Ingevity's (NGVT) Earnings and Sales Miss Estimates in Q3

Ingevity Corporation NGVT recorded third-quarter 2023 profits of $25.2 million or 69 cents per share, down from $75.4 million or $1.98 per share in the year-ago quarter.

Excluding one-time items, adjusted earnings in the quarter were $1.21 per share, down from $2.09 a year ago. The figure missed the Zacks Consensus Estimate of $1.22.

Revenues fell 7.5% year over year to $446 million in the quarter, missing the Zacks Consensus Estimate of $466.4 million. Lower volumes due to weak industrial demand mainly affected Advanced Polymer Technologies and the Industrial Specialties business lines, partly offset by increased North America and Asia sales and higher pricing in the Pavement Technologies business line.

Ingevity Corporation Price, Consensus and EPS Surprise

Ingevity Corporation price-consensus-eps-surprise-chart | Ingevity Corporation Quote

Segmental Review

The Performance Chemicals division generated revenues of $256 million in the reported quarter, down around 4% year over year. The reported figure was lower than the consensus estimate of $264 million.

Revenues in the Performance Materials unit rose around 2% year over year to $147.2 million. The figure was higher than the consensus estimate of $142 million.

Sales in the Advanced Polymer Technologies segment were down 38% at $42.8 million. It was below the consensus estimate of $61 million.

Financials

Operating cash flow in the third quarter was $106.9 million, and free cash flow came in at $73.4 million. This was mostly due to greater inventory levels brought on both higher CTO prices and lower demand for rosin. There were no share repurchases during the quarter, and $353.4 million of the $500 million Board authorization from July 2022 is still available. Due to higher borrowing for the Ozark acquisition in the fourth quarter of 2022, net leverage was 3.2 times.

Outlook

As it enters the fourth quarter, the year-long soft industrial demand environment does not seem to be improving, therefore volume weakness is anticipated to persist, NGVT noted. Furthermore, price pressure is increasing as the weakness continues, especially in cyclical areas like adhesives and oilfield. The company cut its adjusted EBITDA outlook for the full year to between $375 million and $390 million due to growing CTO expenses in the fourth quarter and the failure to recover costs through pricing adjustments.

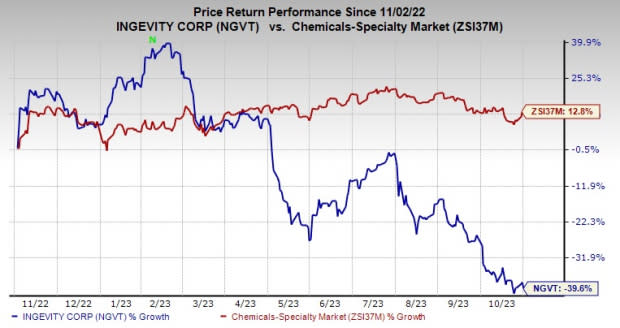

Price Performance

Shares of Ingevity have plunged 39.6% in a year against a 12.8% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Ingevity currently carries a Zacks Rank #4 (Sell).

Better-ranked stocks in the basic materials space include Equinox Gold Corp. EQX, Koppers Holdings Inc. KOP and The Andersons Inc. ANDE.

Equinox has a projected earnings growth rate of 90% for the current year. It currently carries a Zacks Rank #2 (Buy). Equinox delivered a trailing four-quarter earnings surprise of roughly 18.1%, on average. The stock is up around 54.1% in a year. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Koppers has a projected earnings growth rate of 7.5% for the current year. It currently carries a Zacks Rank #2. Koppers delivered a trailing four-quarter earnings surprise of roughly 21.7%, on average. The stock is up around 52.8% in a year.

Andersons currently carries a Zacks Rank #1. The stock has gained roughly 38.9% in the past year. ANDE beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

Ingevity Corporation (NGVT) : Free Stock Analysis Report

Equinox Gold Corp. (EQX) : Free Stock Analysis Report