Ingevity Corp (NGVT) Faces Restructuring Challenges Despite Revenue Growth

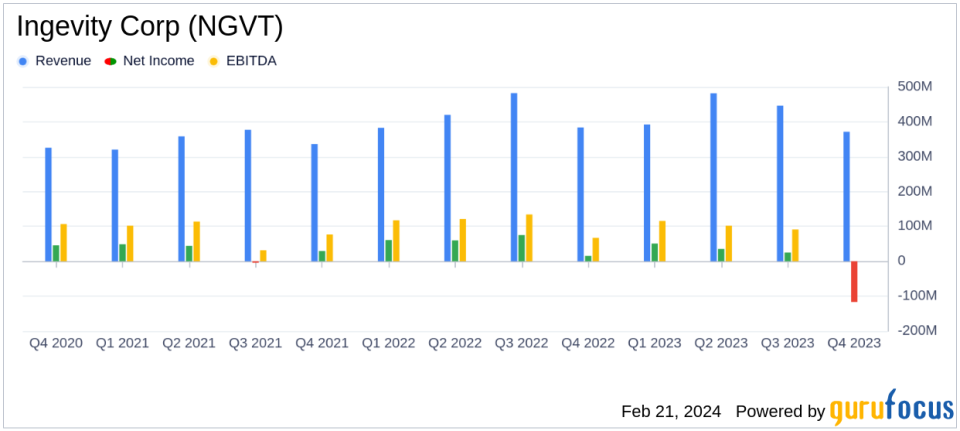

Net Sales: Reported a slight increase of 1.4% to $1.69 billion for the full year.

Net Loss: A net loss of $5.4 million was recorded, including significant restructuring charges.

Adjusted EBITDA: Reached $396.8 million for the full year, with a margin of 23.5%.

Performance Materials: Segment saw a 7% increase in sales, driven by higher pricing and improved global auto production.

Cost Savings: Implemented significant actions aimed at reducing costs and improving profitability.

Guidance: Provided full year 2024 guidance with sales expected between $1.40 billion and $1.55 billion and adjusted EBITDA between $365 million and $390 million.

Share Repurchases: Totaled $92.1 million for the year under the current Board authorization.

Ingevity Corp (NYSE:NGVT) released its 8-K filing on February 21, 2024, detailing its financial results for the fourth quarter and full year of 2023. The chemical manufacturer, known for its Performance Chemicals and Performance Materials segments, faced a challenging year marked by a net loss and significant restructuring charges. Despite these challenges, the company managed to post a slight increase in net sales for the full year.

Company Overview

Ingevity Corp is a prominent player in the chemical manufacturing industry, operating primarily through its two segments: Performance Chemicals and Performance Materials. The company's Performance Chemicals segment, which is the larger revenue contributor, specializes in producing specialty chemicals used in various applications such as asphalt paving and oil exploration. The Performance Materials segment focuses on automotive carbon products. Ingevity's global presence is particularly strong in North America, where it enjoys a significant market share.

Financial Performance and Challenges

The fourth quarter saw a 3.1% decrease in net sales to $371.7 million, with a net loss of $116.8 million, which included restructuring charges of $107.5 million. The adjusted earnings were $7.8 million, and the diluted adjusted EPS was $0.21. The adjusted EBITDA for the quarter was $61.8 million, a decrease of 17% from the previous year, with an adjusted EBITDA margin of 16.6%. The full year results were more positive, with net sales increasing by 1.4% to $1.69 billion. However, the company still reported a net loss of $5.4 million for the year, after accounting for restructuring charges of $145.3 million. The adjusted earnings for the full year were $144.7 million, and the diluted adjusted EPS was $3.94. The adjusted EBITDA for the full year was $396.8 million, with an adjusted EBITDA margin of 23.5%.

Financial Achievements and Importance

The company's Performance Materials segment reported a 7% increase in sales to a record $586.0 million for the full year, driven by increased pricing and improved global auto production. The segment's EBITDA also reached a record $286.6 million, up 14%, with an EBITDA margin of 48.9%. These achievements highlight Ingevity's ability to leverage its product offerings and pricing strategies effectively, even in a challenging market environment.

Analysis and Future Outlook

President and CEO John Fortson commented on the year's performance, stating:

"2023 was a record year for Performance Materials driven by increased global auto production and the growing popularity of hybrid electric vehicles, and the Road Technologies business line posted another strong year as the teams strategic focus on expanding technology adoption keeps driving steady growth."

Fortson also acknowledged the challenges faced by the Advanced Polymer Technologies segment and the Industrial Specialties business line, which were impacted by weak industrial demand and unprecedented increases in CTO costs. However, he expressed confidence in the company's growth strategy and its focus on less cyclical end markets.

Looking ahead, Ingevity provided guidance for the full year 2024, with sales expected to be between $1.40 billion and $1.55 billion and adjusted EBITDA between $365 million and $390 million. The company's focus on cost savings and strategic repositioning, particularly within the Performance Chemicals segment, is expected to drive profitability and growth in the coming year.

For more detailed financial information and the full earnings report, investors and interested parties can access the 8-K filing.

Explore the complete 8-K earnings release (here) from Ingevity Corp for further details.

This article first appeared on GuruFocus.