Inogen (INGN) Completes Buyout Deal to Expand Product Portfolio

Inogen, Inc. INGN recently completed the acquisition of Physio-Assist SAS. Following the close of the transaction (earlier announced on Jul 13, 2023), Inogen owns Physio-Assist and will now market the Simeox device outside of the United States.

Inogen will also continue with the ongoing preparations for FDA submission.

The latest buyout is expected to expand Inogen’s global Respiratory Care presence by addressing a growing and underserved airway clearance market opportunity.

Rationale Behind the Acquisition

Simeox has been cleared under the CE mark in the European Union and is currently being sold in Europe, Asia and the Middle East. Inogen is expected to leverage its commercial infrastructure and capabilities to continue marketing the device in these geographies while pursuing U.S. regulatory approvals. The acquisition will likely provide access to a large and growing market opportunity with 400,000 to 490,000 patients suffering from bronchiectasis in the United States.

Inogen’s management believes that Physio-Assist's Simeox product will likely provide a differentiated and clinically-proven airway clearance technology. This is expected to support its strategy to become a multi-portfolio global respiratory care company.

Financial Implications

The buyout is expected to be immaterial to Inogen’s 2023 revenues but immediately accretive to gross margin.

Given the clinical and commercial investment required to obtain the FDA’s clearance and launch Simeox in the United States, the transaction is expected to be accretive to adjusted earnings beginning in 2027.

Industry Prospects

Per a report by Data Bridge Market Research, the global respiratory care devices market was valued at $18.40 billion in 2021 and is anticipated to reach $36.66 billion by 2029 at a CAGR of 9%. Factors like the increased incidence of respiratory disorders, the high prevalence of cigarette smoking and rising levels of pollution are likely to drive the market.

Given the market potential, the acquisition seems to have been timed well.

Notable Development

Last month, Inogen announced its second-quarter 2023 results, wherein it registered a robust year-over-year uptick in rental revenues and domestic business-to-business sales. During the quarter, Inogen introduced Rove 6 in the United States, a portable oxygen concentrator now with an eight-year expected service life.

Price Performance

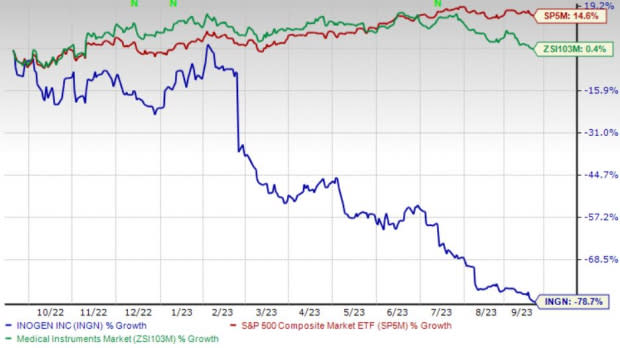

Shares of the company have lost 78.7% in the past year against the industry’s 0.3% rise and the S&P 500’s 14.6% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Inogen carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, HealthEquity, Inc. HQY and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 12.7%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 21.4%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita has gained 9.1% against the industry’s 5.6% decline over the past year.

HealthEquity, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 23.5%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 13%.

HealthEquity has lost 4.7% compared with the industry’s 7.2% decline over the past year.

Integer Holdings, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 12.1%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 8.4%.

Integer Holdings has gained 28.9% compared with the industry’s 0.3% rise over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Inogen, Inc (INGN) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report