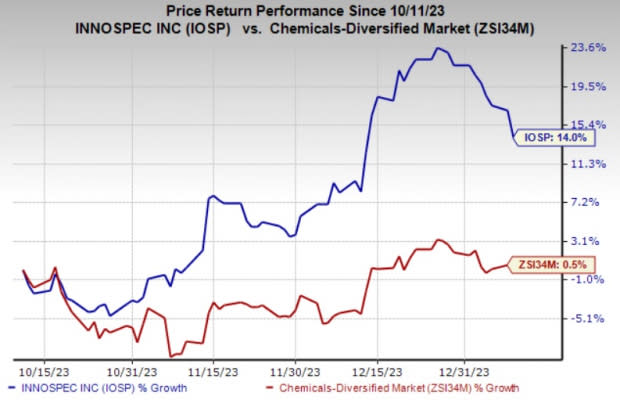

Innospec's (IOSP) Stock Up 14% in 3 Months: Here's Why

Innospec Inc.’s IOSP shares have gained 14% over the past three months. The company has also outperformed its industry’s rise of 0.5% over the same time frame. It has also topped the S&P 500’s roughly 9.9% rise over the same period.

Let’s take a look into the factors behind the stock’s price appreciation.

Image Source: Zacks Investment Research

Strategic Actions, Strength in Oilfield Services Drive IOSP

Innospec, a Zacks Rank #3 (Hold) stock, is benefiting from the strength in its Oilfield Services unit and strategic growth measures. It remains focused on technology development and margin improvement to drive organic growth across its balanced and diversified business portfolio.

Innospec's adjusted earnings for the third quarter of 2023 of $1.59 per share trounced the Zacks Consensus Estimate of $1.45. The company saw continued strong results in its Oilfield Services unit and a sequential improvement in the Performance Chemicals segment in the quarter. Oilfield Services delivered strong operating income growth and higher margin compared with the year-ago quarter.

The company, in its third-quarter call, said that it is cautiously optimistic that its new contracts and the ongoing improvement in the base business have the potential to deliver growth and margin improvement on a sequential comparison basis in the fourth quarter in Performance Chemicals. It also anticipates sequential margin improvement and operating income growth in Fuel Specialties. For Oilfield Services, IOSP sees similar results in the fourth quarter.

IOSP’s investment in capacity expansion is expected to offer incremental growth opportunities. New contracts in personal care are expected to drive the company’s Performance Chemicals division. Its Fuel Specialties unit is benefiting from the expansion of technologies in areas such as renewable diesel, low-sulfur marine fuel and gasoline direct injection engines.

Moreover, Innospec recently expanded its global presence with the acquisition of QGP Quimica Geral (QGP), a prominent specialty chemicals company located in Brazil. This strategic acquisition provides IOSP with a substantial manufacturing presence, enhanced customer service capabilities and a strengthened product development base in South America. This region is recognized as one of the largest and most crucial global markets for all of Innospec's technologies. QGP's expertise in surfactants and other specialty chemistries also contributes valuable additions to Innospec's global portfolio, particularly in growing markets such as Agriculture.

The acquisition seamlessly aligns with Innospec's longstanding mergers and acquisitions (M&A) strategy, reinforcing the Performance Chemicals segment and establishing a manufacturing foothold in South America. Innospec emphasized that post-acquisition, it maintains a significantly robust, debt-free balance sheet, positioning it favorably for future M&A activities, consistent shareholder returns and strategic investments in organic growth.

Innospec Inc. Price and Consensus

Innospec Inc. price-consensus-chart | Innospec Inc. Quote

Stocks to Consider

Better-ranked stocks worth a look in the basic materials space include, Cameco Corporation CCJ, Carpenter Technology Corporation CRS and Cabot Corporation CBT.

Cameco has a projected earnings growth rate of 156% for the current year. The Zacks Consensus Estimate for CCJ’s current-year earnings has been revised upward by 6.7% over the past 60 days. The stock is up around 76% in a year. CCJ currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Carpenter Technology’s current fiscal year earnings is pegged at $3.96, indicating a year-over-year surge of 247.4%. CRS, carrying a Zacks Rank #1, beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 14.3%. The company’s shares have rallied 53% in the past year.

The consensus estimate for Cabot’s current fiscal-year earnings is pegged at $6.58, indicating a year-over-year rise of 22.3%. CBT, carrying a Zacks Rank #2, beat the Zacks Consensus Estimate in three of the last four quarters while missed once, with the average earnings surprise being 2.3%. The company’s shares are up around 6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Cameco Corporation (CCJ) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

Innospec Inc. (IOSP) : Free Stock Analysis Report