Insider Buying: CTO Joseph Wong Acquires 90,000 Shares of Advanced Emissions Solutions Inc

In the realm of stock market movements, insider trading activity is often a significant indicator that can provide insights into a company's potential future performance. Notably, insider buying, where company executives purchase shares of their own firms, can signal confidence in the company's prospects. In this context, the recent transaction by Joseph Wong, the Chief Technology Officer of Advanced Emissions Solutions Inc (NASDAQ:ADES), is particularly noteworthy.

On November 21, 2023, the insider made a substantial purchase of 90,000 shares of the company's stock. This transaction is part of a pattern of insider activity that merits a closer look, especially when considering the company's valuation and market performance.

Who is Joseph Wong of Advanced Emissions Solutions Inc?

Joseph Wong serves as the Chief Technology Officer of Advanced Emissions Solutions Inc, a company that specializes in providing environmental technologies and specialty chemicals to the coal-burning utility industry. In his role, Wong is responsible for overseeing the technological advancements and innovations that drive the company's product offerings and services. His insider position gives him a unique perspective on the company's operations, future direction, and potential for growth.

Advanced Emissions Solutions Inc's Business Description

Advanced Emissions Solutions Inc is a leader in providing environmental and emission control solutions to the power generation and other industries. The company's portfolio includes a range of technologies and chemicals designed to reduce pollutants and improve air quality. Their services are critical in helping businesses comply with environmental regulations and in promoting cleaner energy production.

Description of Insider Buy/Sell

Insider buying occurs when an officer, director, or any person with access to key company information purchases shares of the company's stock. This is often interpreted as a sign that insiders believe the stock is undervalued or that there is positive news on the horizon. Conversely, insider selling might indicate that insiders believe the stock is overvalued or that there may be challenges ahead for the company.

Joseph Wong's recent purchase of 90,000 shares is a significant insider buy, suggesting that he may have a strong belief in the company's future success. Over the past year, Wong has accumulated a total of 170,000 shares, without selling any of his holdings, further reinforcing the notion that he is confident in the company's trajectory.

Insider Trends

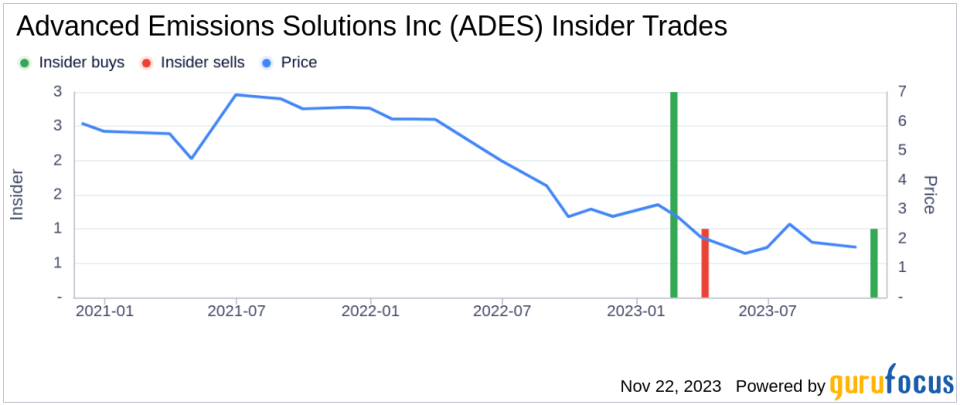

The insider transaction history for Advanced Emissions Solutions Inc shows a pattern of more insider buying than selling over the past year. With 6 insider buys and only 1 insider sell, the trend seems to indicate a general optimism among those with intimate knowledge of the company.

Valuation

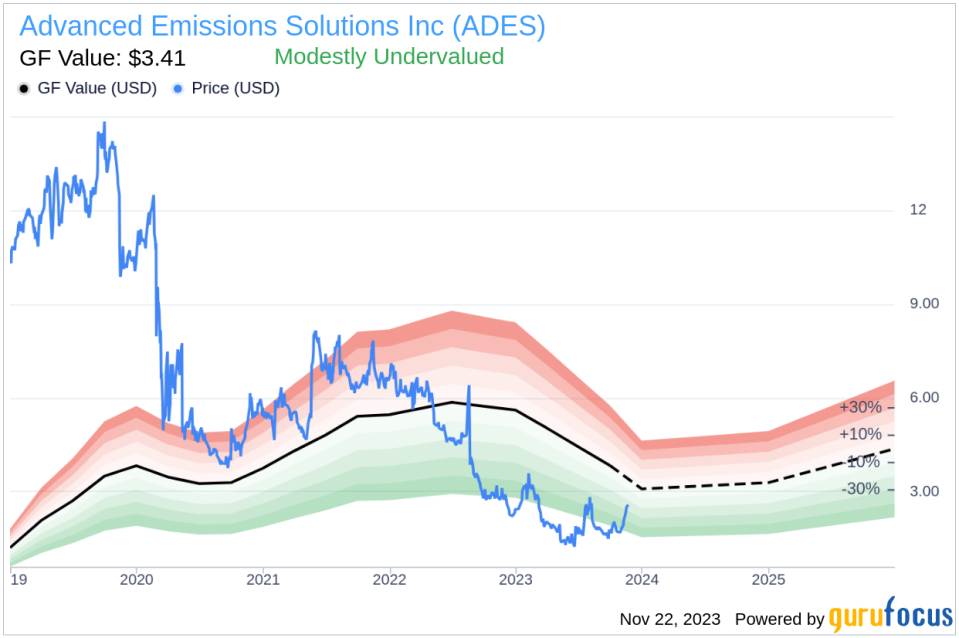

On the day of the insider's recent purchase, shares of Advanced Emissions Solutions Inc were trading at $2.48, giving the company a market cap of $85.772 million. This valuation is particularly interesting when juxtaposed with the company's GF Value.

With a price of $2.48 and a GuruFocus Value of $3.41, Advanced Emissions Solutions Inc has a price-to-GF-Value ratio of 0.73. This suggests that the stock is modestly undervalued based on its GF Value, which could be a factor motivating the insider's decision to increase his stake in the company.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus. It is calculated based on historical trading multiples, a GuruFocus adjustment factor that accounts for the company's past returns and growth, and future business performance estimates provided by Morningstar analysts.

When insiders like Joseph Wong make significant purchases of their company's stock, it often warrants attention from investors and market analysts. Such transactions can be indicative of the insider's belief in the company's undervaluation or potential for future growth. In the case of Advanced Emissions Solutions Inc, the pattern of insider buying, coupled with the company's modestly undervalued GF Value, presents a compelling narrative for those monitoring the stock.

Investors may consider these insider transactions as one of many factors in their overall analysis of Advanced Emissions Solutions Inc. While insider buying is not a guarantee of future stock performance, it can be a useful piece of the puzzle when assessing a company's investment potential. As always, it is recommended that investors conduct their own due diligence and consider a wide range of financial metrics and market indicators before making any investment decisions.

In conclusion, the insider buying activity at Advanced Emissions Solutions Inc, particularly the recent purchase by CTO Joseph Wong, offers an intriguing insight into the company's valuation and the confidence level of its executives. As the market continues to digest this information, it will be interesting to observe how the stock responds in the coming months.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.