Innovative Solutions and Support Inc (ISSC) Reports Strong First Quarter Fiscal 2024 Results

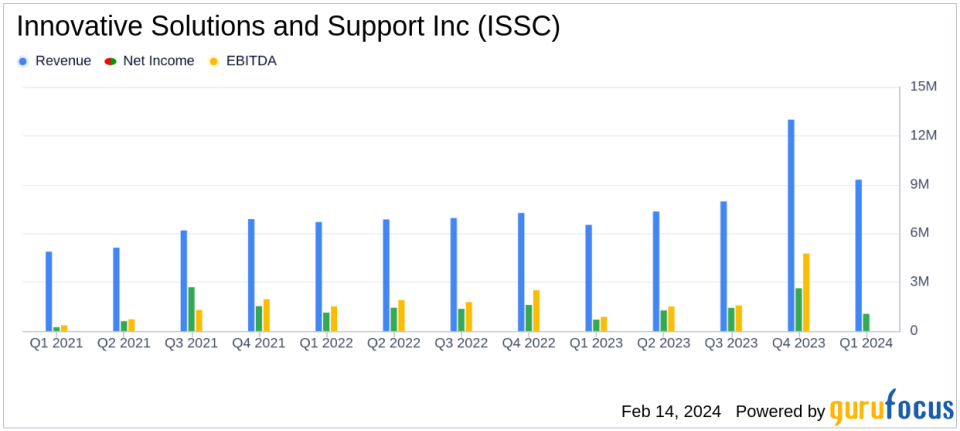

Net Sales: Increased by 43% to $9.3 million in Q1 FY 2024 from $6.5 million in Q1 FY 2023.

Net Income: Rose by 51% to $1,057,350, or $0.06 per share, compared to $698,651, or $0.04 per share in the prior year's quarter.

Gross Profit: Improved to $5.5 million, or 59.3% of sales, up from 57.1% in Q1 FY 2023.

Cash Flow: Generated $4.2 million from operations during the quarter.

New Orders: Totaled approximately $10.4 million with a backlog of $14.6 million as of December 31, 2023.

Debt Position: Reduced to $10.6 million, a decrease of approximately $8.9 million from three months prior.

On February 14, 2024, Innovative Solutions and Support Inc (NASDAQ:ISSC) released its 8-K filing, announcing financial results for the first quarter of fiscal year 2024, which ended December 31, 2023. The company, a leading systems integrator in the aerospace and defense industry, reported a significant increase in net sales and net income, attributing much of its success to the integration of product lines acquired from Honeywell International, Inc.

Financial Performance Highlights

Innovative Solutions and Support Inc (NASDAQ:ISSC) experienced a robust first quarter with net sales climbing to $9.3 million, a 43% increase from the same quarter last year. This growth was accompanied by a substantial rise in net income, which surged 51% to $1,057,350, or $0.06 per share. The company's gross profit also saw an improvement, reaching $5.5 million or 59.3% of sales, compared to $3.7 million or 57.1% of sales in the first quarter of fiscal 2023.

The company's financial achievements are particularly significant in the aerospace and defense industry, where high gross margins are crucial for sustaining research and development and for maintaining competitive pricing strategies. The strong cash flow from operations, amounting to $4.2 million, underscores the company's operational efficiency and its ability to generate liquidity.

Operational and Strategic Developments

Shahram Askarpour, Chief Executive Officer of IS&S, commented on the company's performance, stating:

We are pleased to report another quarter of year-over-year growth in both revenues and earnings. The integration of the product lines acquired from Honeywell is progressing and ongoing. These products complement our existing portfolio of products, offer recurring revenues, and introduce IS&S to a new market segment. As we continue to generate gross margins approaching 60% and strong cash flow, our debt position was reduced to $10.6 million as of December 31, 2023, or approximately $8.9 million less than just three months ago. Revenues were up 43% in the quarter, keeping us on pace with our goal to grow annualized revenues by approximately 40% compared to our pre-acquisition revenue levels upon the completion of the integration.

The company's backlog, which primarily consists of orders from OEM customers with long-term programs, stood at $14.6 million. Notably, the products licensed from Honeywell do not typically enter the backlog due to their nature, indicating a potential for additional revenue streams not reflected in the current backlog figures.

Financial Statements Overview

The balance sheet of ISSC reflects a solid financial position with total assets amounting to $55.7 million. The company's liabilities have been managed effectively, with a notable reduction in long-term debt from $17.5 million to zero, and the current portion of long-term debt reduced to $10.6 million. Shareholders' equity stands at $39.9 million, indicating a strong underlying value in the company.

The income statement reveals that the net sales increase was driven by both product sales and customer service, with product sales accounting for $4.4 million and customer service contributing $4.2 million. Engineering development contracts also added $656,708 to the net sales. The cost of sales was well-managed, resulting in a healthy gross profit margin.

In conclusion, Innovative Solutions and Support Inc (NASDAQ:ISSC) has reported a strong start to fiscal 2024, with significant growth in revenue and net income, a testament to the successful integration of the Honeywell product lines and the company's strategic positioning in the aerospace and defense industry. The company's financial health and operational efficiency bode well for its future prospects, making it a potentially attractive option for value investors.

For more detailed information and analysis on Innovative Solutions and Support Inc (NASDAQ:ISSC)'s financial performance, interested parties are encouraged to join the company's conference call on February 15, 2024, or visit the Investor Relations page on the company's website.

Explore the complete 8-K earnings release (here) from Innovative Solutions and Support Inc for further details.

This article first appeared on GuruFocus.