Insider Buying: Director Robert Kreidler Acquires 10,000 Shares of TrueBlue Inc

On October 31, 2023, Robert Kreidler, a director at TrueBlue Inc (NYSE:TBI), made a significant insider purchase of 10,000 shares of the company's stock. This move is noteworthy as insider buying can often be a positive signal about a company's future prospects.

TrueBlue Inc is a leading provider of specialized workforce solutions, helping clients improve growth and performance by providing staffing, workforce management, and recruitment process outsourcing. The company's services are designed to help businesses effectively match the right talent with the right work, enabling them to achieve their strategic goals.

Insider buying refers to when a company's executives, directors, or other insiders purchase the company's stock. This is often seen as a positive sign as it indicates that insiders believe in the company's future and are willing to invest their own money in it. Conversely, insider selling is when insiders sell their shares, which can sometimes be seen as a negative sign as it could indicate that insiders believe the company's stock price may not increase in the future.

Over the past year, the insider, Robert Kreidler, has purchased a total of 10,000 shares and has not sold any shares. This suggests a strong belief in the company's future prospects.

The insider transaction history for TrueBlue Inc shows a total of 5 insider buys over the past year, compared to 3 insider sells. This indicates a positive trend in insider sentiment towards the company.

On the day of the insider's recent buy, shares of TrueBlue Inc were trading at $11.07, giving the company a market cap of $345.651 million.

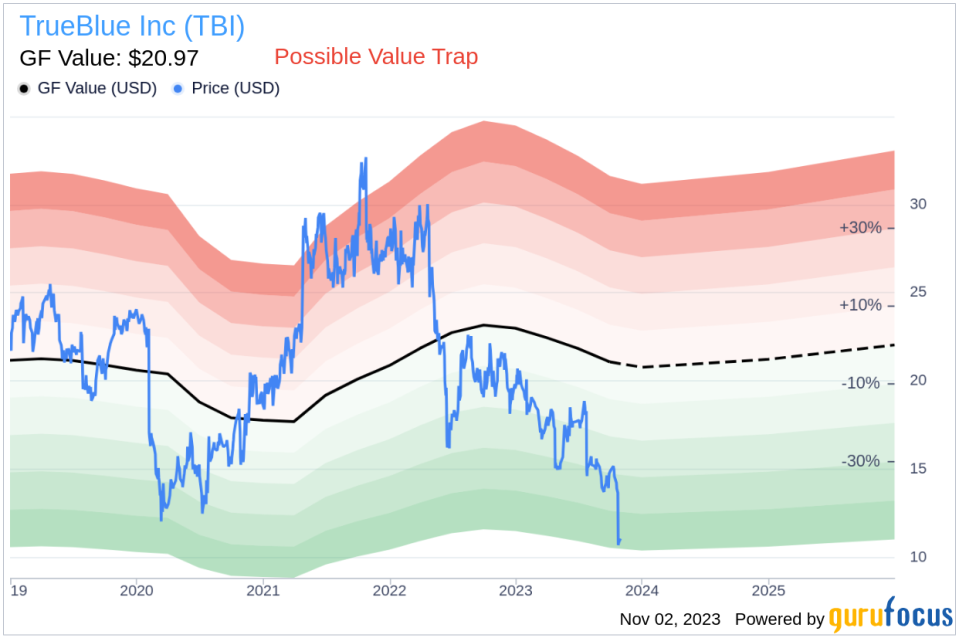

With a price of $11.07 and a GuruFocus Value of $20.97, TrueBlue Inc has a price-to-GF-Value ratio of 0.53. This suggests that the stock is a possible value trap, and investors should think twice before investing. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, the recent insider buying activity by Robert Kreidler at TrueBlue Inc is a positive signal about the company's future prospects. However, with a price-to-GF-Value ratio of 0.53, the stock appears to be a possible value trap, and investors should exercise caution.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.