Insider Buying: CFO Michelle Esterman Acquires 13,889 Shares of Altisource Portfolio Solutions ...

On September 8, 2023, Michelle Esterman, the CFO of Altisource Portfolio Solutions SA (NASDAQ:ASPS), made a significant insider purchase of 13,889 shares of the company's stock. This move is noteworthy and deserves a closer look by investors and market watchers.

Michelle Esterman is a seasoned financial executive with a wealth of experience in the financial services industry. As the CFO of Altisource Portfolio Solutions SA, she is responsible for the company's financial strategy and operations, including financial planning, budgeting, and financial risk management. Her insider purchase of ASPS shares is a strong vote of confidence in the company's future prospects.

Altisource Portfolio Solutions SA is a premier marketplace and transaction solutions provider for the real estate, mortgage, and consumer debt industries. The company's innovative services and technologies empower businesses to navigate the complex, rapidly changing marketplace environment and drive their success.

Over the past year, the insider has purchased a total of 13,889 shares and sold 0 shares. This trend indicates a strong belief in the company's future performance and growth potential.

The insider transaction history for Altisource Portfolio Solutions SA shows a total of 4 insider buys over the past year, with no insider sells over the same timeframe. This trend suggests that insiders at the company are bullish about its future prospects.

On the day of the insider's recent buy, shares of Altisource Portfolio Solutions SA were trading for $3.6 apiece, giving the stock a market cap of $82.838 million.

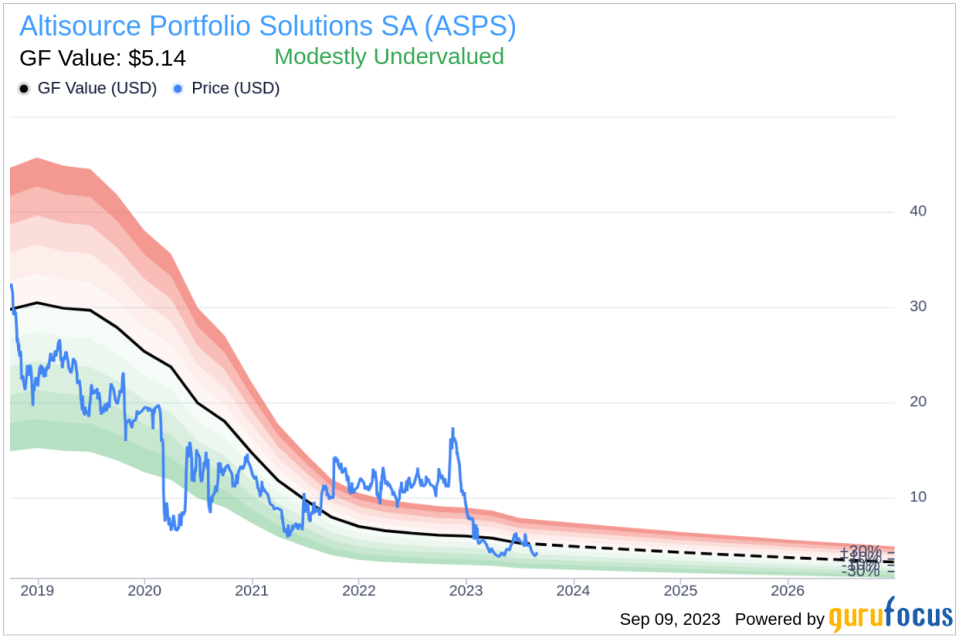

With a price of $3.6 and a GuruFocus Value of $5.14, Altisource Portfolio Solutions SA has a price-to-GF-Value ratio of 0.7. This suggests that the stock is modestly undervalued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples (price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow) that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, the insider's recent purchase of Altisource Portfolio Solutions SA shares, coupled with the stock's modest undervaluation based on its GF Value, suggests that the stock could be an attractive investment opportunity. However, as always, potential investors should conduct their own due diligence before making investment decisions.

This article first appeared on GuruFocus.