Insider Buying: Corporate Executive VP & COO Birgit Girshick Acquires Shares of Charles ...

Insider buying is often regarded as a bullish signal by investors, as it suggests that insiders are confident in the future prospects of their company. In a recent transaction, Corporate Executive VP & COO Birgit Girshick of Charles River Laboratories International Inc (NYSE:CRL) has demonstrated such confidence by purchasing 1,322 shares of the company's stock.

Who is Birgit Girshick of Charles River Laboratories International Inc?

Birgit Girshick serves as the Corporate Executive Vice President & Chief Operating Officer at Charles River Laboratories International Inc. With a deep understanding of the company's operations and strategic direction, the insider's investment decisions are closely watched by the market for insights into the company's health and future performance.

Charles River Laboratories International Inc's Business Description

Charles River Laboratories International Inc is a leading provider of preclinical and clinical laboratory services for the pharmaceutical, medical device, and biotechnology industries. The company aids in the drug discovery and development process, offering a range of services from compound identification to preclinical and clinical testing, as well as manufacturing support for commercialization. With a focus on enhancing the speed and efficiency of getting new drugs to market, Charles River Laboratories plays a critical role in the healthcare sector.

Description of Insider Buy/Sell

Insider transactions involve the buying and selling of a company's stock by its executives, directors, or other internal stakeholders. These transactions are closely monitored as they can provide insights into an insider's view of the company's value. An insider buy, such as the one executed by Birgit Girshick, can indicate a belief that the stock is undervalued or that positive developments are on the horizon. Conversely, insider sells may suggest that insiders believe the stock is fully valued or that they are diversifying their investments.

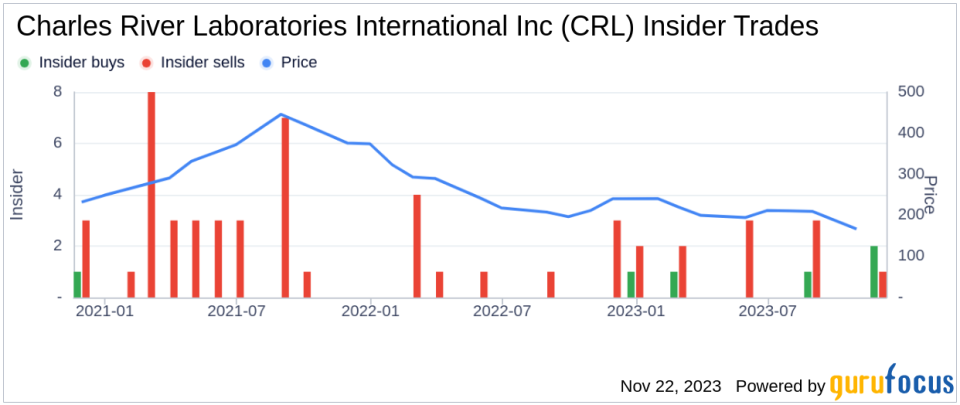

Insider Trends

The insider transaction history for Charles River Laboratories International Inc shows a mix of buys and sells over the past year. There have been 5 insider buys and 11 insider sells during this period. This activity can provide a broader context for interpreting individual transactions.

Valuation

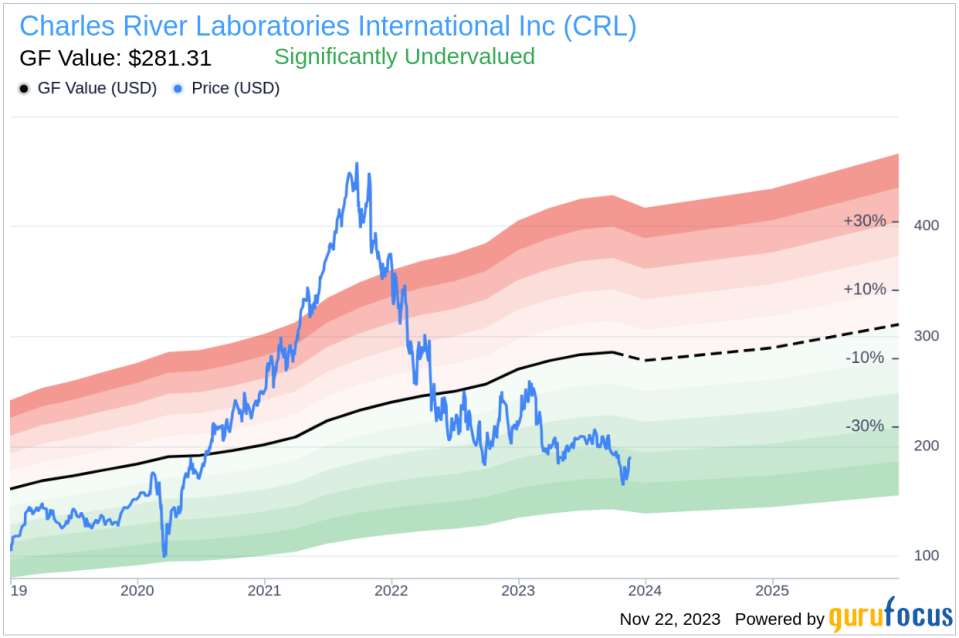

On the day of the insider's recent buy, shares of Charles River Laboratories International Inc were trading at $187.82, giving the company a market cap of $9.861 billion. This valuation places the stock at a price-earnings ratio of 20.81, which is lower than both the industry median of 26.15 and the company's historical median price-earnings ratio. This suggests that the stock may be undervalued relative to its peers and its own historical valuation.

Further supporting the notion of undervaluation is the price-to-GF-Value ratio of 0.67, with the stock's price at $187.82 and the GuruFocus Value at $281.31. This indicates that the stock is significantly undervalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus. It is calculated using historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

Analysis of Birgit Girshick's Insider Buying

Over the past year, Birgit Girshick has been active in the market, purchasing a total of 1,322 shares and selling 3,205 shares of Charles River Laboratories International Inc. The recent acquisition of shares by the insider is particularly noteworthy given the current valuation metrics and the company's position in the market.

The insider's decision to increase their stake in the company could be interpreted as a strong vote of confidence in the company's future prospects. This is especially relevant considering the insider's role as Corporate Executive VP & COO, which likely provides them with detailed knowledge of the company's operations and strategic initiatives.

Investors often look to insider buying as a positive sign that those with the most intimate knowledge of a company's inner workings are willing to invest their personal capital into the stock. This can be a reassuring signal for existing shareholders and potential investors alike.

Conclusion

The recent insider buying by Birgit Girshick at Charles River Laboratories International Inc aligns with several indicators of potential undervaluation. The lower-than-average price-earnings ratio, combined with a price-to-GF-Value ratio that suggests the stock is significantly undervalued, presents a compelling case for investors considering this stock.

While insider buying is just one piece of the puzzle when it comes to evaluating a stock's potential, it is a significant one, especially when it comes from high-ranking executives like Birgit Girshick. Investors would do well to consider the context of this insider transaction, along with the company's business fundamentals and market position, when making investment decisions.

As always, it is important for investors to conduct their own due diligence and consider their investment goals and risk tolerance before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.