Infosys (INFY) Unveils Its New Proximity Center in Bulgaria

Infosys Limited INFY recently announced that it has set up a new proximity center in Sofia, Bulgaria, with the commitment to employ 500 local professionals over a span of four years. This strategic move serves to further expand INFY's presence within the European market.

The new facility will provide solutions that will leverage Infosys Cobalt and Topaz. It will also provide solutions across the cloud, artificial intelligence, automation, software engineering, data analytics, Internet of Things and 5G. Additionally, the new arrangement will enable Infosys to strengthen its capabilities across digital, analytical and systems, applications & products in data processing.

This project will help the company to counter the anti-outsourcing sentiments, a challenge that Infosys has been facing for a long time. Alongside hiring from a pool of local IT specialists, INFY will also be able to leverage Bulgaria’s robust IT infrastructure. With the new proximity center, it will be able to drive digital transformation throughout the European and Bulgarian clientele in various sectors that include retail, manufacturing and financial services.

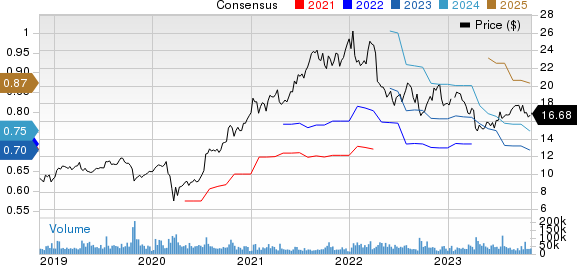

Infosys Limited Price and Consensus

Infosys Limited. price-consensus-chart | Infosys Limited Quote

The newest proximity center comes as an extension of a long line of projects that Infosys has throughout Europe, which also includes deals like partnerships with Stark Group, Danske Bank, Keytrade Bank, ABN AMRO, smart Europe GmbH and ng-voice GmbH. In the second quarter of 2024, INFY signed eight large deals in Europe.

However, the company is facing a mixed bag of challenges. Its business is being affected by near-term uncertainties stemming from inflation and high interest rates. Slow decision-making processes, along with softness in digital transformation programs and discretionary spending in the current uncertain macroeconomic environment, are hurting the company’s volumes.

Considering the aforementioned factors, Infosys, during its last reported quarterly results, trimmed fiscal 2024 revenue growth guidance to 1-2.5% at constant currency from 1-3.5% projected earlier. However, the company continues to estimate an operating margin in the 20-22% range for the full fiscal.

Zacks Rank and Stocks to Consider

Currently, INFY carries a Zacks Rank #4 (Sell). Shares of the company have declined 7.4% year to date.

Some better-ranked stocks from the broader technology sector are NVIDIA NVDA, NetEase NTES and Dell Technologies DELL, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for NVDA’s third-quarter fiscal 2024 earnings has been revised by 10 cents northward to $3.34 per share in the past 60 days. For fiscal 2024, earnings estimates have increased by 28 cents to $10.74 in the past 60 days.

NVIDIA's earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, while missing the same on one occasion, the average surprise being 9.8%. Shares of NVDA have rallied 208% year to date.

The Zacks Consensus Estimate for NetEase's third-quarter 2024 earnings has been revised upward by 8 cents to $1.65 per share in the past 30 days. For fiscal 2024, earnings estimates have increased by 42 cents to $6.96 per share in the past 30 days.

NTES' earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, while missing the same on one occasion, the average surprise being 24.54%. Shares of NTES have gained 55.2% year to date.

The Zacks Consensus Estimate for DELL's third-quarter 2024 earnings has been revised upward by a penny to $1.47 per share in the past 30 days. For fiscal 2024, earnings estimates have increased by 2 cents to $6.33 per share in the past 30 days.

Dell’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 39.52%. Shares of DELL have climbed 72.8% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Noble Gas Inc. (INFY) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

NetEase, Inc. (NTES) : Free Stock Analysis Report