Ingersoll Rand Inc. (IR) Reports Record Earnings, Strong Cash Flow in Q4 and Full Year 2023

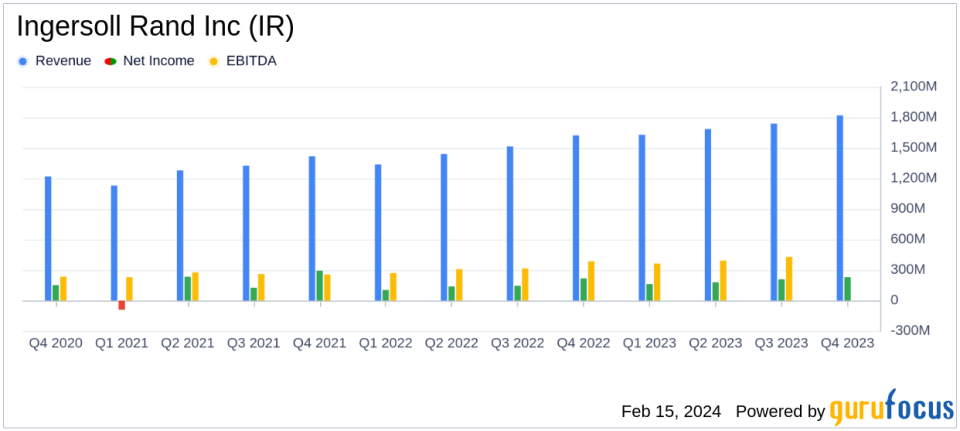

Revenue Growth: Q4 reported revenues increased by 12% to $1,821 million, and full-year revenues rose by 16% to $6,876 million.

Net Income Surge: Q4 net income attributable to Ingersoll Rand Inc. reached $230 million, with full-year net income at $779 million.

Adjusted EBITDA Expansion: Q4 Adjusted EBITDA grew by 19% to $501 million, while full-year Adjusted EBITDA increased by 25% to $1,787 million.

Free Cash Flow Leap: Free cash flow from continuing operations soared by 72% in Q4 to $552 million, and by 65% for the full year to $1,272 million.

2024 Guidance: Ingersoll Rand projects a 5-7% revenue growth and an Adjusted EBITDA of $1,915 to $1,975 million for 2024.

On February 15, 2024, Ingersoll Rand Inc (NYSE:IR) released its 8-K filing, announcing record results for the fourth quarter and full year of 2023. The company, known for its industrial technologies and services, as well as precision and science technologies, serves a diverse range of end markets and generated approximately $5.9 billion in revenue in 2022.

Ingersoll Rand's performance in the fourth quarter was particularly strong, with reported orders up 13% and revenues increasing by 12%. The company's net income attributable to Ingersoll Rand Inc. was $230 million, translating to earnings of $0.56 per share. Adjusted net income from continuing operations, net of tax, was $355 million, or $0.86 per share. The Adjusted EBITDA for the quarter was $501 million, a 19% increase, with a margin of 27.5%, up 160 basis points year over year.

Financial Achievements and Future Outlook

The company's financial achievements are significant, particularly in the industrial products industry, where consistent cash flow and strong EBITDA margins are critical for sustained investment and growth. The impressive 72% increase in free cash flow from continuing operations underscores Ingersoll Rand's operational efficiency and financial discipline.

Looking ahead, Ingersoll Rand's guidance for 2024 is optimistic, with expected full-year revenue growth of 5% to 7% and Adjusted EBITDA of $1,915 to $1,975 million, marking a 7% to 11% increase over the prior year. Adjusted EPS is anticipated to be in the range of $3.14 to $3.24, up 6% to 9% over the previous year.

Challenges and Strategic Initiatives

Despite its strong performance, Ingersoll Rand is not immune to challenges. The company's Precision and Science Technologies Segment experienced softness in the life sciences businesses, particularly in the oxygen concentration and biopharma end markets. However, the company's strategic use of Ingersoll Rand Execution Excellence (IRX) and its focus on high-growth sustainable end markets have enhanced the long-term durability of the business.

Chairman and CEO Vicente Reynal attributed the company's success to its global workforce and the unique ownership mindset that has fueled a sense of belonging and led to numerous accolades. Reynal stated,

Our fourth quarter and full year results outperformed on revenue, Adjusted EBITDA, Adjusted EPS, and Free Cash Flow targets, keeping us on track to achieve our 2025 goals and positioning us well for the aggressive 2027 targets we set at our Investor Day."

In conclusion, Ingersoll Rand's record earnings and robust cash flow in the fourth quarter and full year of 2023 reflect a company well-positioned for continued growth. With a strong financial foundation and strategic initiatives in place, Ingersoll Rand is poised to meet its ambitious targets for the coming years.

For a detailed analysis of Ingersoll Rand's financial performance and future outlook, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Ingersoll Rand Inc for further details.

This article first appeared on GuruFocus.