Innovative Portfolios' Two ETFs Announce 5-Year Performance Numbers

Four Out of Five Calendar Years of Outperformance

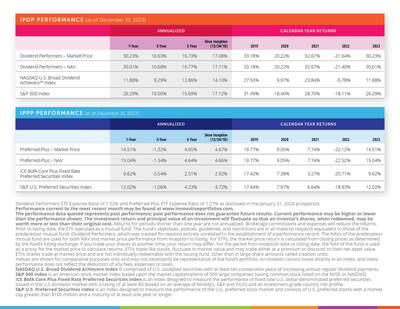

INDIANAPOLIS, Feb. 29, 2024 /PRNewswire/ -- Innovative Portfolios announced that its Dividend Performers ETF [IPDP] and Preferred-Plus ETF [IPPP] beat their respective benchmarks four of the last five calendar years. 2023 was the fourth calendar year of IPDP's and IPPP's outperformance on an annual basis over their five-year history; the inception date for both ETFs was 12/24/2018.

Innovative Portfolios mapped out each Cboe-Listed ETF's annual performance over the past five calendar years and compared it to their benchmarks; Dividend Performers [IPDP] beat both the NASDAQ U.S. Broad Dividend Achievers™ Index and the S&P 500 Index in 2019, 2020, 2021, and 2023 while Preferred-Plus [IPPP] outperformed the ICE BofA Core Plus Fixed Rate Preferred Securities Index and the S&P U.S. Preferred Securities Index in those same years.

"Hitting the five-year mark for these ETFs is a major milestone, and we're incredibly excited to celebrate not only that accomplishment, but also the fact that both ETFs beat their benchmarks for four of those past five years," said Chief Investment Officer Dave Gilreath.

The five-year performance numbers for Dividend Performers ETF [IPDP] and Preferred-Plus ETF [IPPP] are shown to the side.

The two ETFs began as mutual funds on December 24, 2018, and were converted to ETFs in March of 2022. Dividend Performers [IPDP] seeks current income with capital appreciation as a secondary goal, while Preferred-Plus [IPPP]'s main goal is income. Both ETFs seek cash-flow through option premiums in exchange for additional market volatility.

About Innovative Portfolios, LLC:

Based in Indianapolis, Indiana, Innovative Portfolios provides strategic investment solutions to RIAs and institutional clients throughout the United States. As of 12/31/2023, AUM for the firm and its affiliates totaled $1.72 billion. Innovative Portfolios Principal Dave Gilreath is a contributor of investment commentary to CNBC.com, ThinkAdvisor, Medical Economics, and FA Financial Advisor. Visit innovativeportfolios.com for more information.

Disclosure:

Carefully consider the Fund's investment objective, risk factors, charges and expenses before investing. This and additional information can be found in the Dividend Performers ETF and Preferred-Plus ETF prospectus, which can be obtained by calling 800 617-0004 or by visiting Innovativeportfolios.com. Please read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal.

Derivative Securities Risk: The Fund invests in options that derive their performance from the performance of the S&P 500 Index. Derivatives, such as the options in which the Fund invests, can be volatile and involve various types and degrees of risks, depending upon the characteristics of a particular derivative. Derivatives may entail investment exposures that are greater than their cost would suggest, meaning that a small investment in a derivative could have a substantial impact on the performance of the Fund. The Fund could experience a loss if its derivatives do not perform as anticipated, or are not correlated with the performance of their underlying asset or if the Fund is unable to purchase or liquidate a position because of an illiquid secondary market. The market for many derivatives is, or suddenly can become, illiquid. Changes in liquidity may result in significant, rapid, and unpredictable changes in the prices for derivatives.

Dividend Paying Security Risk: Securities that pay high dividends as a group can fall out of favor with the market, causing these companies to underperform companies that do not pay high dividends. Also, companies owned by the Fund that have historically paid a dividend may reduce or discontinue their dividends, thus reducing the yield of the Fund.

REIT Risk: Investment in real estate companies, including REITs, exposes the Fund to the risks of owning real estate directly. Real estate is highly sensitive to general and local economic conditions and developments.

Preferred Security Risk: Preferred securities generally are subordinated to bonds and other debt instruments in a company's capital structure and therefore will be subject to greater credit risk than those debt instruments. In addition, but not limited to, preferred securities are subject to other risks, such as being called by the issuer before its stated maturity, subject to special redemption rights, having distributions deferred or skipped, rising interest rates causing the value to decline, having floating interest rates or dividends, and having limited liquidity. Preferred securities that do not have a maturity date are perpetual investments.

Innovative Portfolios, LLC is investment advisor to Dividend Performers ETF and Preferred-Plus ETF.

Dividend Performers ETF and Preferred-Plus ETF is distributed by Foreside Fund Services, LLC.

View original content to download multimedia:https://www.prnewswire.com/news-releases/innovative-portfolios-two-etfs-announce-5-year-performance-numbers-302076389.html

SOURCE Innovative Portfolios