Insider Buying: David Boyle Acquires 1000 Shares of Burke & Herbert Financial Services Corp

On September 11, 2023, David Boyle, the Chair, President, and CEO of Burke & Herbert Financial Services Corp (NASDAQ:BHRB), purchased 1000 shares of the company. This move is significant as insider buying often signals confidence in the company's future prospects.

David Boyle is a seasoned executive with extensive experience in the financial services industry. As the Chair, President, and CEO of Burke & Herbert Financial Services Corp, he is responsible for the overall strategic direction and performance of the company. His decision to increase his stake in the company is a strong vote of confidence in its future.

Burke & Herbert Financial Services Corp is a well-established financial institution that provides a wide range of banking and financial services. The company operates through a network of branches and ATMs, offering services such as personal banking, business banking, wealth management, and mortgage services. With a market cap of $369.281 million, the company has a solid presence in the financial services sector.

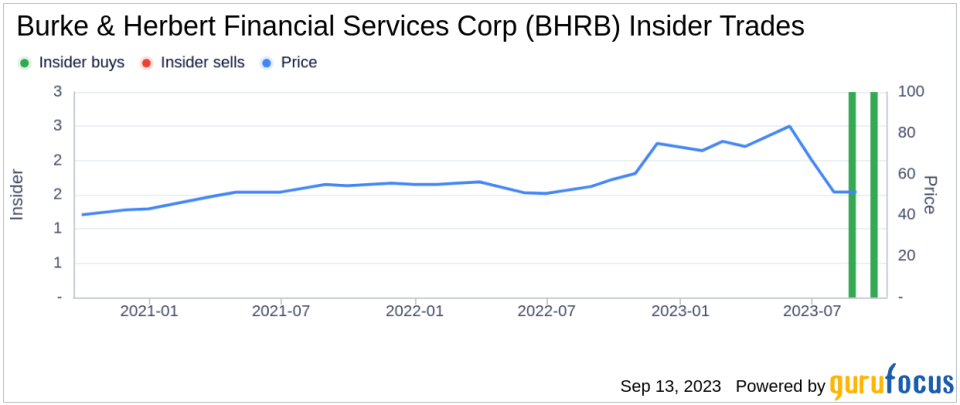

Over the past year, David Boyle has purchased 1000 shares in total and sold 0 shares in total. This indicates a positive trend in insider buying for the company. The insider transaction history for Burke & Herbert Financial Services Corp shows that there have been 6 insider buys in total over the past year, with no insider sells over the same timeframe.

The relationship between insider buying/selling and stock price is often considered a key indicator of a company's future performance. In this case, the insider's decision to buy shares could be seen as a positive signal, suggesting that the insider believes the stock is undervalued and has potential for growth.

On the day of the insider's recent buy, shares of Burke & Herbert Financial Services Corp were trading for $48.69 apiece. This gives the stock a price-earnings ratio of 27.62, which is higher than the industry median of 8.28 and lower than the companys historical median price-earnings ratio.

With a price of $48.69 and a GuruFocus Value of $58.41, Burke & Herbert Financial Services Corp has a price-to-GF-Value ratio of 0.83. This means the stock is modestly undervalued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus that is calculated based on historical multiples (price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow) that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, the insider's recent purchase of Burke & Herbert Financial Services Corp shares, coupled with the company's solid fundamentals and undervalued status, could be a positive signal for potential investors.

This article first appeared on GuruFocus.