Insider Buying: COO John Beattie Acquires 47,966 Shares of Inotiv Inc (NOTV)

In the realm of stock market movements, insider trading activity is often a significant indicator that can provide insights into a company's potential future performance. Recently, John Beattie, the Chief Operating Officer (COO) of Inotiv Inc (NASDAQ:NOTV), made a notable insider purchase that has caught the attention of investors and market analysts alike. On December 14, 2023, the insider acquired a substantial number of shares, signaling a strong vote of confidence in the company's prospects.

Who is John Beattie of Inotiv Inc?

John Beattie serves as the COO of Inotiv Inc, a company that operates within the life sciences industry. Beattie's role involves overseeing the company's operational activities, ensuring that they align with strategic goals and contribute to the firm's growth and efficiency. His insider status provides him with a deep understanding of the company's inner workings, making his trading activities particularly noteworthy to those following Inotiv Inc's stock.

Inotiv Inc's Business Description

Inotiv Inc is a company that specializes in providing drug discovery and development services. The firm offers a comprehensive range of nonclinical and analytical services to support clients in the pharmaceutical, biotechnology, and medical device industries. Inotiv Inc's expertise lies in its ability to assist clients in navigating the complex process of bringing new drugs and therapies to market, from early-stage discovery through preclinical development.

Description of Insider Buy/Sell

Insider buying occurs when a company's executives, directors, or other insiders purchase shares of their own company's stock. Conversely, insider selling refers to the same group of individuals selling shares they own in the company. These transactions are closely monitored by investors as they can provide clues about the insiders' confidence in the company's future performance. A pattern of insider buying may suggest that those with the most intimate knowledge of the company believe the stock is undervalued or that positive developments are on the horizon.

According to the data, John Beattie has been actively purchasing shares, with a total of 47,966 shares acquired over the past year and no recorded sales. This pattern of buying without any corresponding sales suggests a strong belief in the company's value and potential.

Insider Trends

The insider transaction history for Inotiv Inc shows a positive trend, with 3 insider buys and 0 insider sells over the past year. This could be interpreted as a collective optimistic outlook from the company's insiders.

Valuation

On the day of the insider's recent purchase, shares of Inotiv Inc were trading at $3.12, giving the company a market cap of $80.725 million. This valuation places the company in the small-cap category, which is often associated with higher growth potential but also higher volatility and risk.

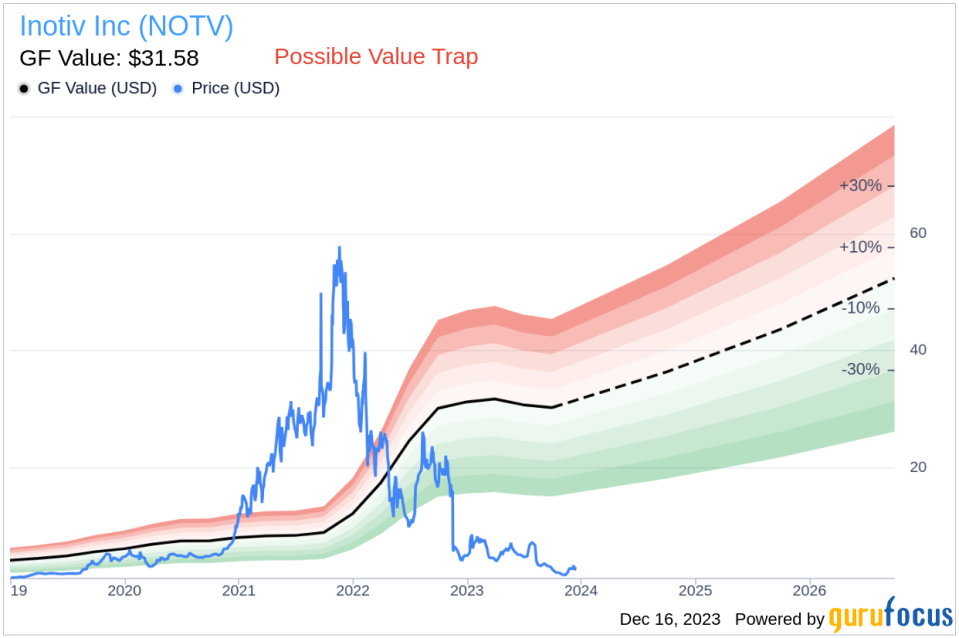

When considering the price-to-GF-Value ratio, which stands at 0.1, Inotiv Inc appears to be a Possible Value Trap, Think Twice, according to its GF Value. The GF Value, which is $31.58, suggests that the stock is significantly undervalued based on historical trading multiples, an adjustment factor for past performance, and future business performance estimates.

The GF Value is a proprietary metric developed by GuruFocus, and it incorporates several factors:

Historical multiples such as the price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow.

An adjustment factor based on the company's historical returns and growth.

Future business performance estimates provided by Morningstar analysts.

While the GF Value suggests that Inotiv Inc's stock might be undervalued, the label of a Possible Value Trap indicates that investors should proceed with caution. This could mean that despite the low price-to-GF-Value ratio, there may be underlying issues or challenges that could affect the company's ability to reach its intrinsic value as estimated by GuruFocus.

Conclusion

The recent insider buying activity by John Beattie, particularly the purchase of 47,966 shares of Inotiv Inc, is a significant event that warrants attention from the investment community. While the insider's actions suggest confidence in the company's future, the valuation metrics provided by GuruFocus highlight the need for a careful analysis before making investment decisions. Investors should consider both the insider trends and the GF Value in the context of their own investment strategy and risk tolerance.

As with any investment decision, it is crucial to conduct thorough research and consider a multitude of factors, including insider transactions, company fundamentals, industry trends, and broader market conditions. The insider buying at Inotiv Inc presents an interesting case for further investigation and could potentially signal an opportunity for those willing to delve deeper into the company's prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.