Insider Buying: CEO Douglas Valenti Acquires 2,500 Shares of QuinStreet Inc

On September 11, 2023, Douglas Valenti, the CEO of QuinStreet Inc (NASDAQ:QNST), purchased 2,500 shares of the company. This move is significant as insider buying often indicates a strong belief in the company's future prospects.

Who is Douglas Valenti?

Douglas Valenti is the CEO of QuinStreet Inc, a leader in the performance marketing products and technologies industry. With his extensive experience and deep understanding of the industry, Valenti has been instrumental in guiding the company towards its current success. His recent purchase of QuinStreet shares further demonstrates his confidence in the company's future.

About QuinStreet Inc

QuinStreet Inc is a pioneer in delivering online marketplace solutions to match searchers with brands in digital media. The company provides clients with performance marketing products and technologies. With its proprietary technologies, QuinStreet Inc helps businesses reach, engage, and acquire customers and enhance their brand presence in the digital world.

Insider Buying Analysis

Over the past year, Douglas Valenti has purchased a total of 10,000 shares and sold 150,000 shares. The recent acquisition of 2,500 shares is a positive signal as it indicates the insider's belief in the company's potential.

The insider transaction history for QuinStreet Inc shows a total of 7 insider buys over the past year, compared to 2 insider sells over the same timeframe. This trend suggests a positive sentiment among the insiders towards the company's stock.

Relationship with Stock Price

On the day of the insider's recent buy, shares of QuinStreet Inc were trading at $9.43, giving the stock a market cap of $507.655 million. The insider's decision to buy at this price could indicate a belief that the stock is undervalued and has the potential for growth.

Valuation

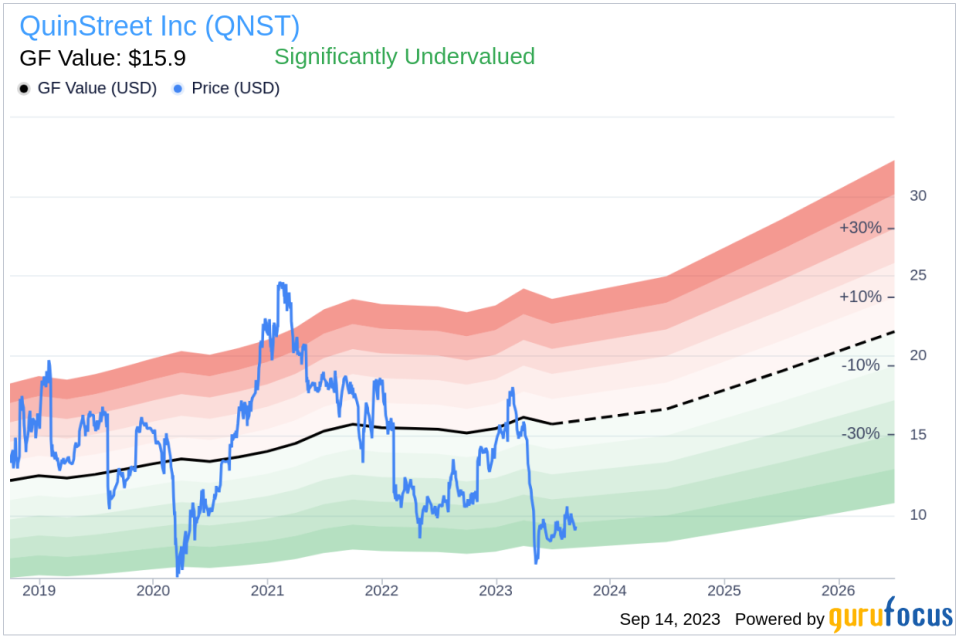

With a price of $9.43 and a GuruFocus Value of $15.90, QuinStreet Inc has a price-to-GF-Value ratio of 0.59. This suggests that the stock is significantly undervalued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, the recent insider buying activity by CEO Douglas Valenti, coupled with the company's strong GF Value, suggests a positive outlook for QuinStreet Inc's stock. Investors should keep a close eye on this stock for potential investment opportunities.

This article first appeared on GuruFocus.