Insider Buying: Chairman James Wirth Acquires 2,000 Shares of InnSuites Hospitality Trust

On September 21, 2023, James Wirth, Chairman of InnSuites Hospitality Trust (IHT), purchased 2,000 shares of the company, further solidifying his investment in the hospitality trust. This move is of particular interest to investors and market watchers, as insider buying can often be a positive signal about a company's future prospects.

But who is James Wirth? Wirth is a seasoned executive with extensive experience in the hospitality industry. As the Chairman of InnSuites Hospitality Trust, he plays a pivotal role in guiding the company's strategic direction and overseeing its operations. His decision to increase his stake in the company is a strong vote of confidence in its future.

InnSuites Hospitality Trust is a real estate investment trust (REIT) that focuses on the ownership and operation of hotel properties. The company's portfolio includes hotels in various states across the U.S., providing a diverse range of hospitality services to its guests. The company's business model is built on leveraging its real estate assets to generate steady revenue streams and deliver value to its shareholders.

Now, let's delve into the insider buying activity and its relationship with the stock price.

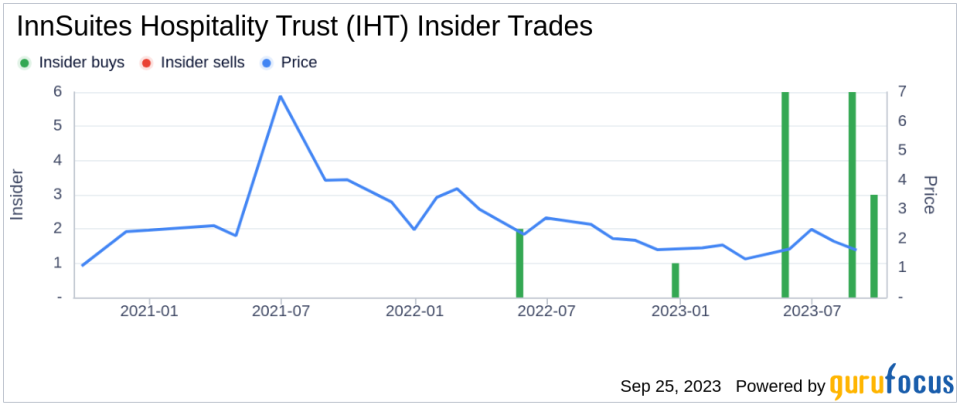

Over the past year, the insider has purchased a total of 18,000 shares and sold none. This trend of consistent insider buying, coupled with zero insider selling, is generally viewed as a positive indicator. It suggests that those with the most intimate knowledge of the company's operations and prospects see value in owning its shares.

On the day of the insider's recent purchase, shares of InnSuites Hospitality Trust were trading at $2,667 apiece, giving the company a market cap of $12.153 million. This purchase further increased the insider's stake in the company, demonstrating his belief in its value and potential for growth.

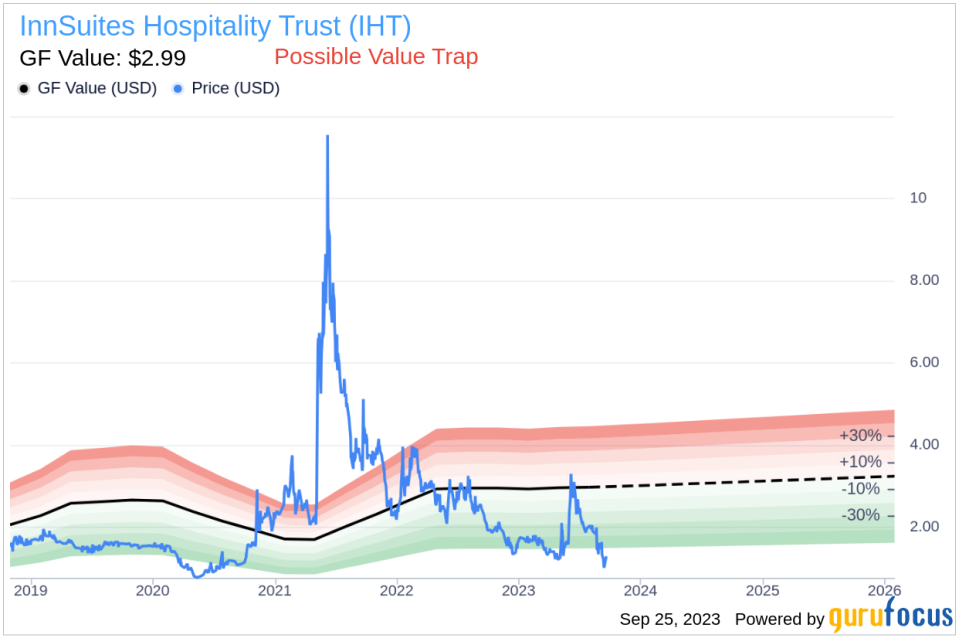

However, it's important to consider the company's valuation in this context. The stock's price-earnings ratio stands at 21.76, higher than both the industry median of 16.65 and the company's historical median. This suggests that the stock is currently trading at a premium compared to its earnings.

Furthermore, with a price of $2,667 and a GuruFocus Value of $2.99, InnSuites Hospitality Trust has a price-to-GF-Value ratio of 891.97. This indicates that the stock may be a possible value trap, and investors should think twice before investing. The GF Value is an intrinsic value estimate developed by GuruFocus, based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

In conclusion, while the insider's recent buying activity and the lack of insider selling over the past year are positive signs, potential investors should also consider the company's current valuation and the potential risk of it being a value trap. As always, thorough research and careful consideration are key when making investment decisions.

This article first appeared on GuruFocus.