Insider Buying: Chairman James Wirth Acquires 4,000 Shares of InnSuites Hospitality Trust

On September 18, 2023, Chairman James Wirth of InnSuites Hospitality Trust (IHT) made a significant move in the stock market by purchasing 4,000 shares of the company. This insider buying activity is a strong indicator of the confidence the insider has in the company's future performance.

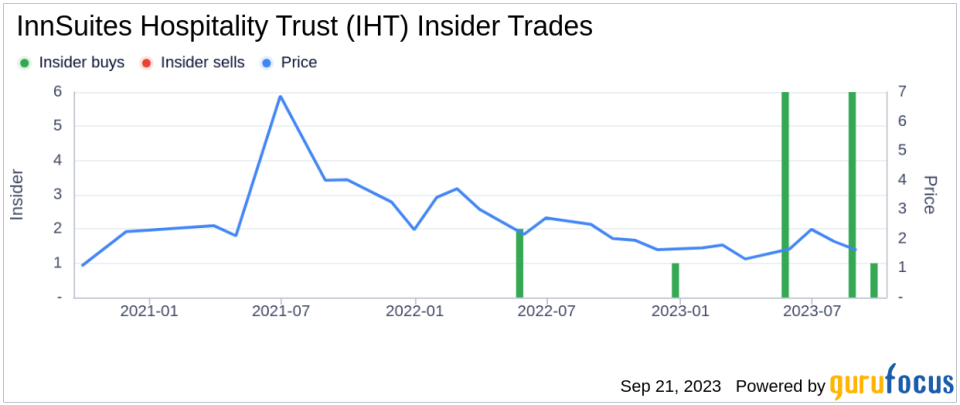

James Wirth is not just an insider but also the Chairman of InnSuites Hospitality Trust. His decision to invest in the company he leads is a positive sign for investors and stakeholders. Wirth's insider trading activity over the past year shows a clear pattern of buying, with a total of 16,000 shares purchased and no shares sold.

InnSuites Hospitality Trust is a real estate investment trust (REIT) that focuses on the ownership and operation of hotel properties. The company's portfolio includes hotels in various states across the U.S., providing a diverse range of hospitality services. The company's business model is built on providing quality service and accommodations to its guests while generating returns for its shareholders.

The insider transaction history for InnSuites Hospitality Trust shows a clear trend of insider buying. Over the past year, there have been 15 insider buys and no insider sells. This trend suggests that insiders, like Wirth, have a positive outlook on the company's future.

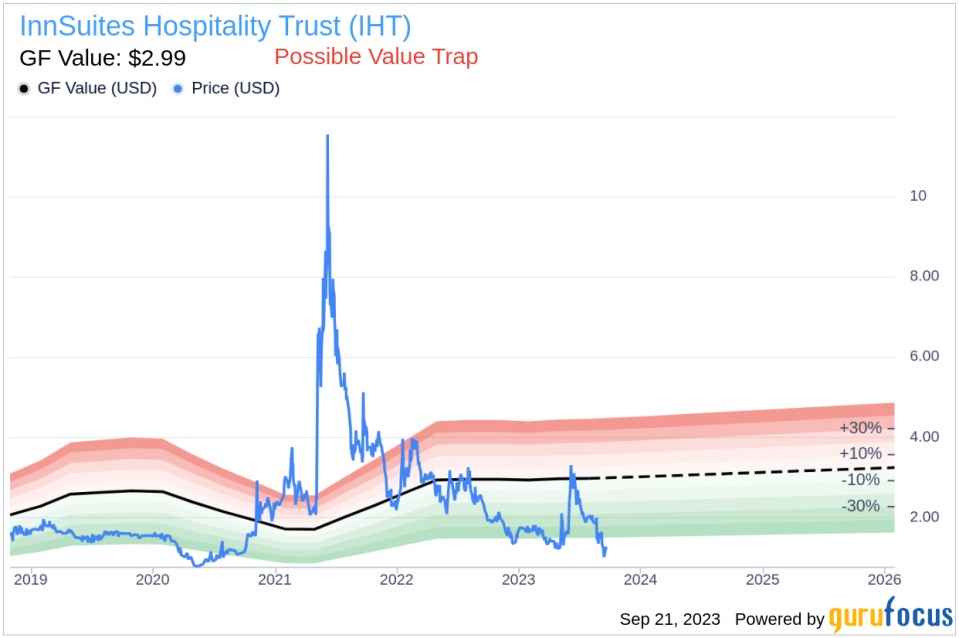

On the day of the insider's recent buy, shares of InnSuites Hospitality Trust were trading at $4,541.7 each, giving the company a market cap of $11.461 million. The price-earnings ratio of 20.53 is higher than both the industry median of 17.03 and the company's historical median price-earnings ratio, indicating that the stock may be overvalued.

However, the GuruFocus Value of $2.99 and a price-to-GF-Value ratio of 1518.96 suggest that the stock may be a possible value trap. Investors should think twice before following the insider's lead.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, while the insider's recent buying activity may seem promising, the high price-to-GF-Value ratio suggests caution. Investors should carefully consider these factors before making investment decisions.

This article first appeared on GuruFocus.