Ingles Markets (IMKTA): A Hidden Gem in the Retail Industry? An In-depth Valuation Analysis

On October 03, 2023, Ingles Markets Inc (NASDAQ:IMKTA) recorded a daily gain of 2.18%, despite a 3-month loss of 7.85%. With an Earnings Per Share (EPS) (EPS) of 12.01, the question arises: Is the stock modestly undervalued? This article presents an in-depth valuation analysis of Ingles Markets, providing investors with valuable insights to make informed decisions. Let's delve into the specifics.

Company Overview

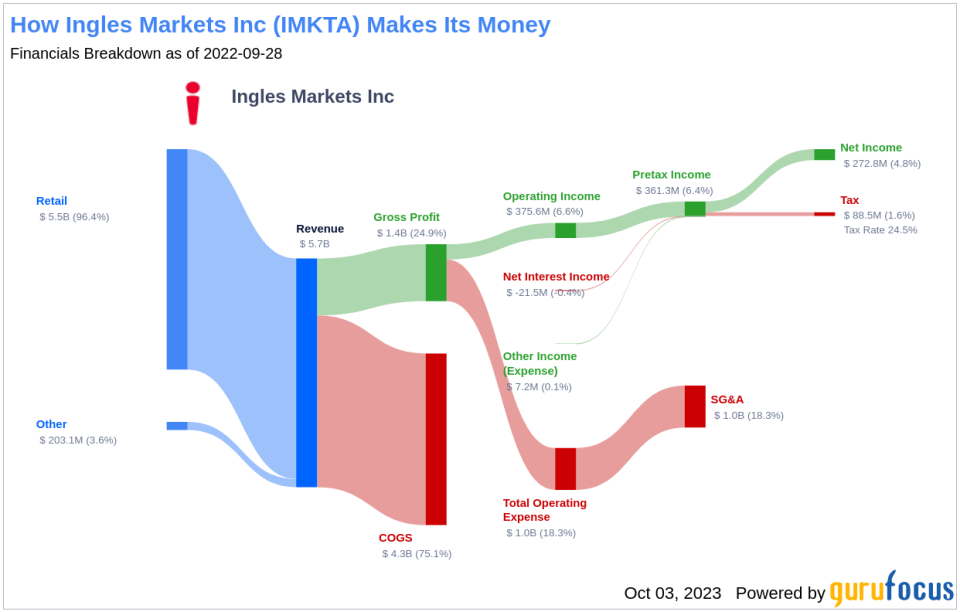

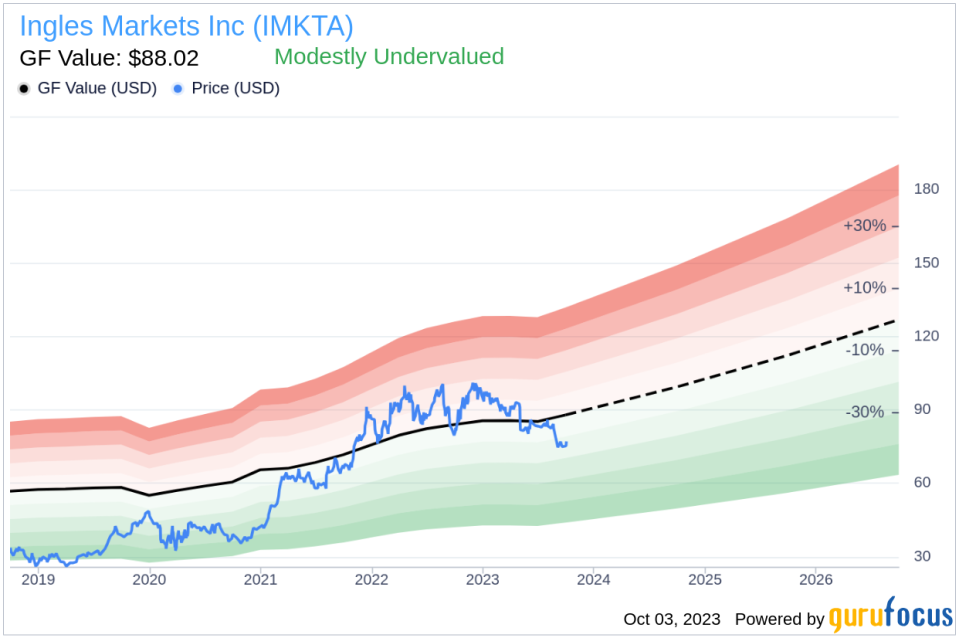

Ingles Markets Inc is a U.S.-based company with a significant presence in the supermarket chain industry. Predominantly operating in the southeast United States, the company offers a wide range of products, from food items to general merchandise. With its strategic location in suburban areas, small towns, and neighborhood areas, Ingles Markets has generated substantial revenue from its retail business. As of October 03, 2023, the company's stock price stood at $76.95, while the estimated fair value (GF Value) was $88.02, suggesting a potential undervaluation.

