Insider Buying: CFO Pierre Gravier Acquires 7,700 Shares of PTC Therapeutics Inc (PTCT)

In the realm of stock market movements, insider trading activity is often a significant indicator that can provide insights into a company's potential future performance. Recently, Pierre Gravier, the Chief Financial Officer of PTC Therapeutics Inc (NASDAQ:PTCT), made a notable purchase of company shares, which warrants a closer examination.

Who is Pierre Gravier of PTC Therapeutics Inc?

Pierre Gravier is the Chief Financial Officer at PTC Therapeutics Inc, a biopharmaceutical company focused on the discovery, development, and commercialization of orally administered, proprietary small-molecule drugs that target post-transcriptional control processes. The insider's role is crucial in managing the company's finances, including financial planning, risk management, record-keeping, and financial reporting. Gravier's recent investment in the company's stock is a move that may signal confidence in the company's future prospects.

PTC Therapeutics Inc's Business Description

PTC Therapeutics Inc is a global biopharmaceutical company that has dedicated itself to the mission of bringing new therapies to patients affected by rare disorders and highly unmet medical needs. The company's pipeline includes treatments for genetic disorders, cancer, and infectious diseases. With a focus on innovative science and a passion for patient care, PTC Therapeutics strives to provide access to best-in-class treatments for patients who have few or no therapeutic options.

Description of Insider Buy/Sell

Insider buying occurs when a company's executives, directors, or other insiders purchase shares of their own company's stock. Conversely, insider selling refers to the sale of company shares by insiders. These transactions are closely monitored by investors and analysts as they can provide valuable insights into insiders' views on the company's current valuation and future prospects. A higher number of insider buys compared to sells can be interpreted as a positive sign, suggesting that insiders are bullish on the company's future performance.

Insider Trends

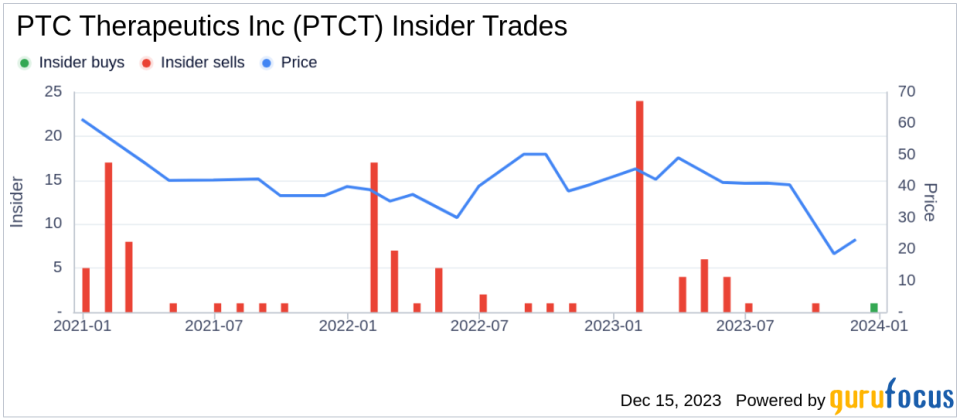

The insider transaction history for PTC Therapeutics Inc shows a disparity between insider buys and sells over the past year. With only 1 insider buy and a significantly higher number of 40 insider sells, the trend may raise questions among investors. However, the recent purchase by CFO Pierre Gravier could be a signal of a turning point in insider sentiment.

Valuation

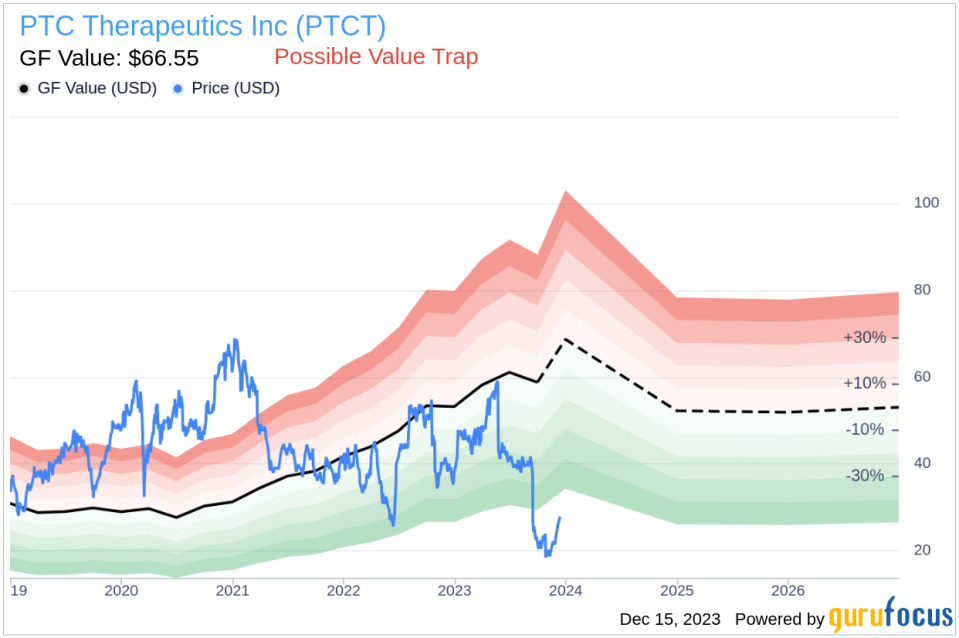

Shares of PTC Therapeutics Inc were trading at $25.81 on the day of the insider's recent buy, giving the stock a market cap of $2.142 billion. This valuation is a critical piece of information for investors considering the company's size and market position.With a price of $25.81 and a GuruFocus Value of $66.55, PTC Therapeutics Inc has a price-to-GF-Value ratio of 0.39. This suggests that the stock may be a Possible Value Trap, and investors should Think Twice based on its GF Value.

The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

Analysis of CFO Pierre Gravier's Insider Buying

Pierre Gravier's recent acquisition of 7,700 shares of PTC Therapeutics Inc is a significant event that merits attention. Over the past year, the insider has purchased a total of 7,700 shares and has not sold any shares. This could be interpreted as a strong vote of confidence in the company's future from a key executive with intimate knowledge of the company's financial health and strategic direction.The insider's decision to increase their stake in the company comes at a time when the stock is trading below its GF Value, which could indicate that the insider believes the stock is undervalued and has the potential for appreciation. However, the price-to-GF-Value ratio suggests caution, as the stock may be considered a possible value trap.Investors should consider the insider's buying activity in the context of the overall insider trend, which has been skewed towards selling. While the CFO's purchase is a positive sign, the predominance of insider selling over the past year could suggest that other insiders have different perspectives on the company's valuation or future prospects.

Conclusion

The recent insider buying by CFO Pierre Gravier at PTC Therapeutics Inc presents an interesting case for investors. While the purchase alone does not guarantee future stock performance, it does provide a data point that could be indicative of the company's potential. Investors should weigh this insider activity alongside other financial metrics, market trends, and the company's overall strategic initiatives before making investment decisions.As with any investment, due diligence is key, and insider transactions are just one piece of the puzzle. The insights provided by Pierre Gravier's recent buying activity, combined with a thorough analysis of PTC Therapeutics Inc's financials, market position, and growth prospects, will help investors make more informed decisions about the potential risks and rewards associated with investing in the company's stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.