Innovative Industrial Properties Inc Reports Growth in Net Income and AFFO for FY 2023

Net Income: Increased by 5% to $5.77 per share in FY 2023 compared to $5.52 in FY 2022.

AFFO: Grew by 7% to $9.08 per share in FY 2023 versus $8.45 in the previous year.

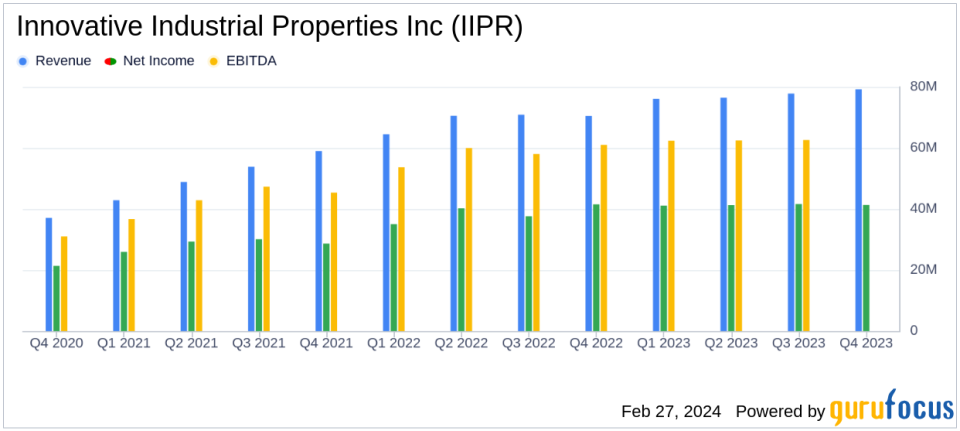

Revenue: Rose by 12% to approximately $309.5 million for the year ended December 31, 2023.

Dividend: Quarterly dividend of $1.82 per common share paid, with an AFFO payout ratio of 80%.

Rent Collection: Achieved a 98% collection rate of contractual rents for FY 2023.

Portfolio Growth: Continued expansion with new leasing and commitments, maintaining a robust property portfolio.

On February 26, 2024, Innovative Industrial Properties Inc (NYSE:IIPR) released its 8-K filing, reporting its financial results for the fourth quarter and full year ended December 31, 2023. As the first and only real estate company on the New York Stock Exchange focused on the regulated U.S. cannabis industry, IIPR specializes in the acquisition, ownership, and management of specialized industrial properties leased to state-licensed operators for their regulated medical-use cannabis facilities. The company operates through a traditional umbrella partnership real estate investment trust (UPREIT) structure, with a property portfolio that spans across the United States.

Fiscal Year 2023 Performance Highlights

Innovative Industrial Properties reported a net income attributable to common stockholders of $5.77 per share for the full year 2023, marking a 5% increase from $5.52 per share in 2022. Adjusted Funds From Operations (AFFO) per share also saw a 7% increase, rising to $9.08 in 2023 from $8.45 the previous year. These increases reflect the company's ability to grow its earnings and cash flow, which are crucial metrics for REITs as they directly impact dividend payouts and investment returns.

For the fourth quarter of 2023, IIPR experienced a slight decrease in net income per share, dropping by 1% to $1.45 compared to $1.46 in the same quarter of the previous year. However, the company saw growth in Normalized FFO and AFFO per share, increasing by 6% and 8% respectively.

Challenges and Strategic Responses

Despite facing challenges such as lease defaults by certain tenants, IIPR demonstrated resilience with a 98% collection rate of contractual rents for the full year. The company's proactive management and strategic leasing practices have been key to navigating the complexities of the cannabis industry's regulatory environment.

Financial Position and Portfolio Development

The balance sheet as of December 31, 2023, shows a solid financial position with $140.2 million in cash and cash equivalents. IIPR's property portfolio continued to expand with new leasing activities and commitments, ensuring a diverse and robust portfolio that supports long-term growth.

The company's financing activities included entering into a Loan Agreement, upsized in February 2024 to provide for $45.0 million in aggregate commitments, and issuing shares under its ATM Program for net proceeds of approximately $9.6 million.

Innovative Industrial Properties declared and paid a quarterly dividend of $1.82 per common share, demonstrating its commitment to delivering shareholder value. The AFFO payout ratio of 80% underscores the company's disciplined approach to capital allocation.

Looking Forward

As IIPR continues to capitalize on the growing cannabis industry, its focus on strategic property acquisitions and management positions the company for sustained growth. Investors and stakeholders can anticipate continued progress as IIPR leverages its unique market niche.

For more detailed information, investors are encouraged to review the full earnings release and financial statements available on the SEC's website and IIPR's investor relations page.

For further inquiries and a deeper analysis of Innovative Industrial Properties Inc's financial results, please contact David Smith, Chief Financial Officer, at (858) 997-3332.

Explore the complete 8-K earnings release (here) from Innovative Industrial Properties Inc for further details.

This article first appeared on GuruFocus.