Insider Buying: CFO Tuweiq Farouq Salem Ali Acquires 300 Shares of Bel Fuse Inc

On September 14, 2023, Tuweiq Farouq Salem Ali, the Chief Financial Officer of Bel Fuse Inc (NASDAQ:BELFB), purchased 300 shares of the company. This move is significant as insider buying often signals confidence in the company's future prospects.

Tuweiq Farouq Salem Ali has been with Bel Fuse Inc for several years, serving in various financial roles before his appointment as CFO. His deep understanding of the company's financial health and strategic direction makes his recent purchase noteworthy for investors.

Bel Fuse Inc is a leading global manufacturer of products that power, protect and connect electronic circuits. These products are primarily used in the networking, telecommunications, computing, military, aerospace, transportation and broadcasting industries. Bel's product groups include Magnetic Solutions (integrated connector modules, power transformers, power inductors and discrete components), Power Solutions and Protection (front-end, board-mount and industrial power products, module products and circuit protection), and Connectivity Solutions (expanded beam fiber optic, copper-based, RF and RJ connectors and cable assemblies).

Over the past year, the insider has purchased a total of 950 shares and sold none. This trend suggests a strong belief in the company's future performance.

The insider transaction history for Bel Fuse Inc shows a total of 4 insider buys and 5 insider sells over the past year. Despite the higher number of sells, the recent purchase by the insider could indicate a positive shift in sentiment.

On the day of the insider's recent buy, shares of Bel Fuse Inc were trading at $45.94, giving the company a market cap of $606.019 million. The price-earnings ratio stands at 8.33, significantly lower than the industry median of 21.79 and the companys historical median price-earnings ratio. This could suggest that the stock is undervalued.

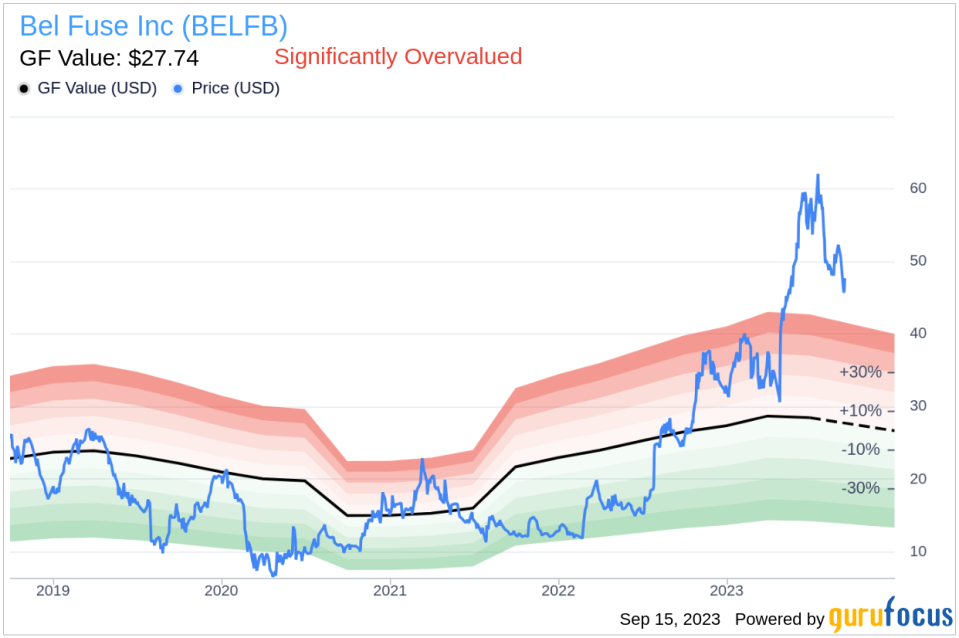

However, with a price of $45.94 and a GuruFocus Value of $27.74, Bel Fuse Inc has a price-to-GF-Value ratio of 1.66. This indicates that the stock is significantly overvalued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, while the insider's recent purchase could signal confidence in Bel Fuse Inc's future, the stock appears to be significantly overvalued based on its GF Value. Investors should consider these factors and their own risk tolerance before making investment decisions.

This article first appeared on GuruFocus.