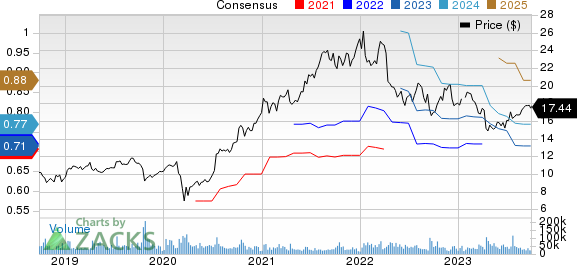

Infosys Limited Price and Consensus

Infosys Limited price-consensus-chart | Infosys Limited Quote

Infosys revealed that the ICAC platform has been built on composable architecture principles that draw from the overall framework of Infosys Cobalt, which is a set of services, solutions and platforms for enterprises that helps them accelerate their cloud journey. Under this set of services, Infosys offers about 14,000 cloud assets and more than 200 cloud solution blueprints.

Infosys has been reinforcing its digital transformation capabilities to expand and solidify its position in the highly competitive environment. It enables its clients across more than 45 countries to create and execute strategies for their digital transformation. Such efforts in the digital transformation business will aid the company in competing with peers like Accenture and Cognizant.

However, Infosys’ near-term growth prospects are likely to be hurt as organizations are postponing the plans of investing in big and expensive technology products on growing global slowdown concerns amid persistent macroeconomic headwinds and geopolitical tensions. Moreover, elevated operating expenses related to hiring new employees and sales and marketing strategies to capture more market share are likely to strain margins in the near term.

These, along with the rapid proliferation of customizable Internet-based software, have been hampering Infosys’ traditional outsourcing business. These challenges might weigh on the company’s profitability going ahead.

Zacks Rank & Stocks to Consider

Infosys currently carries a Zacks Rank #4 (Sell). The stock has declined 3.2% year to date (YTD).

Some better-ranked stocks from the broader technology sector are NVIDIA NVDA, Paylocity Holding PCTY and Palo Alto Networks PANW. NVIDIA and Paylocity each sport a Zacks Rank #1 (Strong Buy), while Palo Alto Networks carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for NVIDIA's third-quarter fiscal 2024 earnings has been revised upward by 8 cents to $3.32 per share in the past 30 days. For fiscal 2024, earnings estimates have increased by 21 cents to $10.67 per share in the past 30 days.

NVIDIA’s earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while missing on one occasion, the average surprise being 9.8%. Shares of NVDA have surged 190.6% YTD.

The Zacks Consensus Estimate for Paylocity’s first-quarter fiscal 2024 earnings has remained unchanged at $1.07 per share in the past 60 days. For fiscal 2024, earnings estimates have moved 31 cents upward to $5.58 per share in the past 60 days.

Paylocity’s earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 39.7%. Shares of PCTY have declined 5% YTD.

The Zacks Consensus Estimate for Palo Alto Networks' first-quarter fiscal 2024 earnings has been revised upward by a penny to $1.16 per share in the past 30 days. For fiscal 2024, earnings estimates have increased by 4 cents to $5.34 per share in the past 30 days.

Palo Alto Networks’ earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 22.2%. Shares of PANW have surged 66.2% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Noble Gas Inc. (INFY) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

Paylocity Holding Corporation (PCTY) : Free Stock Analysis Report