Innospec's (IOSP) Earnings and Sales Surpass Estimates in Q4

Innospec Inc. IOSP recorded a profit of $37.8 million or $1.51 per share in fourth-quarter 2023, up from a profit of $25.5 million or $1.02 in the year-ago quarter.

Barring one-time items, earnings came in at $1.84 per share, up from $1.20 per share a year ago. It surpassed the Zacks Consensus Estimate of $1.59.

The company’s revenues fell roughly 3% year over year to $494.7 million in the quarter. It beat the Zacks Consensus Estimate of $474 million. The company saw continued strong results in its Oilfield Services unit. Performance Chemicals and Fuel Specialties segments also recorded double-digit operating income growth and margin expansion over the prior-year quarter.

Innospec Inc. Price, Consensus and EPS Surprise

Innospec Inc. price-consensus-eps-surprise-chart | Innospec Inc. Quote

Segment Highlights

The Performance Chemicals unit logged sales of $137.2 million in the reported quarter, down around 5% year over year, hurt by unfavorable price/mix, partly offset by higher volumes and favorable currency swings. It was below the consensus estimate of $147 million.

Revenues in the Fuel Specialties segment fell 1% year over year to $182.1 million in the reported quarter as an unfavorable price/mix was offset by the positive currency impact. Volumes were flat in the quarter. The figure was higher than the consensus estimate of $178 million.

Revenues in the Oilfield Services division fell 4% year over year to $175.4 million. It was higher than the consensus estimate of $149 million.

FY23 Results

Earnings for full-year 2023 were $5.56 per share compared with $5.32 per share a year ago. Net sales declined around 0.8% year over year to $1,948.8 million.

Financials

Innospec ended 2023 with cash and cash equivalents of $203.7 million, up around 38% year over year.

Cash from operating activities was $207.3 million for full-year 2023 and $72.4 million for the fourth quarter.

Outlook

Innospec said that it entered 2024 with optimism notwithstanding expectations for continued economic headwinds in the coming quarters. Its growing pipeline of technology-based organic opportunities will continue to advance along with the integration of the QGP acquisition, IOSP noted.

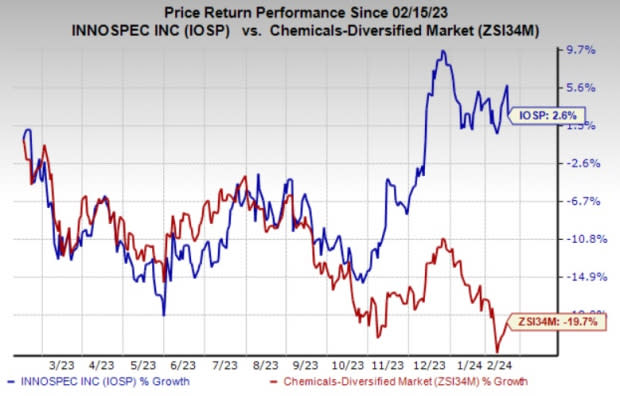

Price Performance

Shares of Innospec have gained 2.6% over a year, compared with the industry’s 19.7% decline.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

IOSP currently has a Zacks Rank #3 (Hold).

Better-ranked stocks worth a look in the basic materials space include, Carpenter Technology Corporation CRS, Alpha Metallurgical Resources Inc. AMR and Hawkins, Inc. HWKN.

The consensus estimate for Carpenter Technology’s current fiscal year earnings is pegged at $4.00, indicating a year-over-year surge of 250.9%. CRS beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 12.2%. The company’s shares have gained 20% in the past year. CRS currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Alpha Metallurgical Resources’ current-year earnings has been revised upward by 8.8% in the past 60 days. It currently carries a Zacks Rank #1. AMR delivered a trailing four-quarter earnings surprise of roughly 9.6%, on average. AMR shares are up around 125% in a year.

The consensus estimate for Hawkins’ current fiscal year earnings is pegged at $3.61 per share, indicating a year-over-year rise of 26.2%. The Zacks Consensus Estimate for HWKN’s current-year earnings has been revised 4.3% upward in the past 30 days. HWKN, a Zacks Rank #2 (Buy) stock, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 30.6%. The company’s shares have rallied 55% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alpha Metallurgical Resources, Inc. (AMR) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Innospec Inc. (IOSP) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report