Insider Buying: Director Cynthia Flanders Acquires 8,500 Shares of Argan Inc

On October 12, 2023, Cynthia Flanders, a director at Argan Inc (NYSE:AGX), purchased 8,500 shares of the company. This move is significant as insider buying can often be an indicator of an executive's confidence in the company's future prospects.

Argan Inc is a prominent player in the provision of a full range of power industry and telecommunications infrastructure services. The company's primary business is the development, construction, and operations of power generation and renewable energy and telecommunications infrastructure projects.

Insider buying refers to when a director, executive, or any person with access to key company information purchases shares of that company's stock. Such transactions are closely monitored as they can provide valuable insights into the company's health and future direction.

Over the past year, the insider has purchased a total of 8,500 shares and sold 7,000 shares. This recent acquisition by Flanders is a positive signal, as it indicates a strong belief in the company's potential.

The insider transaction history for Argan Inc shows a total of 1 insider buy over the past year, with 1 insider sell over the same timeframe. This trend suggests a balanced view among the insiders about the company's prospects.

On the day of the insider's recent buy, shares of Argan Inc were trading for $30.35 apiece, giving the stock a market cap of $615.322 million. The price-earnings ratio stands at 17.37, which is higher than the industry median of 14.49 and also higher than the companys historical median price-earnings ratio.

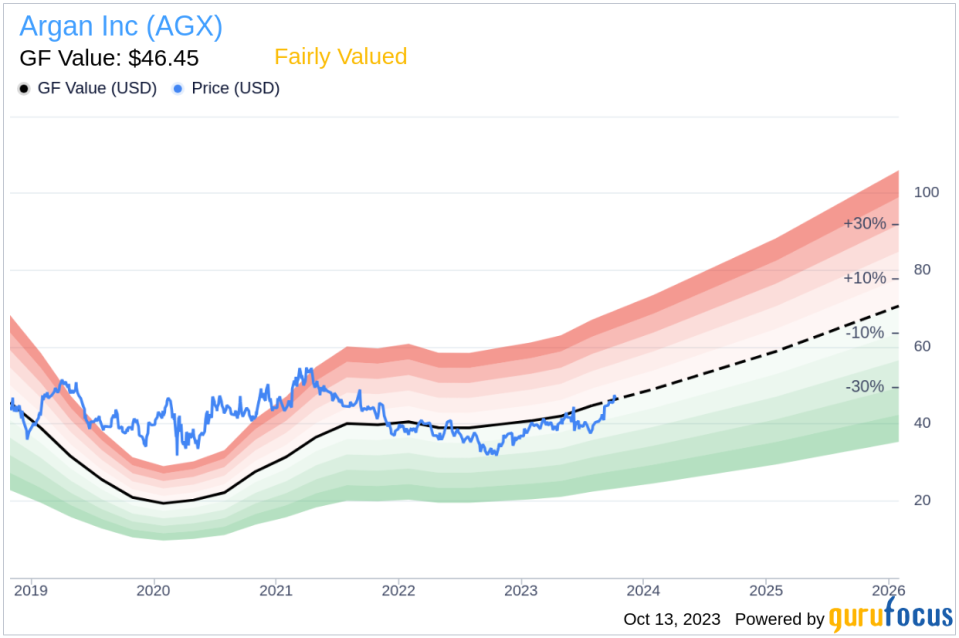

With a price of $30.35 and a GuruFocus Value of $46.45, Argan Inc has a price-to-GF-Value ratio of 0.65. This suggests that the stock is fairly valued based on its GF Value. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts.

In conclusion, the recent insider buying activity by Cynthia Flanders at Argan Inc is a positive signal for potential investors. It indicates a strong belief in the company's future prospects and suggests that the stock is fairly valued at its current price.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.