Insider Buying: Chairman Darrell Crate Acquires 8,000 Shares of Easterly Government Properties Inc

In the realm of stock market movements, insider trading activity is often a significant indicator that can provide insights into a company's potential future performance. Notably, an insider's decision to increase their stake in the company they manage or oversee can be a bullish signal to investors. This is the case with Darrell Crate, Chairman of Easterly Government Properties Inc (DEA), who recently purchased 8,000 shares of the company's stock.

Who is Darrell Crate?

Darrell Crate is the Chairman of Easterly Government Properties Inc, a company that specializes in the acquisition, development, and management of Class A commercial properties that are leased to U.S. Government agencies. Crate's role as Chairman involves providing strategic leadership and oversight, ensuring that the company's operations align with its long-term objectives and the interests of its shareholders.

Easterly Government Properties Inc's Business Description

Easterly Government Properties Inc is a real estate investment trust (REIT) focused on the acquisition and management of properties leased to the U.S. Government. The company's portfolio includes a variety of assets, such as office buildings, data centers, and warehouses, all of which are designed to meet the specific needs of government tenants. With a business model centered around long-term, stable leases to a creditworthy tenantthe U.S. GovernmentEasterly Government Properties offers investors a unique blend of stability and income potential.

Description of Insider Buy/Sell

Insider buying refers to the purchase of shares in a company by individuals who have access to non-public, material information about the company, typically its executives, directors, or significant shareholders. Conversely, insider selling involves these same individuals selling shares of the company. Both actions are closely monitored by investors and regulators to ensure transparency and prevent illegal activities based on insider information. However, legal insider trading can be a valuable indicator of the insiders' confidence in the company's future prospects.

Insider Trends

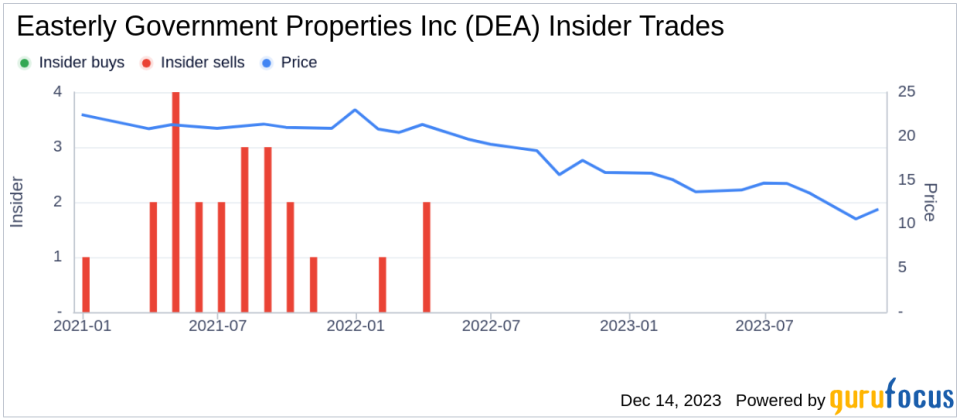

The insider transaction history for Easterly Government Properties Inc reveals a cautious but optimistic pattern from its insiders. Over the past year, there has been a total of 1 insider buy and 0 insider sells. This could suggest that the insiders have confidence in the company's trajectory and are willing to invest their personal capital into the company's stock.

Valuation and Market Cap

On the date of the insider's recent purchase, shares of Easterly Government Properties Inc were trading at $13.14 each, resulting in a market cap of approximately $1.345 billion. This valuation places the company in a significant position within the real estate investment trust industry.

The price-earnings ratio of Easterly Government Properties Inc stands at 42.82, which is above the industry median of 17.38. This higher ratio may indicate that the market expects higher earnings growth from the company compared to its peers or that the stock is currently overvalued. However, it is also lower than the company's historical median price-earnings ratio, suggesting that the stock may be more reasonably priced in comparison to its own trading history.

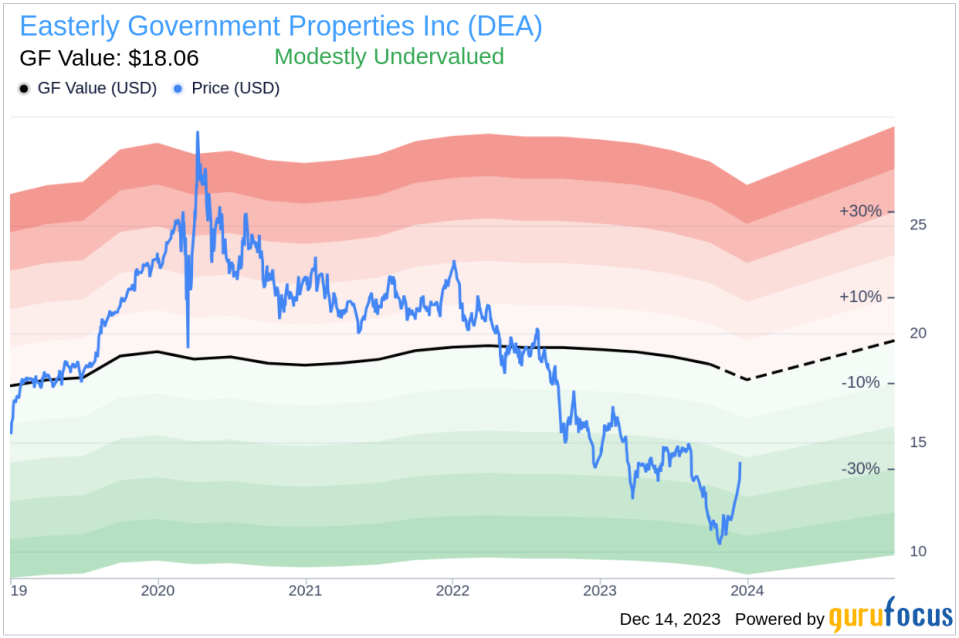

With the current share price of $13.14 and a GuruFocus Value of $18.06, Easterly Government Properties Inc has a price-to-GF-Value ratio of 0.73. This indicates that the stock is modestly undervalued based on its GF Value, which could be a compelling reason for the insider's recent purchase.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which is calculated by considering historical trading multiples such as the price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow. Additionally, it incorporates a GuruFocus adjustment factor based on the company's past returns and growth, as well as future business performance estimates from Morningstar analysts.

Conclusion

The recent insider buying activity by Chairman Darrell Crate, coupled with the company's modestly undervalued status according to the GF Value, presents a potentially optimistic outlook for Easterly Government Properties Inc. While the price-earnings ratio is higher than the industry median, the company's unique position as a landlord to the U.S. Government provides a level of stability that may justify this valuation. Investors should consider these factors, along with the insider's vote of confidence, when evaluating the potential of DEA as an investment opportunity.

It is important to note that while insider buying can be a positive sign, it should not be the sole basis for an investment decision. Investors are encouraged to conduct their own due diligence, considering the company's fundamentals, industry conditions, and broader market trends before making any investment.

The information provided in this article is based on data and does not constitute financial advice. Investors should consult with financial advisors to tailor investment strategies to their individual needs and objectives.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.