Insider Buying: Chairman James Wirth Acquires Shares of InnSuites Hospitality Trust (IHT)

In the realm of stock market movements, insider trading activity is often a significant indicator that garners the attention of investors. Recently, James Wirth, the Chairman of InnSuites Hospitality Trust (IHT), made a notable purchase that has put the spotlight on the company. On November 27, 2023, the insider acquired 300 shares of IHT, signaling a vote of confidence in the trust's future prospects. This article delves into the details of this transaction, providing an objective analysis based on the available data.

Who is James Wirth of InnSuites Hospitality Trust?

James Wirth is a seasoned executive with a deep understanding of the hospitality industry. As the Chairman of InnSuites Hospitality Trust, Wirth brings a wealth of experience to the table, overseeing the strategic direction of the company. His recent purchase of IHT shares is not an isolated event; over the past year, Wirth has accumulated a total of 19,623 shares, demonstrating a consistent pattern of investment in the company he leads.

InnSuites Hospitality Trust's Business Description

InnSuites Hospitality Trust is a real estate investment trust (REIT) that focuses on the ownership and management of hotel properties. The trust operates under the InnSuites Hotels brand, providing accommodations that cater to both business and leisure travelers. With a portfolio that includes hotel suites equipped with modern amenities, InnSuites Hospitality Trust aims to offer a comfortable and value-driven experience to its guests.

Description of Insider Buy/Sell

Insider buying refers to the purchase of shares in a company by individuals who have access to non-public, material information about the company, such as its directors, officers, or significant shareholders. Conversely, insider selling involves these insiders disposing of their shares. These transactions are closely monitored as they can provide insights into the insiders' expectations of the company's future performance. A pattern of insider buying may suggest that those with the most intimate knowledge of the company's prospects believe the stock is undervalued or poised for growth.

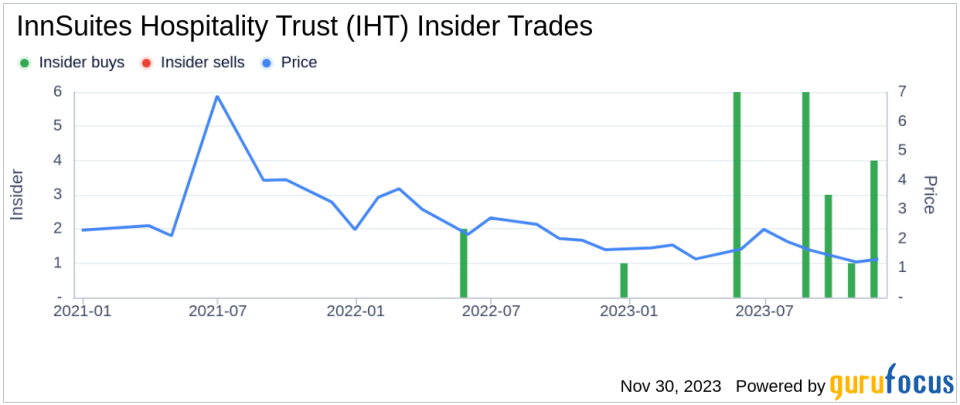

According to the data, there have been 21 insider buys and no insider sells for InnSuites Hospitality Trust over the past year. This trend of insider purchases without corresponding sales could be interpreted as a collective optimistic outlook on the part of the company's insiders.

Valuation and Market Cap

On the day of the insider's recent acquisition, shares of InnSuites Hospitality Trust were trading at $384, giving the company a market cap of $12.171 million. The price-earnings ratio stands at 20.97, which is above both the industry median of 17.47 and the company's historical median. This elevated P/E ratio could suggest that the stock is trading at a premium compared to its peers and its own historical valuation.

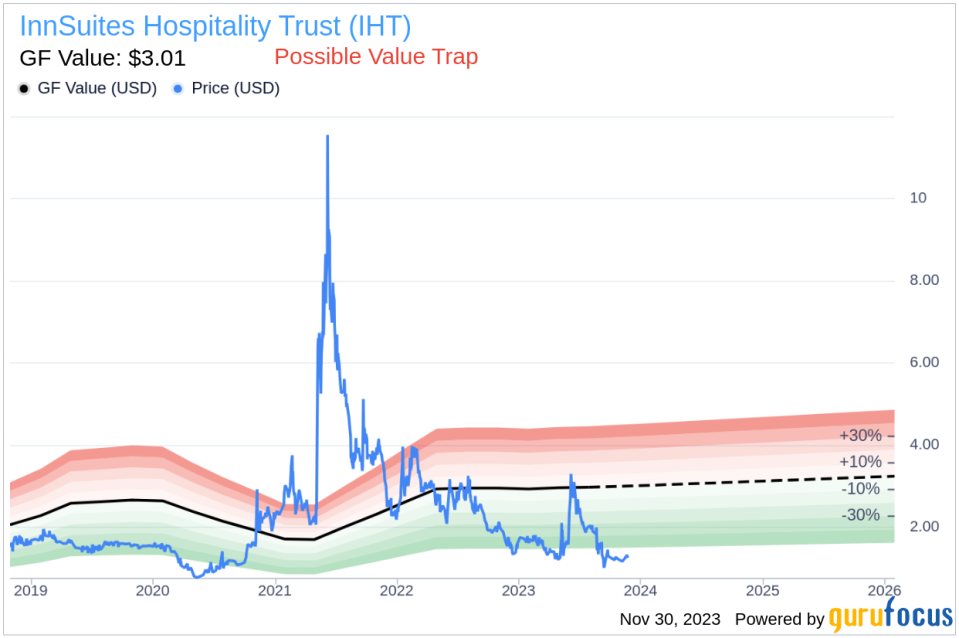

However, when considering the price relative to the GuruFocus Value (GF Value) of $3.01, the picture becomes more nuanced. With a price-to-GF-Value ratio of 127.57, InnSuites Hospitality Trust is categorized as a "Possible Value Trap, Think Twice" based on its GF Value. This assessment indicates that the stock may not be as attractive as its current price suggests, warranting caution from potential investors.

The GF Value is a proprietary metric developed by GuruFocus, which takes into account historical trading multiples, an adjustment factor based on past returns and growth, and future business performance estimates provided by Morningstar analysts. This comprehensive approach to valuation aims to provide a more accurate representation of a stock's intrinsic value.

Conclusion

The recent insider buying activity by Chairman James Wirth at InnSuites Hospitality Trust is a significant event that warrants investor attention. While the insider's consistent pattern of share purchases over the past year could be seen as a positive signal, the company's current valuation metrics suggest a more complex picture. With a high price-earnings ratio and a price-to-GF-Value ratio that indicates the stock might be overvalued, investors should approach InnSuites Hospitality Trust with a degree of caution.

As always, insider trading is just one piece of the puzzle when it comes to evaluating a stock's potential. It is essential for investors to conduct their own due diligence, considering a range of factors including financial performance, industry trends, and broader market conditions before making investment decisions.

For those closely watching InnSuites Hospitality Trust, the insider's recent purchase is a noteworthy development that adds another layer to the ongoing analysis of the company's investment prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.