Insider Buying: CEO Phillip Chan Acquires 75,188 Shares of CytoSorbents Corp (CTSO)

Recent insider trading activity has caught the attention of investors as Phillip Chan, CEO of CytoSorbents Corp, made a significant purchase of company shares. On December 13, 2023, the insider acquired 75,188 shares of CytoSorbents Corp (NASDAQ:CTSO), a move that signals potential confidence in the company's future prospects. This article provides an objective analysis of this insider buying event, offering insights into the implications for investors.

Who is Phillip Chan of CytoSorbents Corp?

Phillip Chan is the Chief Executive Officer (CEO) and President of CytoSorbents Corp, a leader in critical care immunotherapy, specializing in blood purification. With a background in medicine and business, Chan has been at the helm of CytoSorbents, guiding the company through its strategic initiatives and overseeing its growth in the medical technology sector. His recent purchase of company shares is a significant event, as it reflects the insider's perspective on the company's valuation and future.

CytoSorbents Corp's Business Description

CytoSorbents Corp is a publicly traded company focused on providing life-saving therapies for critically ill patients in the intensive care unit and cardiac surgery. The company's flagship product, CytoSorb, is a blood purification technology designed to reduce the excessive inflammatory response that can lead to organ failure. This technology has been used in more than 131,000 human treatments to date and is available in 68 countries worldwide. CytoSorbents' mission is to improve outcomes for patients and reduce healthcare costs by addressing unmet medical needs in inflammation, organ failure, and critical care.

Description of Insider Buy/Sell

Insider buying occurs when a company's executives, directors, or other insiders purchase shares of their own company's stock. This is often considered a bullish signal, as insiders may buy shares because they believe the stock is undervalued or that there are positive developments that could drive the stock price higher. Conversely, insider selling happens when insiders sell their shares, which can be interpreted in various ways, including portfolio diversification or concerns about the company's future performance. However, insider selling is not always a bearish signal, as there are many reasons why an insider might sell shares.

Insider Trends

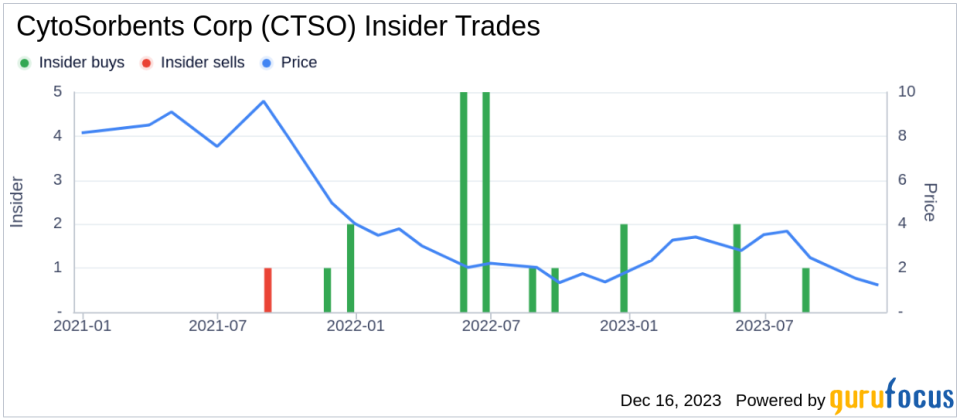

The insider transaction history for CytoSorbents Corp shows a pattern of insider confidence, with 10 insider buys and no insider sells over the past year. This trend suggests that insiders are optimistic about the company's future and see current share prices as attractive investment opportunities.

Valuation

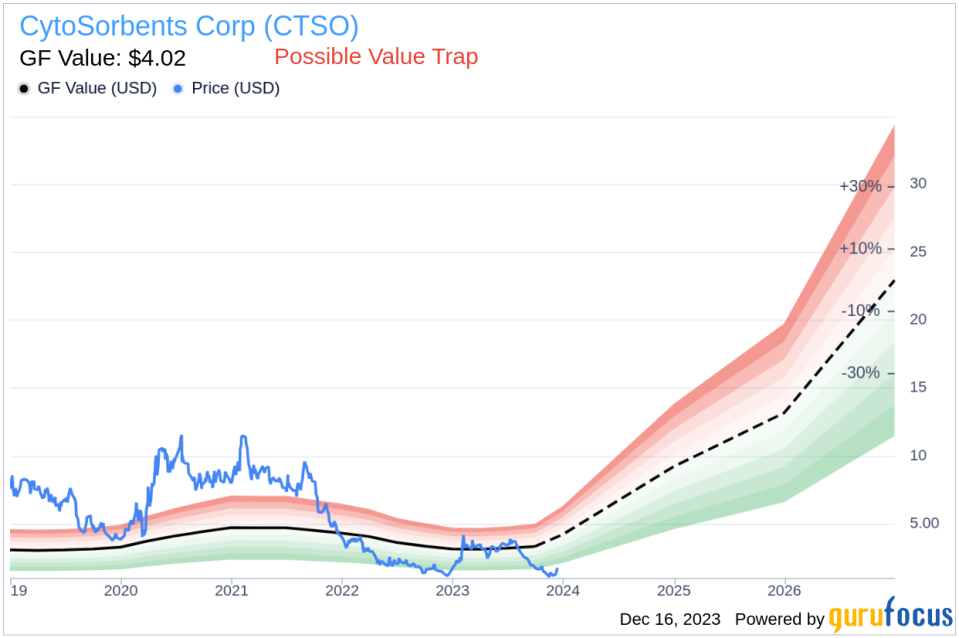

On the day of Phillip Chan's recent buy, shares of CytoSorbents Corp were trading at $1.33 each, giving the company a market cap of $90.153 million. This valuation is particularly interesting when considering the company's price relative to the GuruFocus Value (GF Value).

With a price of $1.33 and a GF Value of $4.02, CytoSorbents Corp has a price-to-GF-Value ratio of 0.33. This indicates that the stock is a Possible Value Trap, Think Twice, based on its GF Value. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

Phillip Chans Trades and the Implications

Over the past year, Phillip Chan has been an active buyer of CytoSorbents Corp shares, with a total of 75,188 shares purchased and no shares sold. This level of insider buying, particularly from the CEO, can be a strong indicator of the insider's belief in the company's value and future performance. Investors often look to insider buying as a signal that the company's leadership is willing to invest their own money into the stock, suggesting that they are confident about the company's direction and potential for growth.

Chan's recent purchase is substantial and could be interpreted as a strong vote of confidence in the company's strategy and its products' market potential. Given the current price-to-GF-Value ratio, it appears that the insider believes the market has undervalued the company's shares, presenting a buying opportunity.

Conclusion

The recent insider buying by CEO Phillip Chan is a noteworthy event for current and potential investors of CytoSorbents Corp. While the market has priced the stock as a possible value trap, the insider's actions suggest a different narrative. Investors should consider the insider trends, the company's business prospects, and the broader market conditions when evaluating the significance of this insider buying event. As always, it is essential to conduct thorough research and consider a diversified investment strategy when making investment decisions.

It is important to note that insider buying is just one piece of the puzzle when it comes to assessing a stock's potential. Other factors, such as company performance, industry trends, and overall market conditions, should also be taken into account. Nonetheless, the insider's recent purchase adds an interesting dimension to the analysis of CytoSorbents Corp's stock and warrants attention from the investment community.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.