Insider Buying: Director Joseph Carleone Acquires 20,000 Shares of Avid Bioservices Inc (CDMO)

On September 21, 2023, Director Joseph Carleone made a significant investment in Avid Bioservices Inc (NASDAQ:CDMO), purchasing 20,000 shares of the company. This move is noteworthy and deserves a closer look.

Joseph Carleone is a seasoned executive with a wealth of experience in the biopharmaceutical industry. He has served as a director of Avid Bioservices Inc, a company that provides a comprehensive range of process development, high quality cGMP clinical and commercial manufacturing services for the biotechnology and biopharmaceutical industries. Avid Bioservices aims to improve patient lives by providing high-quality development and manufacturing services for biopharmaceutical products.

Over the past year, the insider has purchased 20,000 shares in total and sold 0 shares in total. This recent acquisition by Carleone is a positive signal, as it represents a significant increase in his holdings of Avid Bioservices Inc.

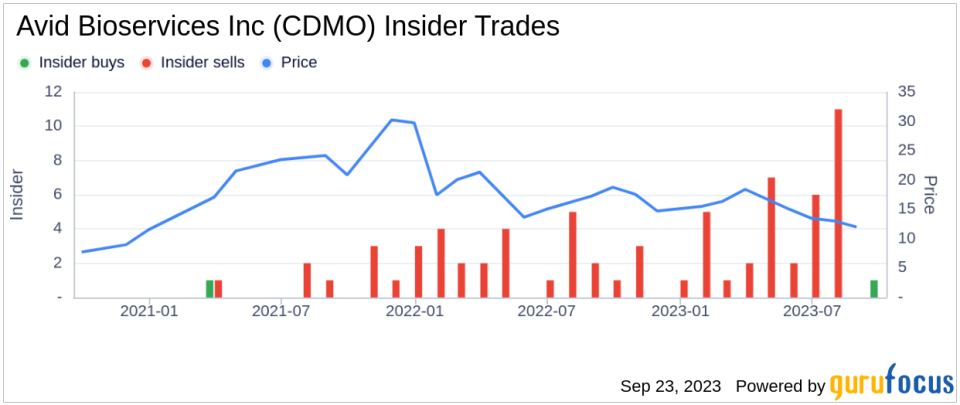

The insider transaction history for Avid Bioservices Inc shows that there have been 1 insider buys in total over the past year. Meanwhile, there have been 38 insider sells over the same timeframe. This trend suggests that insiders have been more inclined to sell than buy, which could be a cause for concern for potential investors. However, the recent purchase by Carleone could signal a shift in this trend.

On the day of the insider's recent buy, shares of Avid Bioservices Inc were trading for $9.53 apiece, giving the stock a market cap of $605.884 million.

With a price of $9.53 and a GuruFocus Value of $23.45, Avid Bioservices Inc has a price-to-GF-Value ratio of 0.41. This means the stock is considered a possible value trap, and investors should think twice before investing. The GF Value is an intrinsic value estimate developed by GuruFocus that is calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts.

In conclusion, the recent insider buying activity at Avid Bioservices Inc is a positive signal, but the overall insider selling trend and the company's valuation suggest that potential investors should proceed with caution. As always, it's important to do your own research and consider multiple factors before making an investment decision.

This article first appeared on GuruFocus.