Insider Buying: Director Jonathan Kelly Acquires 2000 Shares of Culp Inc

On September 12, 2023, Jonathan Kelly, a director at Culp Inc (NYSE:CULP), purchased 2,000 shares of the company, further solidifying his stake in the business. This move is of particular interest to investors who monitor insider buying activities as a part of their investment strategy.

Jonathan Kelly is a seasoned executive with a wealth of experience in the industry. His role as a director at Culp Inc involves providing strategic guidance and oversight to the company's operations. His decision to increase his holdings in the company is a strong vote of confidence in its future prospects.

Culp Inc is a leading provider of mattress and upholstery fabrics across the globe. The company designs, manufactures, and markets a variety of fabrics to bedding and furniture industries. With a market cap of $71.131 million, Culp Inc is a key player in its sector.

Over the past year, Jonathan Kelly has purchased a total of 28,652 shares and has not sold any shares. This recent purchase of 2,000 shares is a continuation of the insider's trend of increasing his stake in the company.

The insider transaction history for Culp Inc shows a total of 18 insider buys over the past year, with only 1 insider sell over the same timeframe. This trend of insider buying could be an indication of the insiders' bullish outlook on the company's future.

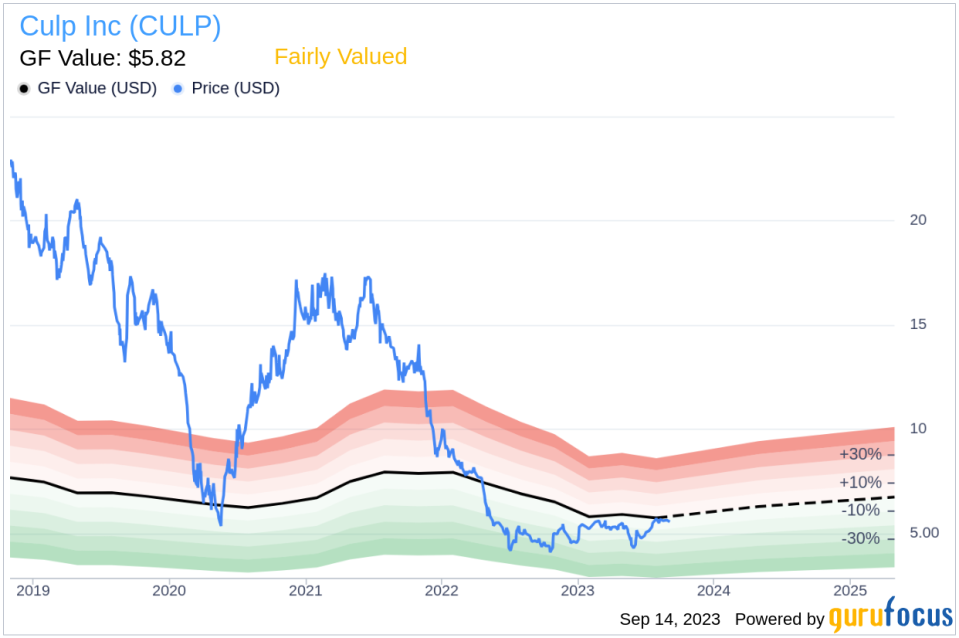

On the day of the insider's recent buy, shares of Culp Inc were trading at $5.48 apiece. With a GuruFocus Value of $5.82, the stock has a price-to-GF-Value ratio of 0.94, indicating that it is fairly valued.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance from Morningstar analysts.

The insider's decision to buy shares when the stock is fairly valued suggests that he believes the company's future performance will justify its current valuation. This could be a positive signal for potential investors considering buying shares in Culp Inc.

In conclusion, the insider's recent buying activity, coupled with the company's fair valuation, could make Culp Inc an interesting stock to watch in the coming months.

This article first appeared on GuruFocus.