Understanding the GF Value

The GF Value is a unique measure that estimates the intrinsic value of a stock. It considers three key factors: historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates. The GF Value Line provides an overview of the stock's fair trading value. If the stock price significantly deviates from the GF Value Line, it could indicate overvaluation or undervaluation, thereby affecting future returns.

For Ingles Markets, the GF Value suggests that the stock is modestly undervalued. This implies that the long-term return of Ingles Markets' stock is likely to be higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

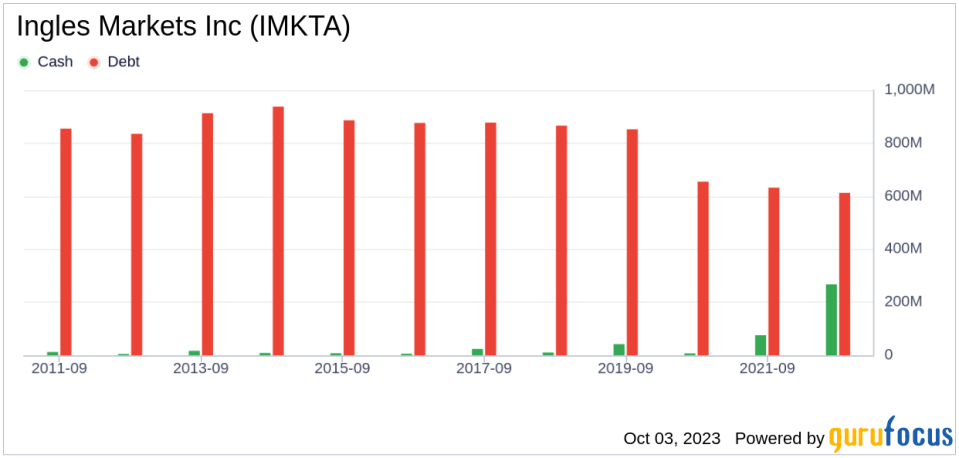

Financial Strength Analysis

Investing in companies with low financial strength could lead to permanent capital loss. Therefore, it's crucial to review a company's financial strength before purchasing its shares. Ingles Markets has a cash-to-debt ratio of 0.47, ranking better than 52.79% of 305 companies in the Retail - Defensive industry. This strong balance sheet suggests a low risk of financial distress.

Profitability and Growth

Consistent profitability over the long term reduces the risk for investors. Ingles Markets has been profitable for the past 10 years, with an operating margin of 5.49%, ranking better than 73.95% of 311 companies in the Retail - Defensive industry. Additionally, the company's 3-year average revenue growth rate is better than 74.65% of 288 companies in the industry, and its 3-year average EBITDA growth rate is 26.1%, ranking better than 81.32% of 257 companies in the industry. These figures indicate strong profitability and growth, enhancing the company's valuation.

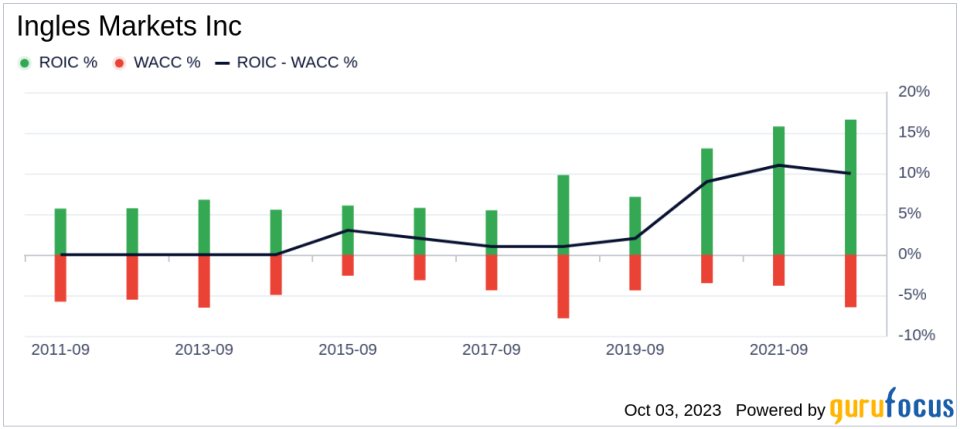

ROIC vs WACC

A comparison of a company's return on invested capital (ROIC) and the weighted average cost of capital (WACC) can provide insights into its profitability. For the past 12 months, Ingles Markets's ROIC was 13.32, and its WACC was 7.71. This suggests that the company generates a higher return on its invested capital than its cost of capital, indicating efficient use of capital.

Conclusion

In conclusion, Ingles Markets (NASDAQ:IMKTA) appears to be modestly undervalued. The company's strong financial condition, profitability, and growth potential make it an attractive investment. For a more detailed financial analysis of Ingles Markets, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.