Insider Buying: Director Linda Harty Acquires Shares of Chart Industries Inc (GTLS)

Insider buying can often provide valuable insights into a company's prospects and the confidence that insiders have in the business's future performance. In a notable transaction, Director Linda Harty has recently increased her stake in Chart Industries Inc (NYSE:GTLS), a leading manufacturer of highly engineered equipment servicing multiple applications in the Energy and Industrial Gas markets. On December 15, 2023, the insider purchased 1,000 shares of the company, signaling a potential positive outlook on the company's valuation and future.

Who is Linda Harty?

Linda Harty is a seasoned executive with a wealth of experience in financial management and corporate governance. Her role as a director at Chart Industries Inc involves providing strategic oversight and contributing to the company's financial and operational decisions. Harty's background includes various leadership positions, including treasurer roles at Medtronic and Cardinal Health, which have equipped her with a deep understanding of the financial intricacies within large corporations. Her decision to invest further in Chart Industries Inc is a move that may carry weight considering her extensive experience in finance.

Chart Industries Inc's Business Description

Chart Industries Inc is a global manufacturer that designs and produces highly engineered equipment used in the production, storage, and end-use of hydrocarbon and industrial gases. The company's product portfolio includes vacuum-insulated containment vessels, heat exchangers, cold boxes, and other cryogenic components. These products are critical in various applications, including energy, electronics, industrial gases, and biomedical industries. Chart Industries' commitment to innovation and sustainability positions it well to capitalize on the growing demand for clean energy solutions and the broader industrial gas market.

Description of Insider Buy/Sell

Insider transactions, which include both buys and sells, are closely monitored by investors as they can provide hints about a company's internal expectations. Insider buying, in particular, is often regarded as a bullish signal, as it suggests that insiders are willing to invest their own money in the company's stock, expecting future growth or believing that the stock is undervalued. Conversely, insider selling can occur for various reasons, including diversification of personal assets, and does not necessarily indicate a lack of confidence in the company.

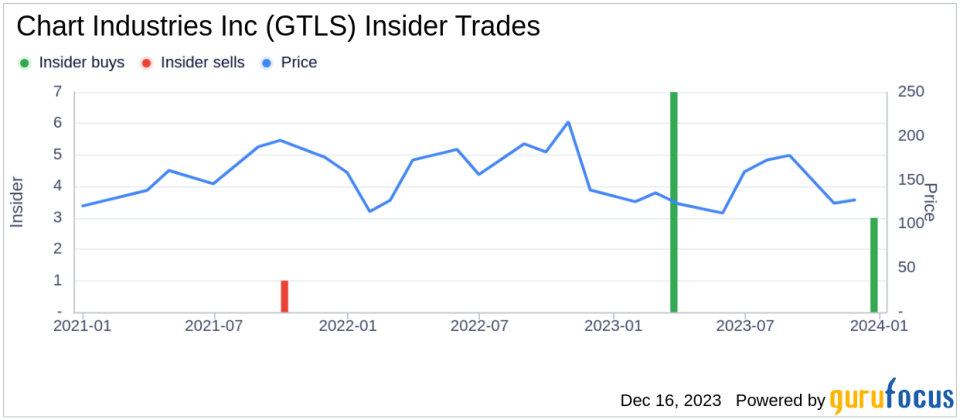

Insider Trends

The insider transaction history for Chart Industries Inc shows a pattern of insider confidence, with 10 insider buys and no insider sells over the past year. This trend can be interpreted as a positive signal, as multiple insiders are choosing to increase their holdings in the company.

Valuation

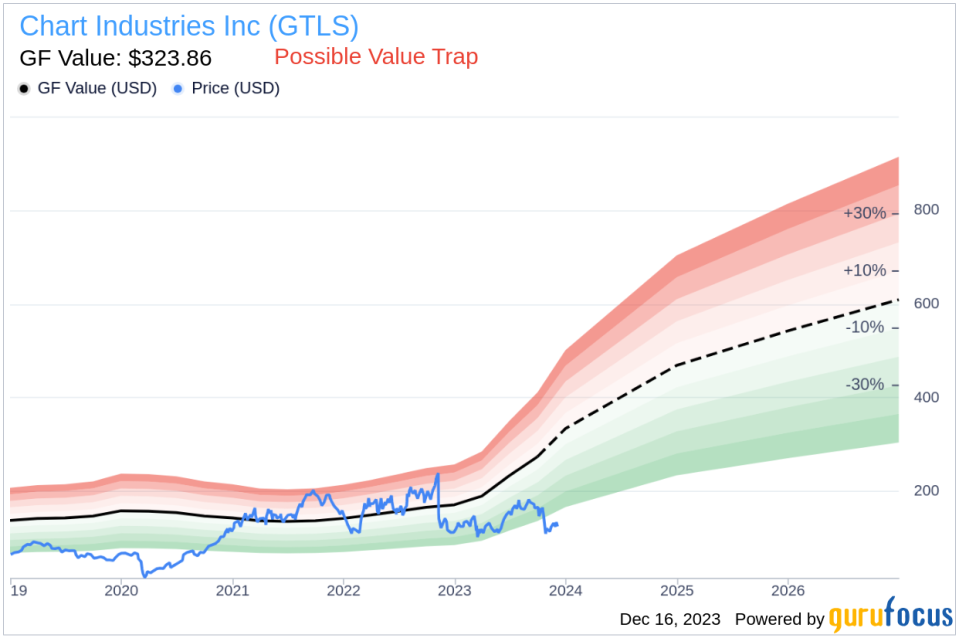

On the day of Linda Harty's recent purchase, shares of Chart Industries Inc were trading at $130.14, giving the company a market cap of $5.554 billion. This valuation is significant as it reflects the market's current assessment of the company's worth.

However, with a price of $130.14 and a GuruFocus Value of $323.86, Chart Industries Inc has a price-to-GF-Value ratio of 0.4. This suggests that the stock is a Possible Value Trap, and investors should think twice based on its GF Value.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which is calculated considering historical trading multiples, a GuruFocus adjustment factor based on the company's past returns and growth, and future business performance estimates from Morningstar analysts.

Historical multiples include the price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow.

The GuruFocus adjustment factor takes into account the company's historical performance and adjusts the valuation accordingly.

Future business performance estimates are sourced from Morningstar analysts, providing a forward-looking component to the valuation.

In conclusion, the insider buying activity by Director Linda Harty at Chart Industries Inc, particularly in the context of the company's business prospects and insider trends, may be seen as a positive indicator by investors. However, the current price-to-GF-Value ratio suggests caution, as the stock may be undervalued according to GuruFocus's valuation model. Investors should consider these factors alongside broader market conditions and individual investment strategies when evaluating the potential of Chart Industries Inc's stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.