Insider Buying Alert: CFO Christopher Eperjesy Acquires 40,000 Shares of Custom Truck One ...

In the realm of stock market movements, insider trading activity is often a significant indicator that can provide insights into a company's potential future performance. Recently, Christopher Eperjesy, the Chief Financial Officer (CFO) of Custom Truck One Source Inc (NYSE:CTOS), made a notable purchase of company shares that has caught the attention of investors and market analysts alike.

Who is Christopher Eperjesy?

Christopher Eperjesy is the CFO of Custom Truck One Source Inc, a key executive responsible for managing the company's financial actions, including tracking cash flow, financial planning, and analyzing the company's financial strengths and weaknesses. Eperjesy's role is crucial in ensuring that the company makes sound financial decisions that will benefit shareholders and contribute to the overall growth and stability of the firm.

Custom Truck One Source Inc's Business Description

Custom Truck One Source Inc is a prominent player in the specialized truck and heavy equipment solutions market. The company offers a comprehensive range of services, including equipment rental, sales, parts, and aftermarket services. With a focus on providing customized solutions for various industries such as utilities, construction, and infrastructure, Custom Truck One Source Inc has established itself as a go-to source for clients requiring specialized vehicles and equipment.

Description of Insider Buy/Sell

Insider buying refers to the purchase of shares in a company by individuals who have access to non-public, material information about the company, such as executives or directors. Conversely, insider selling involves these individuals selling their shares. These transactions are closely monitored by investors as they can provide clues about the insiders' confidence in the company's future prospects. A pattern of insider buying may suggest that those with the most intimate knowledge of the company's workings anticipate positive developments or undervaluation.

On November 13, 2023, Christopher Eperjesy made a significant investment in Custom Truck One Source Inc by purchasing 40,000 shares. This transaction is particularly noteworthy as it represents a substantial increase in his stake in the company, signaling a strong vote of confidence in its future.

Insider Trends

The insider transaction history for Custom Truck One Source Inc shows a positive trend with 4 insider buys over the past year, compared to 2 insider sells in the same period. This could indicate a general optimism among insiders about the company's trajectory.

Valuation

On the day of Eperjesy's purchase, shares of Custom Truck One Source Inc were trading at $4.89, giving the company a market cap of $1.260 billion. This valuation places the stock's price-earnings ratio at 18.54, which is slightly higher than the industry median of 16.52 but lower than the company's historical median price-earnings ratio.

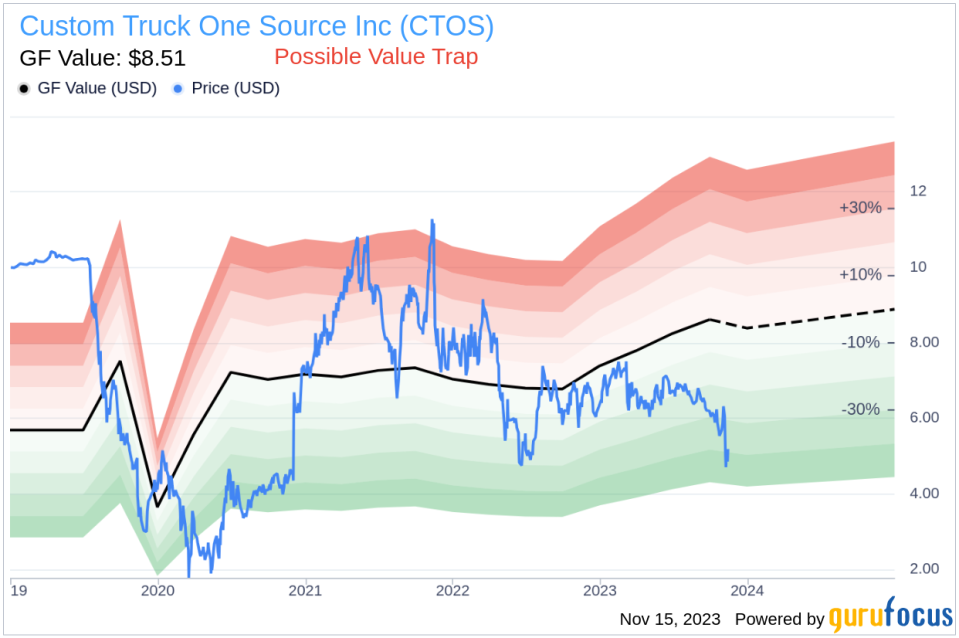

Considering the stock's price of $4.89 against the GuruFocus Value of $8.51, Custom Truck One Source Inc has a price-to-GF-Value ratio of 0.57. This suggests that the stock might be a Possible Value Trap, and investors should Think Twice based on its GF Value.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which is calculated using historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

Objective Analysis Based on Data

Christopher Eperjesy's recent insider purchase is a significant event that warrants attention. The CFO's decision to invest a substantial amount of capital into Custom Truck One Source Inc shares suggests that he may perceive the stock to be undervalued or expects positive developments that could drive the company's growth and profitability.

The insider buying trend at Custom Truck One Source Inc over the past year further supports the notion that insiders are generally bullish on the company's prospects. With more insider buys than sells, it appears that those with the most intimate knowledge of the company's operations are willing to increase their personal stakes, which can be interpreted as a positive signal for potential investors.

However, the valuation metrics present a more nuanced picture. While the price-earnings ratio is slightly above the industry median, it is below the company's historical median, which could indicate that the stock is currently trading at a reasonable valuation relative to its own past performance. The price-to-GF-Value ratio under 1 suggests that the stock may be undervalued, but the classification as a Possible Value Trap indicates that investors should exercise caution and conduct further analysis before making investment decisions.

It is also important to consider the broader market conditions and sector-specific challenges that may impact Custom Truck One Source Inc's performance. Factors such as economic cycles, regulatory changes, and competitive dynamics can all play a role in determining the future success of the company and, by extension, the performance of its stock.

In conclusion, Christopher Eperjesy's insider purchase is a noteworthy event that adds a layer of optimism to the investment thesis for Custom Truck One Source Inc. While the insider buying trend and valuation metrics provide some positive signals, investors should carefully consider all available information and conduct thorough due diligence before making investment decisions. As always, a balanced and data-driven approach is essential in navigating the complexities of the stock market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.